As technology and customer interaction keeps evolving on a regular basis, it becomes highly imperative for any traditional core banking solution to be at par. The growth trend in digital transformation reached its peak during pandemic and this trend continues to grow and expand further. Newly improved versatile technologies such as cloud based databases raised eye brow’s with superior application performance and substantial cost savings. Banks need to re-energise their core banking solutions which could aid them with highly personalised customer engagements and be super-efficient.

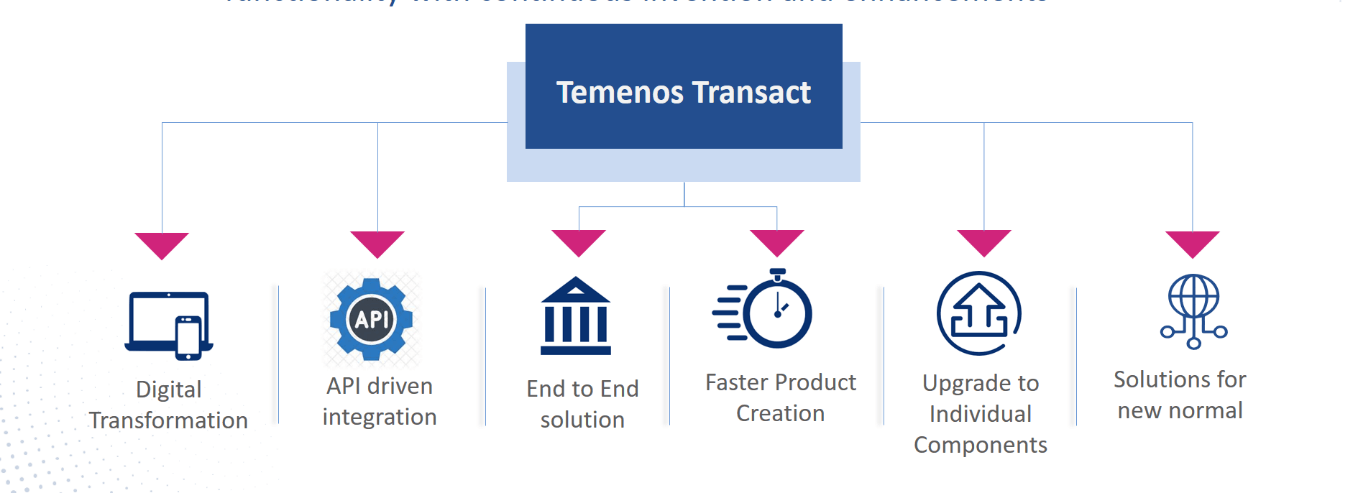

Temenos is the number one banking software company with more than 3000 customers across 150 countries. With the continuous innovation and enhancements of last 25 years, Temenos has brought the core banking solution aka Temenos-Transact, that tops the charts with comprehensive set of modern features and functionalities as listed below in the figure

The digital properties embedded in Temenos Transact are impeccably crafted for elevating customer experience. Banks can rejoice the benefits of Open Banking, which is clearly demonstrated through built-in APIs on cloud native/cloud agnostic databases. Personalised products can be smartly configured in a jiffy.

Let us dig deeper on Temenos Transact and the value it offers to the banking world.

Breath-taking features of Temenos Transact that you can’t miss!

Reusability

The primary key focus of Transact is to maximise the reusability through a common pool of functional components. It has a reusable repository of components for each business services like Customer, Interest, Payment schedules, etc. These components are robust in nature and hence they can work independently with their own attributes and processes. Once we define a component be it either Savings account or Fixed term deposits, Transact easily allows to reuse the cross products with no boundary on what type of product it is. The reusability feature enables banks to reduce the implementation effort by eliminating “similar-look-alike” features.

Easy and faster launch of products

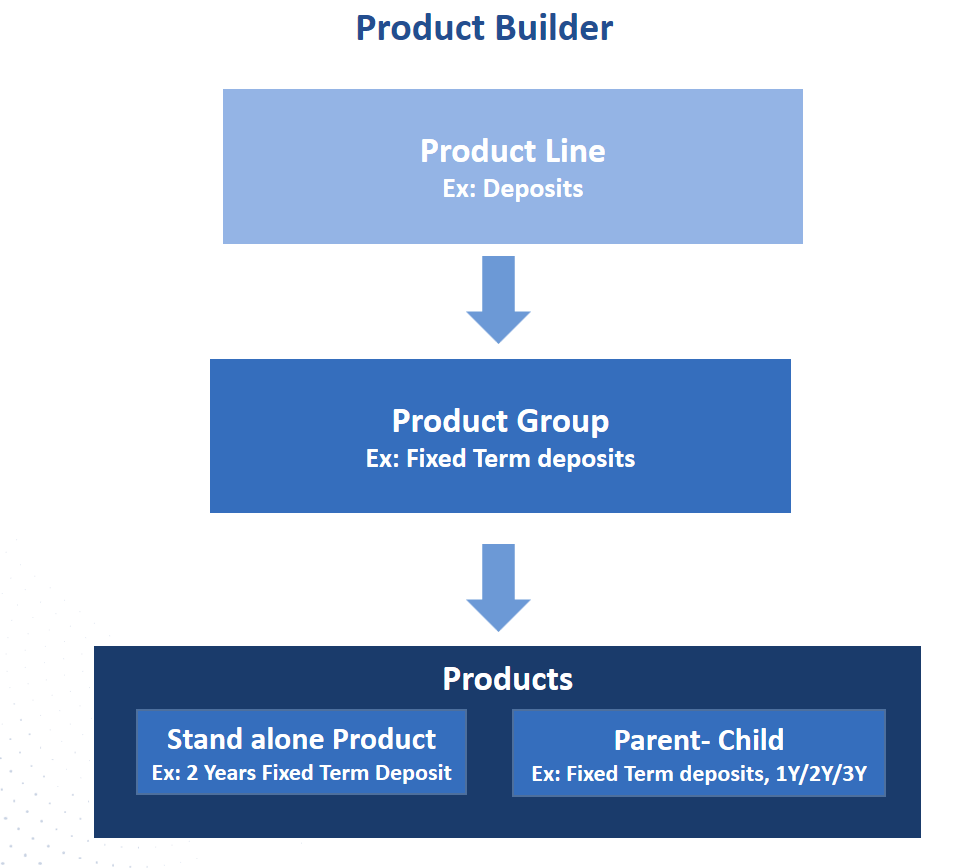

Temenos Transact has a flexible framework to allow bank users to build more banking products in much easier way. It follows a three-tier approach to create any financial products as given below.

The high level product lines are defined with attributes and processes associated with them and published by Temenos. In the subsequent level, banks can create product groups by picking the list of necessary and sufficient components. Usually, Temenos publishes model product groups as a part of the application package itself and some banks may reuse them as they are.

From a product group, any number of products can be designed either as stand-alone products or as parent-child products where child product can be inherited from the parent. It is possible for the child to have additional features on top of the parent or even to overrule parent features, if required. Once parent product is created and ready, Banks can create their own child products even within a week’s time. This ease of flexibility makes the job of product creation much faster.

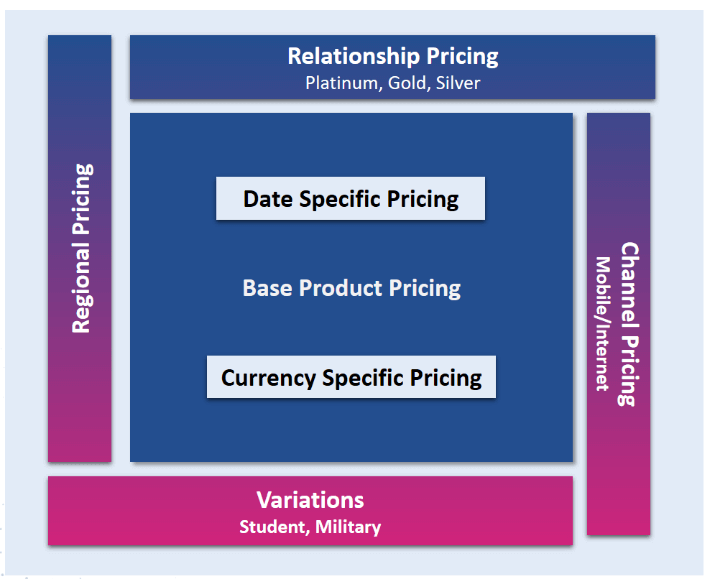

Enterprise Pricing

If your banking business requires to have different pricing for different customers, it is possible now with a single Transact product. This is a big relief to banks. Transact allows to have different interest rates, based on customer relationship or the channel customer uses. Do you want to have different pricing for transactions depending on their creation date or to imply region specific pricing? Yes, these questions are very well answered by Transact’s enterprise pricing feature. You can just create one single product with various pricing options through multiple set of Configurations.

An important point to ponder – Transact Configuration is easily possible even If your requirements need to have user defined variations and exclusive interest rates for each variation. This feature reduces the effort to create separate products for each type of pricing and hence will result in low Implementation cost.

Open APIs for Easy Integration

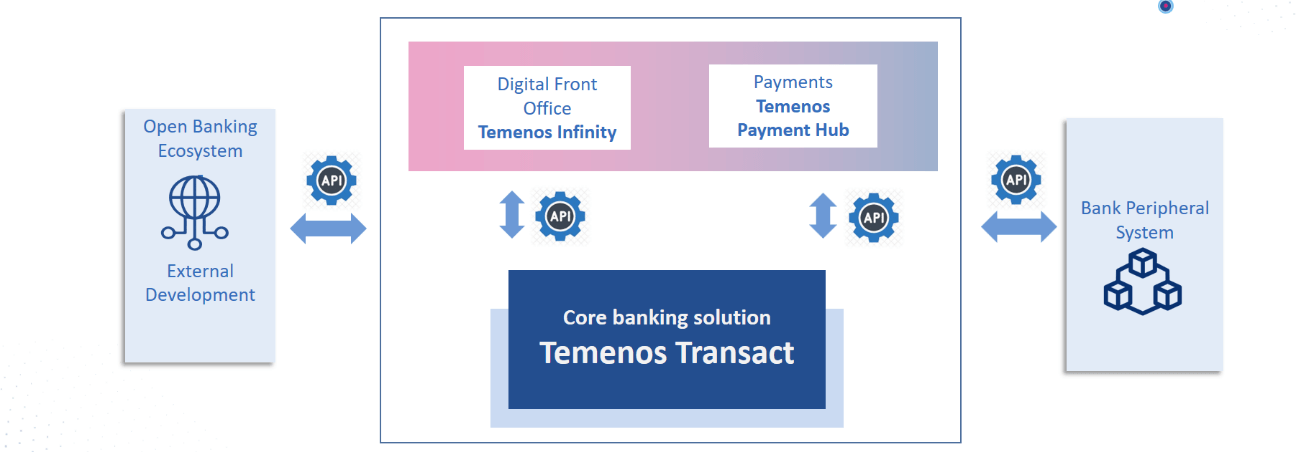

We have so many advanced technology applications and products in the market, so it is essential for any core banking solutions to facilitate easy communication passage and integration with any third party system. The Open APIs available in Temenos Transact offer seamless synergies with other product suites such as Temenos Infinity or Temenos Payment Hub (TPH). Additionally, these can be easily mounted on external systems for sanctioning communication access though built-in library of Open APIs.

Therefore, Transact is highly capable to bring in an unified solution to any bank with its desirable list of products including Infinity for digital front office or TPH for payment system and technologies like SaaS to run on own cloud or to use any external cloud and ride on the advantage of different features

Event/Activity Driven Processes

Temenos transact has a list of event driven processes which enables banks to map an event and trigger all the needed processes with a little effort of configuration. You can trigger a business event like partial withdrawal based on the defined financial transaction codes. As we know, TPH is a standalone product to handle all type of inbound and outbound payments. Using a simple mapping, you can connect to Transact in no time.

You can apply any kind of restrictions in business activities such as withdrawals, deposits, prepayments, etc in order to monitor them against the pre-defined rules. Penalties, overrides or even rejection of the transaction can be initiated in case of any deviations.

If we need to assign different screens to users based on a business event like creation of new arrangement or interest rate change, it is a single step of mapping which is put to action. We can define any number of screens as we want and map them against necessary business events. If you need to create delivery messages for any kind of business events – You can just define a field level mapping for it and the interface to the Transact delivery system can initiate the delivery processing.

Easy Maintenance of Transactions

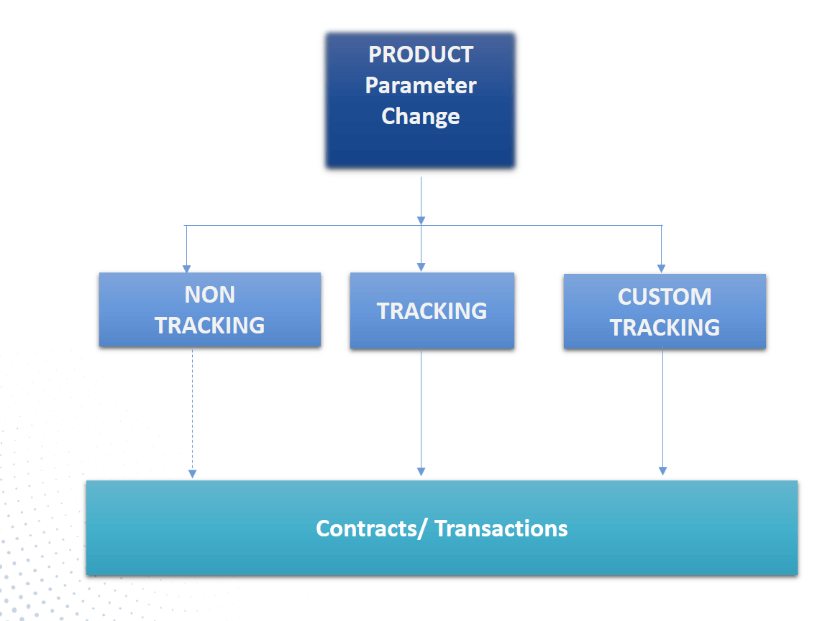

Are you tired of default tracking behaviour of your traditional CBS products on the existing transactions, whenever you need to do a parameter change at product level? Transact has a solution that can define the required tracking rule. You can define the product with tracking option so that any change at the product will be applied to all existing contracts. If you don’t want such tracking, we can choose non-tracking option. We have an advanced custom tracking method too, wherein some attributes alone can be excluded from the tracking.

Such parameter changes in products can be easily controlled by an effective date of the contract which can help us to apply changes or make corrections only for a group of contracts. Also, Transact facilitates to have Backward/forward dated change definitions. Therefore, it is much easier now to maintain the existing contracts according to the business decisions.

Minimal Local Development

What about the ratio of implementation effort Vs local customization effort with the available Traditional Core Banking Solutions? Transact brings a well-packed end-to end solution in order to reduce the local development effort in a massive way with all the below enhanced features.

- It has a single contract view to showcase entire details of a contract including owner details, balances, interest rate, payment schedules, payment bills, settlement instructions and messages.

- It is possible to configure restrictions at field level and business events level

- We can imply charges for business activities just through configurations

- There are multiple stages to attach local routines, as required.

- Field /Component level negotiation rules can be defined

- Periodic attributes are associated with components.

- Well-structured limit functionality

- Enhanced enquiries for better management of banking business.

- Single facility for multiple loans even for retail customers, supporting additional borrowers on top of the primary borrower.

- Amend, reverse or update arrangements with effective date as back dated with recalculation and adjustment, if required

- Settle the disbursement of loan amount to multiple accounts in multi-currency with role-based home pages for users.

Simulation

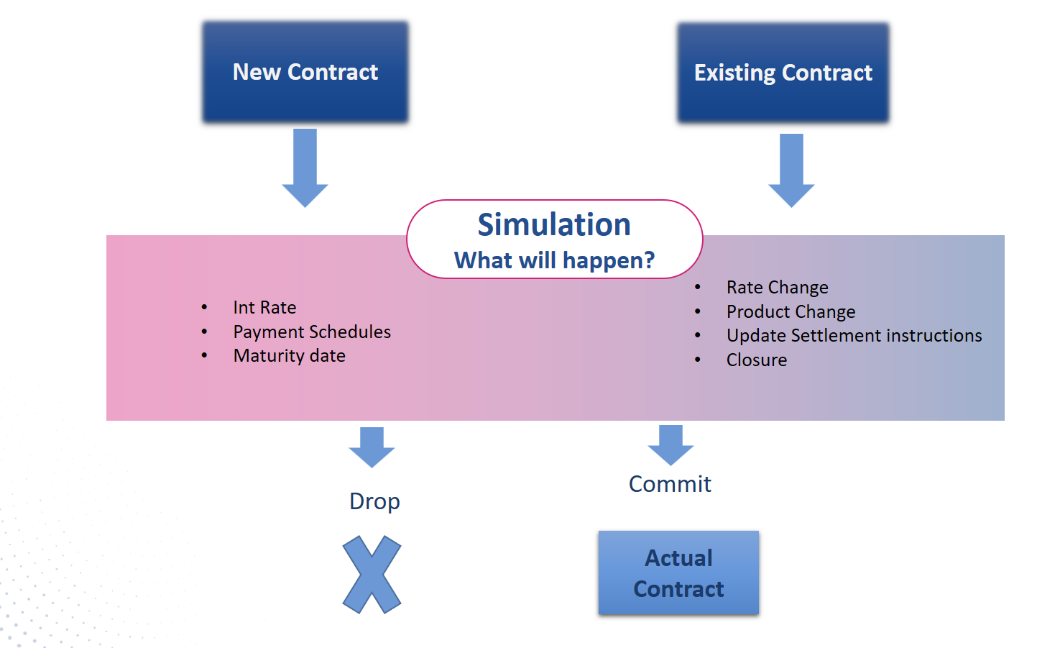

Another customer friendly feature of Transact is Simulation, it helps user to do a transaction and check “what if” before committing the transaction. Let it be a creation of a new contract or modification of existing contracts, if the customer or back office user prefers to see the “what if” result, they can just simulate the operation and decide to proceed with the transaction or not.

It delights customers knowing what will be the interest, maturity date or instalment amount before proceeding with the transaction and helps them to take the right financial decision. This way banks can engage and retain customers well with 100% transparency.

A Contextual Solution for the New Normal

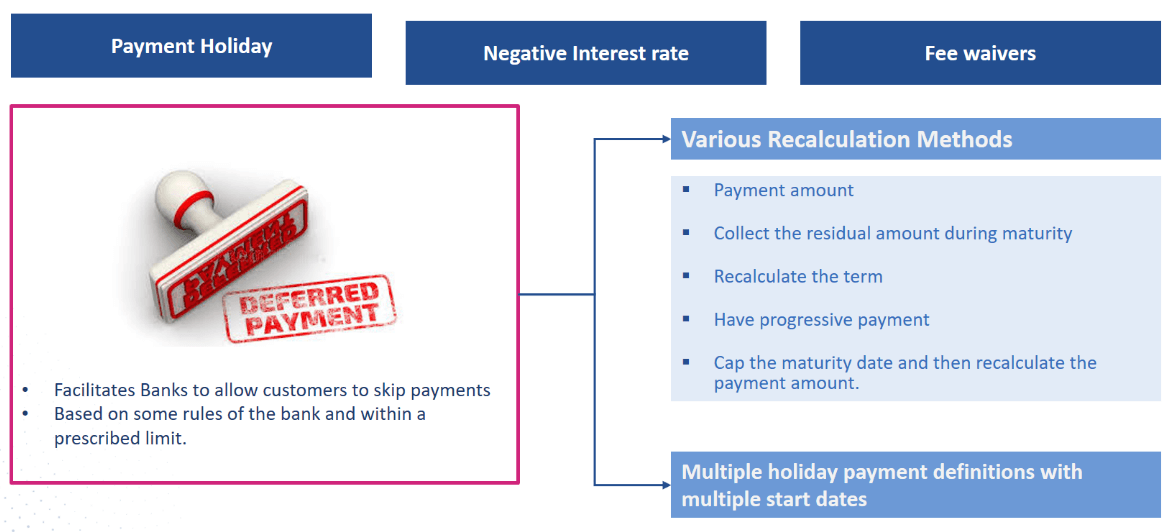

All banks need new functionalities like default payment holidays, negative interest rates and fee waivers to meet up the customer needs for the new normal situation like Covid-19. With the flexible architecture of Transact, Temenos has enhanced a new component for payment holiday with the complete functionality to defer loan Instalments for a defined period and collect the outstanding balances with different recalculation methods.

Transact allows negative interests too and it has a well-defined fee waiver functionality as well.

Soft Accounting

If your modern banking business seeks to define your own accounting and allocation rules, the rules-based accounting model of Transact helps with a smooth configuration. It is possible now to map a single action against a number of accounting events. For Example, interest and charges adjustments can be booked under different profit and loss head and income and expense out of negative rates can be booked under different profit and loss head.

Conclusion

Temenos Transact is the best modern end-to-end core banking solution, enabling wide range of possibilities through its robust architecture and breath-taking features. With the advent of Open API’s, the future of banking is brought alive for driving the culture of open banking eco-system. Transact promotes banks to offer rich customer experiences bringing any kind of products to market faster. Implementation cost is kept under a check with the virtues of higher degree of available configuration, zero customization and lower operational costs with easy maintenance of products and transactions. You can also visit my webinar recording to get a comprehensive view of Temenos Transact. Additionally, you can also learn some classy tips and best practices on Transact upgrade from my colleague’s article.

The game of retail banking can thrive on the compelling promises of Temenos Transact and the outcomes it delivers for operational efficiency, OPEX reduction, lowering IT burdens and process simplification. At Maveric, we help banks in building and managing their future connected core through our encyclopaedic proficiency by unlocking the best of Temenos Transact to #AccelerateNext.