Online Transactions Compliance

![]()

Banks are aiming to achieve compliance by using a portfolio of tools to address Know Your Customer (KYC) and Customer Due Diligence (CDD) including access to public as well as accredited sources for validation of image, record, and the validity for customer onboarding. Financial crime mitigation tools are used for validating the payments (especially international) covering post event rules governing value, volume and velocity. The access and security is enhanced through multi-layer identification covering person, location, device and authentication.

Risk Management

![]()

It is aimed at meeting the requirements of BCBS 239, Basel III/IV and stress testing. As against building these reports on top of the transaction systems, banks are moving the relevant data to a data store or data lake and use the modelling, cleansing, and reporting solution capabilities. The IT related risks are managed through a portfolio of tools that handle access, scanning, licensing terms and Business Continuity Planning (BCP).

Compliance

![]()

It addresses both offline AML and IFRS compliance. While there is no common tool that handles both these areas, they are often grouped together . The availability of data extraction and annotating software helps in purveying the various legislative notes, orders, and regulations faster. Usage of AI, NLP and ML helps in transforming contextual data to a structured format for search and analysis. Further, the developments on reference data across the regions using digital formats have made people identification easier, thereby bringing down false positives by nearly 50%.

Regulatory Reporting

![]()

While on one hand SupTech is developing, on the other hand, reporting solutions with similar features like the common data model with vocabulary and mapping to currently used terms (via technologies of data streaming, Big Data, AI, ML and NLP etc.) have made the requirements less challenging.

Our Focus

Having built a formidable presence as a preferred partner for global top 10 banks, especially in ensuring data and reporting accuracy as part of large compliance programs, we are making strategic investments to be the top 3 banking regulations and compliance solutions specialist by 2025.

By co-creating solutions that thread together deep banking compliance knowledge, emerging distributed data technologies, advanced analytics, and standards of data integration, ably supported by two decades of experience in banking regulatory programs, Maveric aims to help banks manage hyper growths with zero compliance lapses.

Our areas of focus include:

Online Transactions

Putting together a portfolio of tools relevant for retail, corporate and wealth lines of business with Europe and Asia as the focus regions, to meet the needs across the four layers of KYC, CDD, Payment & Identity and Authentication Management.

Regulatory reporting

Europe-focused and therefore centred around FINREP ,COREP and stress testing. The framework is built on the structure and taxonomy of BIRD with an ability to align it to the Common Data Model prevalent in this solution space. This ensures that both quality and agility are achieved.

Conventional AML

The offline validations of business rules relating to value, velocity and volume are handled through a combination of technologies and functions. These range from business rules in excel to data extraction, validation and test execution through ETL; thereby covering 100% of the transactions of the given period in a seamless platform that has lineage, case repository, data dictionary and test history to aid in the decision making.

Redefining Customer Experience with Open Banking

In the past decade, digital transformation has been an integral part of the banking revolution…

Read More

Improving decision accuracy of an anti money laundering solution

The success of any Anti-Money Laundering Solution…

Read More

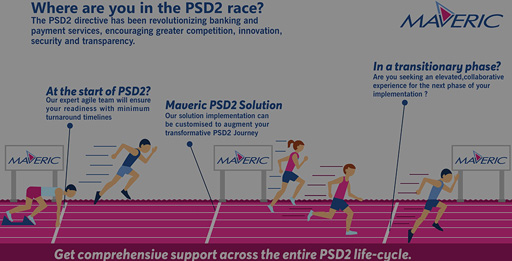

PSD2 Test Automation

The PSD2 directive in Europe brings all the right forces for enabling safer and secured payments…

Read More

Accelerate to 100% psd2 compliance in just 12 weeks

The PSD2 directive has been revolutionizing banking and payment services...

Getting ready for ISO 20022 with Temenos Payments Hub (TPH)

The global payments industry is moving to a single messaging standard ISO 20022...