Banks are at the forefront of digital transformation, but are they truly ahead of the curve, or are they still playing catch-up? While fintech startups disrupt the landscape with agility, traditional banks face challenges ranging from legacy systems, regulatory compliance, and Al-powered fraud detection to multi-cloud adoption and GenAl integration. The rise of agentic Al, predictive compliance, and embedded finance presents both an opportunity and a challenge. How should banks navigate this rapidly evolving ecosystem?

In this exclusive Dataquest Q&A with Minu Sirsalewala, Executive Editor, Dataquest, Kishan Sundar, SVP and Chief Technology Officer, Maveric Svstems Limited, shares his insights on how banks are transforming, the key challenges in Al adoption, the role of RegTech in compliance, and why unlearning old mindsets is as critical as adopting new technologies.

Are banks genuinely transforming, or are they still struggling with legacy systems and compliance barriers?

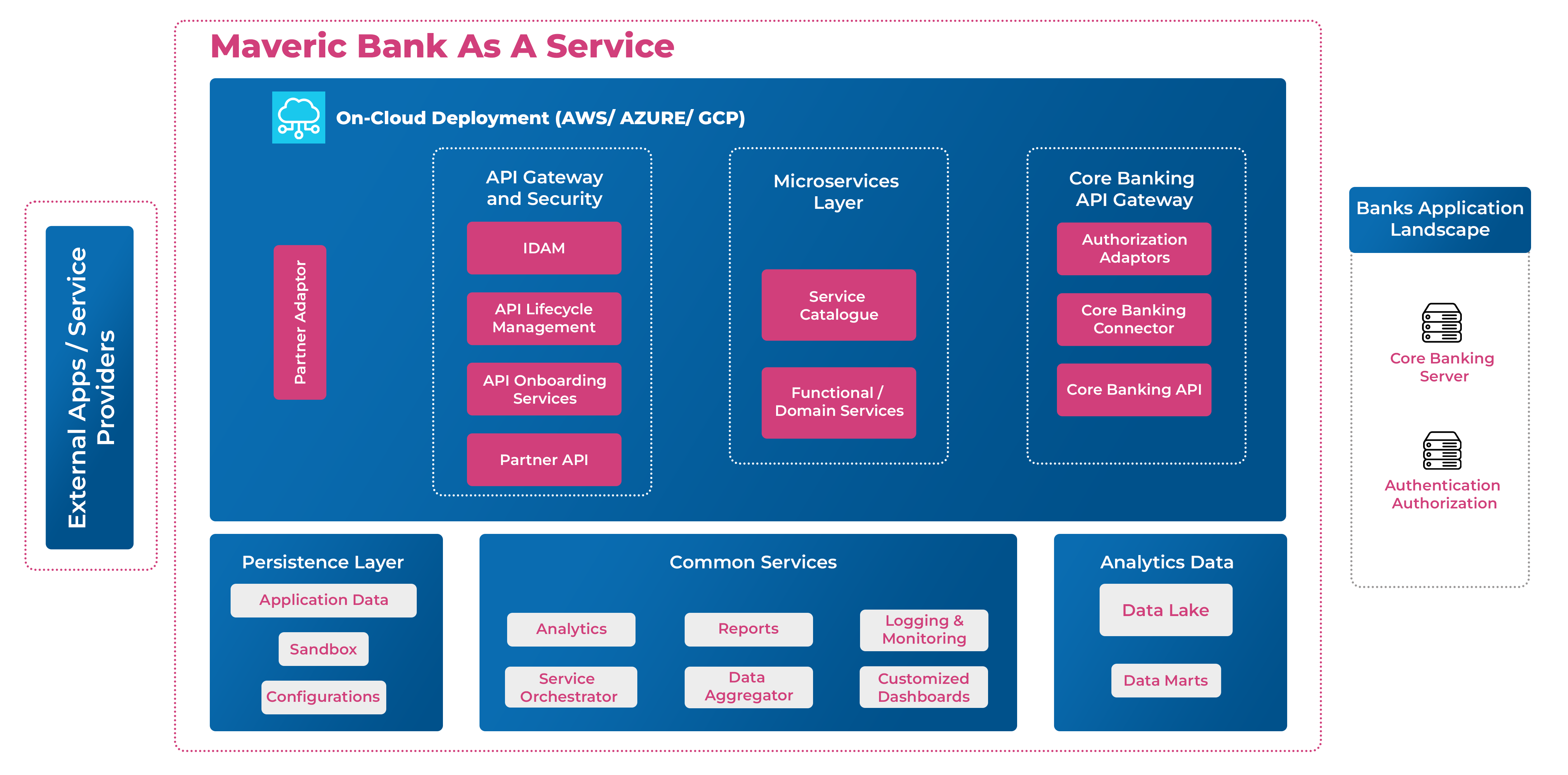

Banks are transforming, but whether its holistic or in bits and pieces depends on how they tackle legacy systems. Most Tier 1 and Tier 2 banks still carry massive technical debt-decades-old infrastructure and tribal knowledge embedded in code. This makes transformation slow, costly, and complex. However, we’re now seeing a shift. Modern accelerators are helping banks extract legacy rules, automate migration, and optimize for cloud adoption. As a result, we see banks increasingly willing to sunset outdated applications and move to modern, flexible tech stacks.

What are the biggest internal roadblocks in banking transformation-tech limitations, mindset, or compliance?

It’s a mix of all three, but mindset is the biggest hurdle. Many banking professionals worry about job security when embracing Al-driven automation. Change also requires unlearning outdated approaches-something that’s often more difficult than learning new technologies. Compliance adds another layer of complexity, especially with constantly evolving global regulations. However, the skill gap is the easiest to fix-it’s the cultural and mindset shift that takes longer.

Al is transforming banking, but is it also introducing new risks like biased lending models and Al-driven fraud?

Al in banking is still in a controlled phase-most implementations are agentic Al models, meaning human-in-the-loop decision-making is still key.

While Al helps with fraud detection, risk assessment, and sentiment analysis, it does pose challenges like opaque decision-making and potential bias in lending models. That’s why we emphasize Al transparency and explainability-banks must ensure Al-driven decisions are auditable and aligned with regulations.

One clear use case is Al-driven call resolution audits, where banks previously audited only 10-20 per cent of calls manually. With Al, they now audit 50 per cent or more-leading to improved customer satisfaction, compliance, and agent training.

RegTech is often seen as a compliance necessity, not a strategic enabler. Can Al-driven compliance change that?

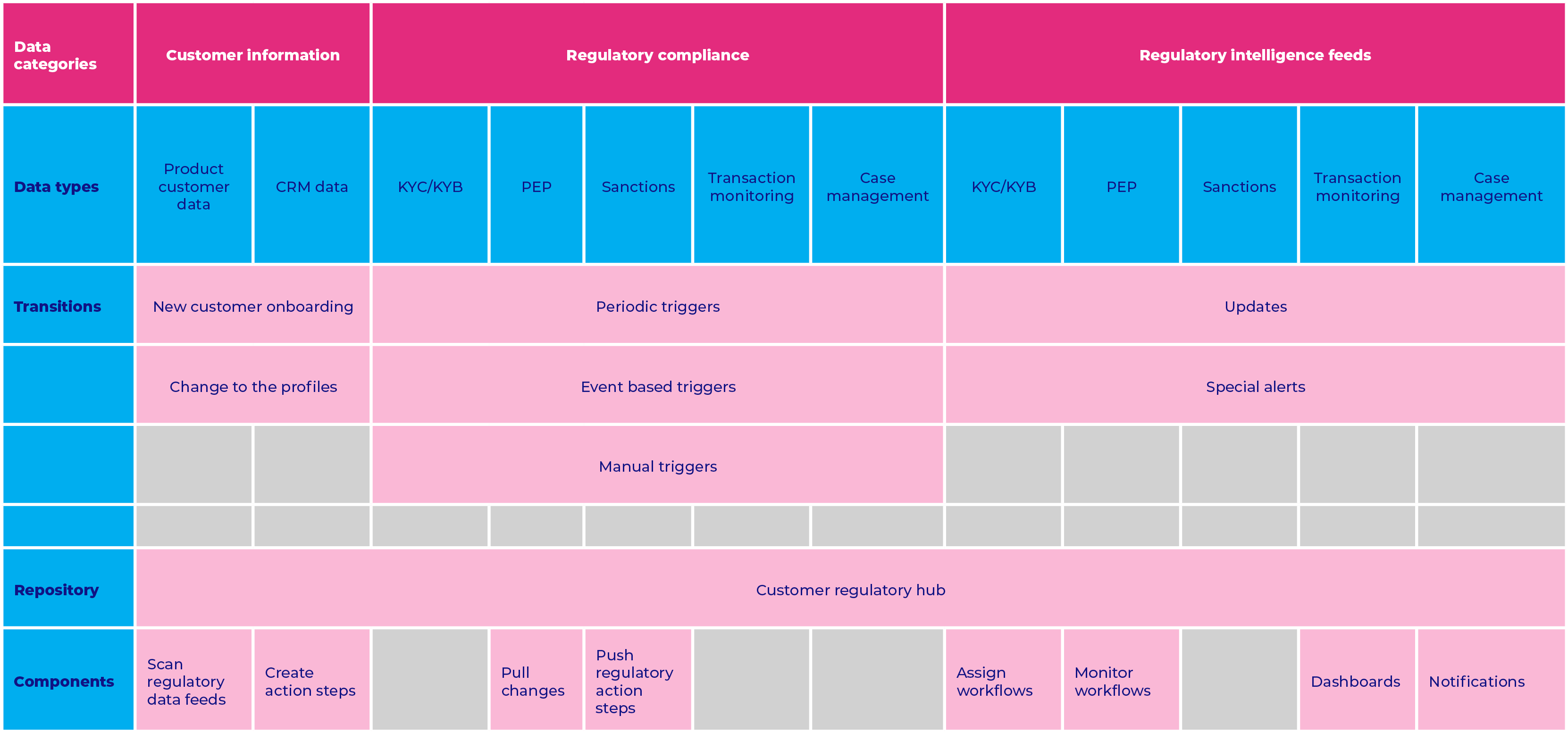

Absolutely. Think of compliance as a seatbelt in a racing car-it’s not just a checkbox but a competitive differentiator. Regulations like DORA in Europe now hold banks accountable for not just their systems but also third-party vendors. Al-driven compliance solutions are helping banks proactively monitor risks, improve cybersecurity, and prevent regulatory penalties. The shift is from reactive compliance to predictive compliance, where Al pre-empts threats rather than just responding to incidents.

Is embedded finance a threat or an opportunity for banks?

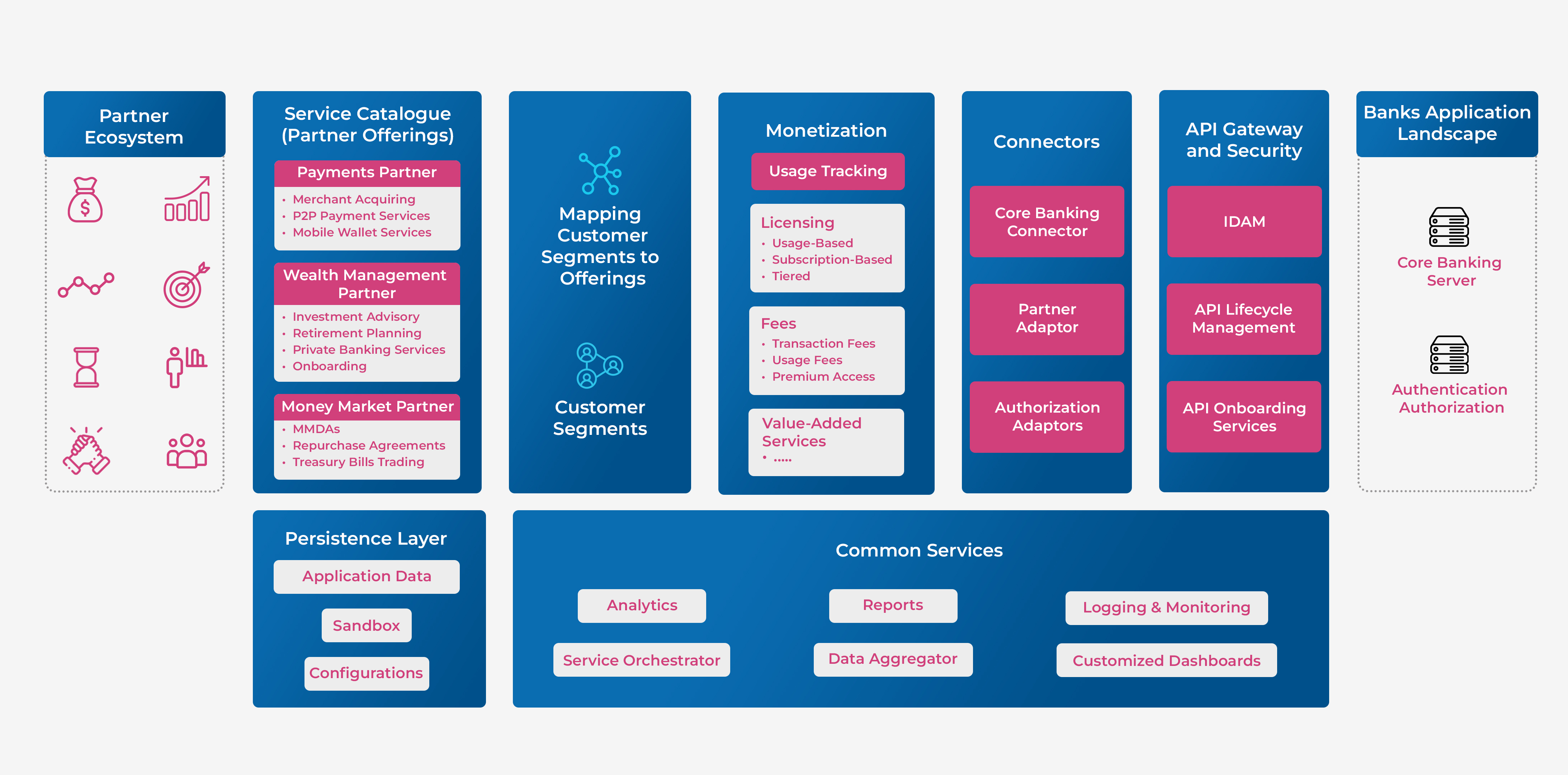

It’s an opportunity-banks are increasingly partnering with fintechs rather than competing with them. BNPL (Buy Now, Pay Later) is a great example. Initially seen as a fintech-only space, we’ve worked with banks to integrate BNPL through open banking APls, turning it into a cross-selling tool. Most banks already have the infrastructure- embedded finance is simply a smarter way to monetize it.

Where does quantum computing fit into banking transformation?

Right now, high-frequency trading and cryptography are the first adopters. But the biggest impact will come in anti-money laundering (AML), fraud detection, and cybersecurity. Today, banks detect fraud using small slices of data-quantum computing will allow them to analyse massive datasets in real time, detecting patterns across global transactions. It’s still early-stage, but financial institutions should start exploring quantum resilience now.

The biggest disruption in banking transformation that people aren’t paying enough attention to?

The disappearance of traditional entry-level IT jobs in banking. Earlier, fresh talent joined with 3o per cent readiness and learned the rest on the job. With Al-powered automation and GenAl-driven coding assistants, banks now expect go per cent job readiness from day one. This fundamentally shifts how talent is trained and hired.

Another disruption is the shift from man-hours to outcome-based delivery. Earlier, banks measured service vendors by man-month efforts. Now, it’s about speed-to-value-how quickly a technology partner can deliver a tangible business impact. The service industry is evolving rapidly in this direction.

If you had to bet on one transformative trend defining banking in the next five years, what would it be?

The move from cloud-native to cloud-ready architectures. Earlier, banks experimented with hybrid cloud, multi-cloud, and on-prem combinations. Now, we see a push toward truly cloud-agnostic infrastructure, where applications can shift seamlessly between providers. This de-risks cloud dependency and gives banks greater flexibility. Banks will no longer be tied to a single cloud ecosystem-that’s the future.

Article Origianally Published in Data Quest