India’s digital payments revolution isn’t just a story of technology. As the Unified Payments Interface (UPI) continues to redefine how Indians transact, a burning question remains – Is UPI poised to signal the end of credit cards? The answer is as multifaceted as India’s vibrant fintech ecosystem.

At its inception, UPI was designed to simplify everyday transactions. Its ability to offer instant, cost-effective payments via smartphone has set a new standard in financial inclusion. “The Unified Payments Interface (UPI) has transformed India’s digital payment landscape since 2016, growing exponentially, with transaction volumes expected to reach 254 billion by 2025. Its success is driven by smartphone penetration, seamless UX, and innovation,” notes Arindam Ray, Vice President – Central Engagement at Maveric Systems. This transformation has been nothing short of a revolution, not just across consumers and merchants, but also raising questions about the future role of traditional credit cards.

Credit cards have long been the backbone of large-value credit, authentication, and global acceptance across payment spaces. While UPI excels at fast, cost-effective spend, credit cards still provide the global infrastructure necessary to facilitate not only for larger, high-value transactions and international commerce, but critical credit systems. “However, credit cards remain relevant due to their extended benefits like buyer protection, reward programs, and global acceptance.”

Even as UPI’s seamless operation reduces reliance on plastic for day-to-day transactions, credit cards maintain an edge in specific scenarios where credit and global utility are paramount.

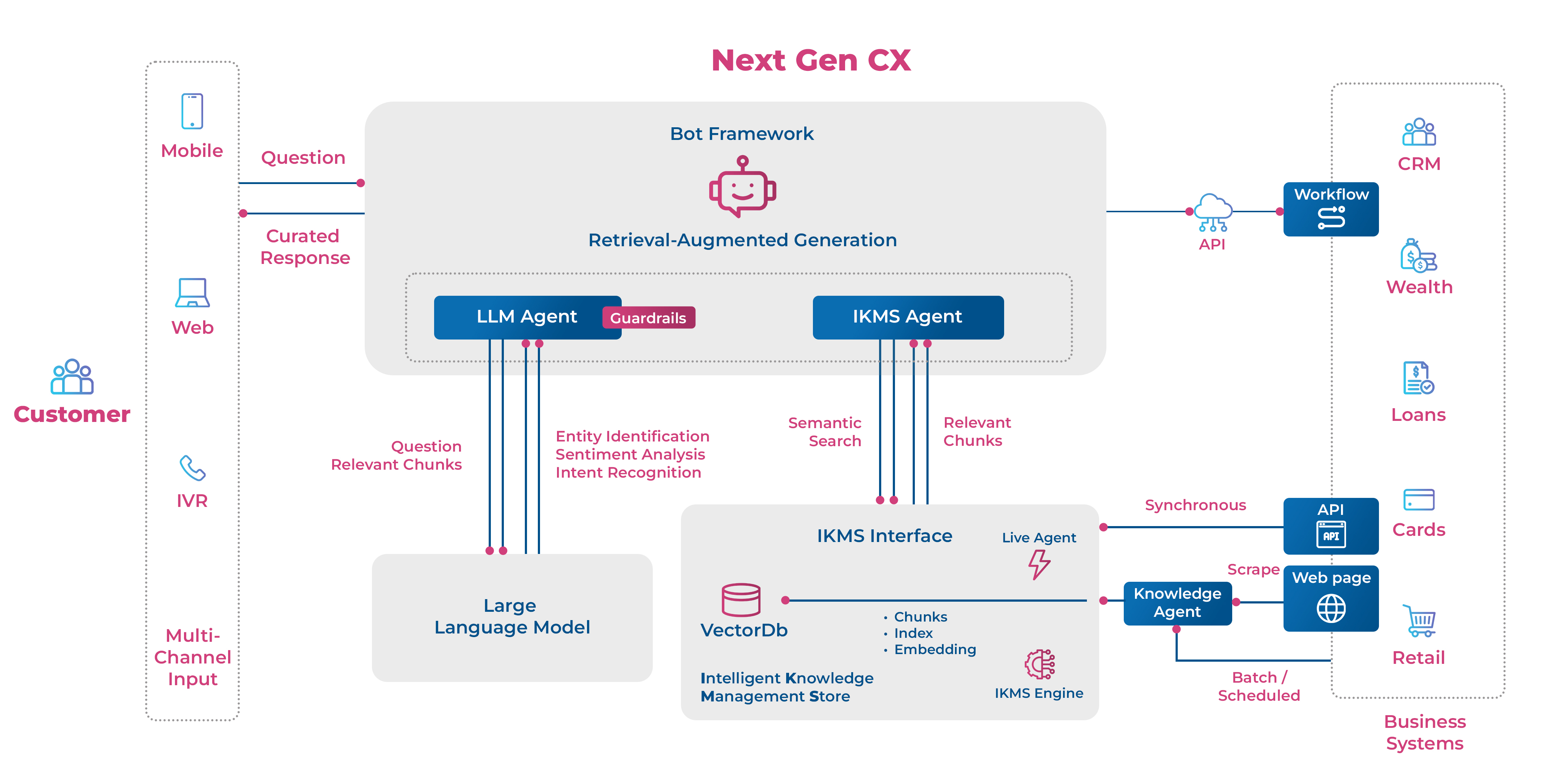

Yet, the evolution of UPI shows no signs of slowing down. Fintech innovations are constantly integrating advanced features into the system, ensuring that its functionality is not only preserved but enhanced over time. Rakesh Mukherjee, CTO at super.money, envisions a future where UPI evolves into an even more integrated ecosystem. He explains, “India’s UPI has been a game-changer in the country’s digital payments landscape, transforming how users interact with finance and the payments landscape. The next phase of evolution is exciting: AI and biometrics could expand UPI’s evolution into an omnichannel utility across diverse financial ecosystems.” His insights hint at a future where UPI could power everything from biometric-based transactions to AI- driven financial tools.

Indeed, the integration of biometric authentication and the AI of digital payment systems promises to make transactions even more secure and user friendly. Mukherjee adds, “Technological innovations will play a crucial role in biometric convenience and security. Home authentication, such as secure and explainable frictionless transactions, making them accessible across all geographies and economic strata.”

All of this underlines that UPI isn’t just a tool for simple payments. It’s a full-fledged infrastructure that powers the financial core of the pervasive platforms of modern commerce.

Yet, amid these technological strides, another transformation lies on the horizon – the fusion of UPI and credit systems. Rajasekhar S. Moya, VP and Head of Digital and Fintech Consulting at Infosys Finacle, succinctly captures this shift:

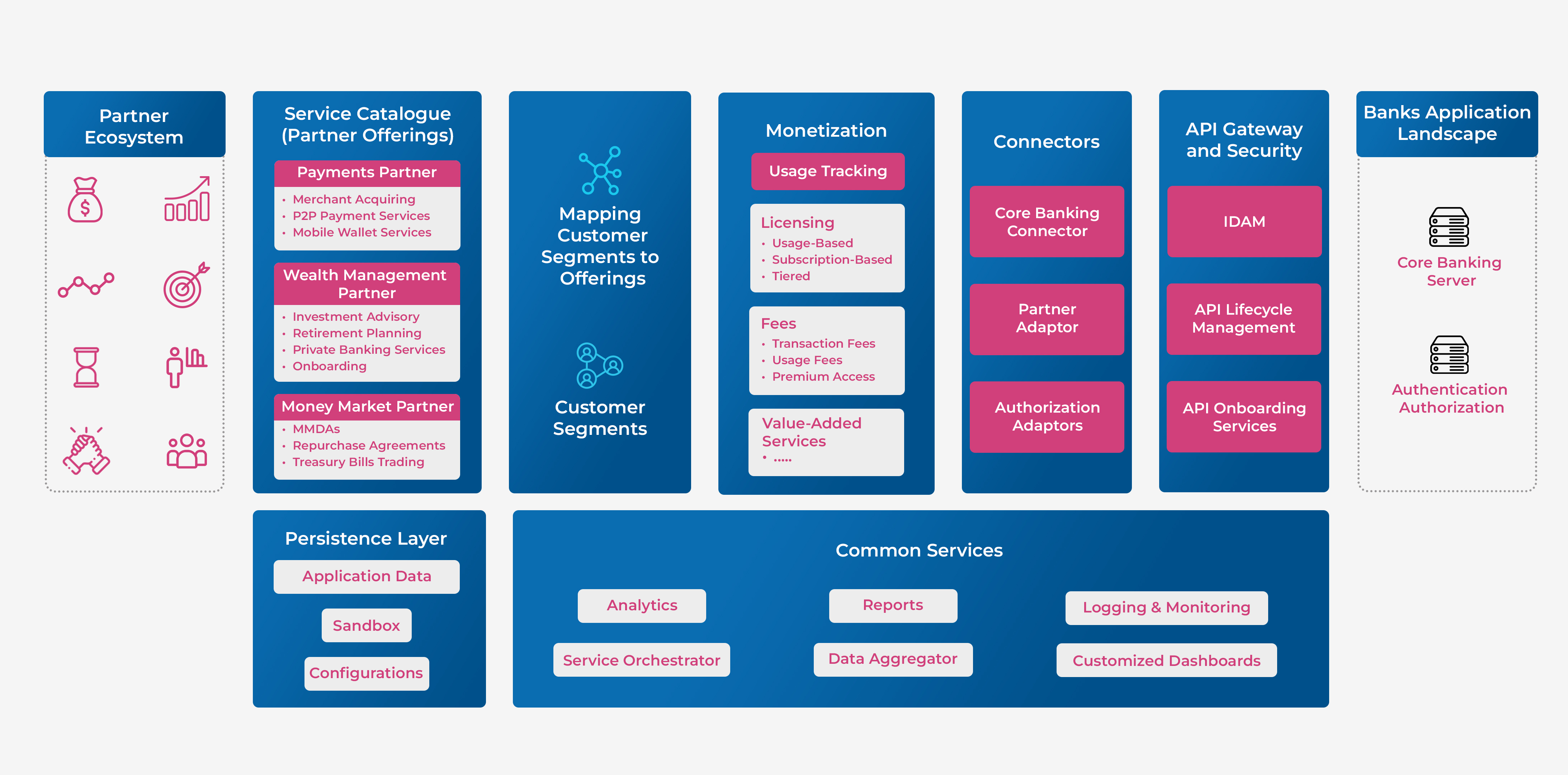

“UPI is game changing the scale & ubiquity of use. While credit line needs blended experience, it would still have lot of expansion ahead. With the level of experience and traction in UPI, we can see another UPI moment in lending and credit line integrations,” he adds. He says the potential impact of blending directly into the UPI platform could blur the lines between traditional credit facilities and UPI-based micro- offering consumers on-demand, credit-like flexibility embedded into their everyday transactions.

This dynamic convergence of services presents an ecosystem where the strengths of both UPI and credit cards could coexist. While UPI may further reduce the necessity of credit cards for low-value and routine transactions, credit cards retain an important niche for larger expenditures, travel, and international dealings. As Arindam Ray points out, “Both payment methods cater to different needs and offer unique advantages. Credit cards provide a crucial feature that UPI lacks—revolving credit.” Thus, rather than replacing credit cards entirely, UPI is likely to carve out its own space in the financial landscape while coexisting with credit facilities.

Adding another layer to this narrative, Kiran Nambiar, Founder of MyFi, underscores the transformative potential of artificial intelligence in the payments space. Nambiar envisions a future where AI not only enhances transaction security but also revolutionizes how we manage recurring payments and personal finances. He observes, “UPI has completely changed the way India transacts, making digital payments affordable to millions… But as digital payments continue to grow, the next big shift isn’t just about speed; it’s about making transactions smarter, safer, and more intuitive and that’s where AI steps in.” This perspective suggests the idea that the evolution of UPI is not solely about speed or convenience, but about intelligent integration of technology for enhanced user experience.

Nambiar continues, “Imagine a world where most of your recurring spends on bills, rent, etc. are taken care of by your personal virtual assistant. This can be a reality within the next 3-5 years.” His vision underscores the potential for UPI to further disrupt traditional financial practices by leveraging AI to deliver customized, intuitive financial management solutions. As AI continues to mature, the payments landscape could witness a revolution in fraud prevention and personalized transaction monitoring, ensuring that digital payments are not just fast, but also smart.

While these innovations are promising, it is clear that the traditional advantages of credit cards — such as global acceptance and robust reward programs — continue to anchor them in the financial ecosystem. Even as UPI integrates cutting-edge technologies and expands its reach, credit cards remain indispensable for certain types of transactions. Ray’s analysis encapsulates of a multifaceted payment ecosystem where each method serves distinct consumer needs.

Moreover, the future of UPI isn’t confined solely to domestic borders. With its scalable and secure infrastructure, UPI is set to expand globally, facilitating cross-border transactions and remittances with ease. Mukherjee highlights this international potential by noting, “On the global front, UPI is well- positioned to integrate with various payment ecosystems, collaborating with fintech players worldwide to encourage adoption.” This global integration could eventually lead to UPI-powered international transactions, further cementing its role in a rapidly globalizing digital economy.

In blending these advanced technologies with innovative lending solutions, UPI is on track to redefine the contours of digital payments yet again. Mayya’s assertion that the integration of lending services marks “another UPI moment in lending” hints at an emerging paradigm where digital payments and credit converge to offer an all- encompassing financial service. The future may hold a unified platform where consumers can seamlessly switch between everyday payments, instant credit, and even personalized financial advice — all under the UPI umbrella.

This Article Orgiginally Published in Digit