CX in Banking

Accelerating Next through Conscious Contextualization.

For companies – Uber, Venmo, Google, Apple Pay – to become ‘daily-use-verbs’ is like a rite of passage. It is a milestone, the ‘blue tick mark’ of customer trust and loyalty.

In today’s experience economy, this milestone is made meaningful when one considers the ominous dark clouds over banking a.k.a. economic downturn, geopolitical instability, and soaring inflation.

CX for banks is a big deal. A Forrester study posits a 1% improvement in CX for a multichannel bank yields additional $123 Mn in revenue (for a direct bank that works out to $92 Mn)

What’s the way for banks to accelerate to their next?

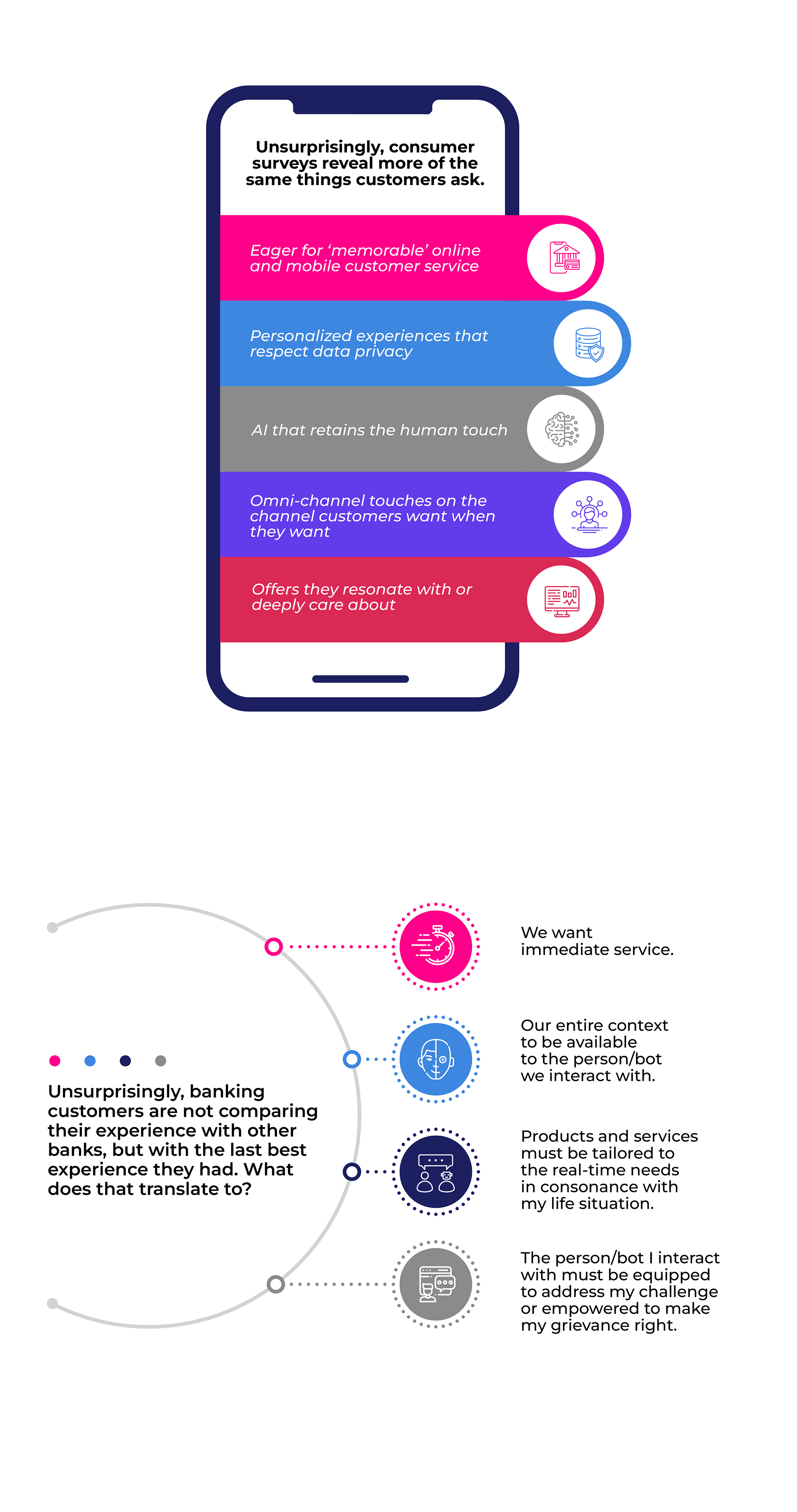

In a climate where B2B C-suite are taking their CX cues from Netflix, Spotify, and Amazon (fast, personalized, and seamlessly digital), neobanks like – Northmill, Starling, Nubank – are approaching CX in a mission mode. These include – 365/24/7 access, 360-degree customer dashboards for agents to offer streamlined support, and embedded support across channels and devices for consistent and connected experiences.

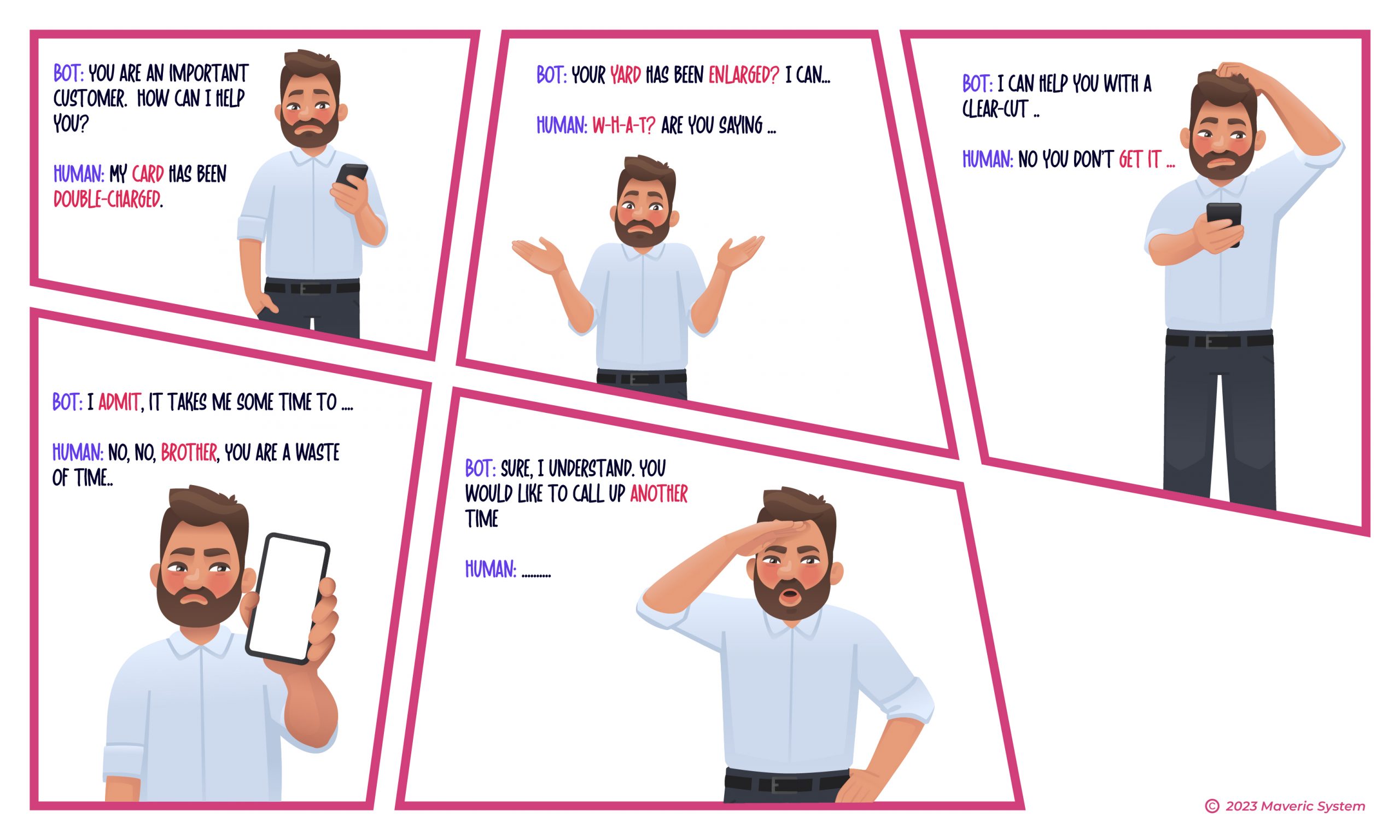

However, CX is largely influenced by feelings, a domain where emotions drive loyalty. This comes from the ability to consciously contextualize – something that AI systems are yet to deliver wholeheartedly.

Sentiment Analyses show that humans, while satisfied with the ease or effectiveness of the solution they receive, rely on their feelings as a truer barometer for future actions.

So, how does contextualization reflect in CX? Said simply, wallet share can only succeed mindshare. Not through the up-sell campaign slipped into an orientation call, or the number of times your name shows up in an ‘education’ emailer, or on top right hand corner of your online account page.

Conscious contextualization happens when financial, personal, and behavioural data can accurately predict lifestyle needs.

Something that this conversation is clearly missing…

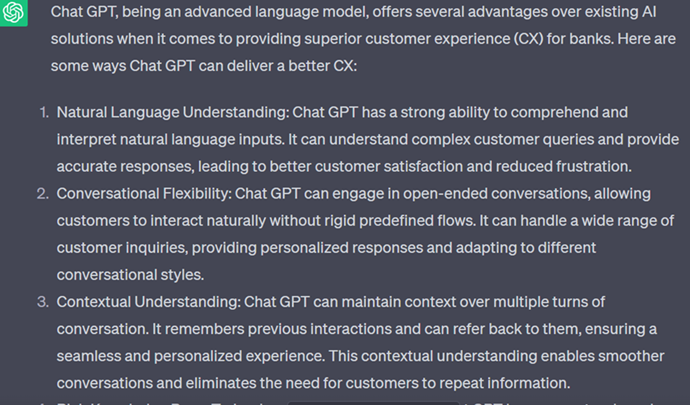

We asked Chat GPT, “Compared to existing AI, how can ChatGPT offer superior CX for Banks?”

Source –https://chat.openai.com/ 07.07.2023 10:10 IST

Source –https://chat.openai.com/ 07.07.2023 10:10 IST

So even with the deluge of GPT AI news and the cautionary tales flooding our inboxes, lets remind ourselves with a line from Steve Jobs, let’s go invent tomorrow instead of worrying about what happened yesterday. That holds true for all of banking tech, as well.

To get more updates, subscribe to our Monthly Newsletter

View