With the increase in regulatory demands, and screening volumes spiking through the ceiling, ML is seen as the only viable option to accurately detect suspicious transactions.

Over the past several years, the instances of international money laundering have increased manifold, driving enforcement agencies in various countries to update their AML rules and regulations to curb illegal means of generating income. Globally, financial institutions are racing to deploy heightened screening systems and pushing their existing technologies to cope with the new rush. Events such as the Deutsche Bank’s alleged failings in securities trades, originating from Russia between 2011 and 2015, have led enforcement agencies to make formidable AML regulations.

Almost all FIs and banks are now deploying enhanced identify verification systems. They have come up with more stringent standards for accepting new customers. PEP (Politically Exposed People) screenings have increased. Scrutiny of public records of customers are gaining momentum, so much so that FIs and banks are not hesitating to add negative news as a factor.

This is a double-edged sword for FIs and banks. As they scrutinize more closely, they also have to tread carefully so as not to cross the thin line of violating customer privacy. The customers, on their part, are becoming edgy with their banks asking far too many questions.

The Spectre of “False Positives”

There is an overload of data but data accuracy is becoming a concern. The common element of complaint amongst the financial institutions is the credibility of data procured. The factor of “false positives” where a legal transaction is often flagged as suspect is increasing.

It is clear that the old ways of rule-based filtering are proving to be inadequate, moreover, existing technologies are not flexible enough for real time interventions. Since the existing system depends on old rule based analytical methods and expert judgment, there is a higher chance of missing valid alerts.

Adoption of ML

There is now widespread belief that the adoption of analytics-led approach and machine learning (ML) will help overcome the false positive challenge. ML based risk assessment scoring and alert generation and adaptive and predictive modeling are now being seriously considered.

One of the biggest roadblocks faced with mostly manual checks and screening is the amount of triage that the personnel must do when alerts are flagged. As this load increases, personnel will set aside triaging or put it in hibernation. Most of it may get auto closed post a time period and the opportunity to action is lost forever. By deploying ML, computers can now be trained to check, screen and do triages, hibernate and close without manual intervention.

With ML, FIs and banks can now draw up a holistic view of the customer from static KYC documents and dynamic data from transactions. ML can also help build the social graphs of customers and can deal with big data effectively to create behavioural models (predictive) for individual customers. The automated system can trigger checks, screenings and triages. What more, an ML engine can be deployed orthogonal to an existing infrastructure running independently without disturbing current operations. Until the organizations gain enough confidence in their ML systems, they can effecively operate both manual and automated systems.

There are a number of solutions put forth by researchers working with real time data for clients across the world. One such solution [6] involves using advanced Data Mining techniques with Neural Network and Transaction Analysis to detect money laundering instances. This solution uses traditional data mining approach involving data gathering, clustering and classification to build a knowledge base about a customer and then watching each transaction for its frequency and quantum of funds involved in those transactions.

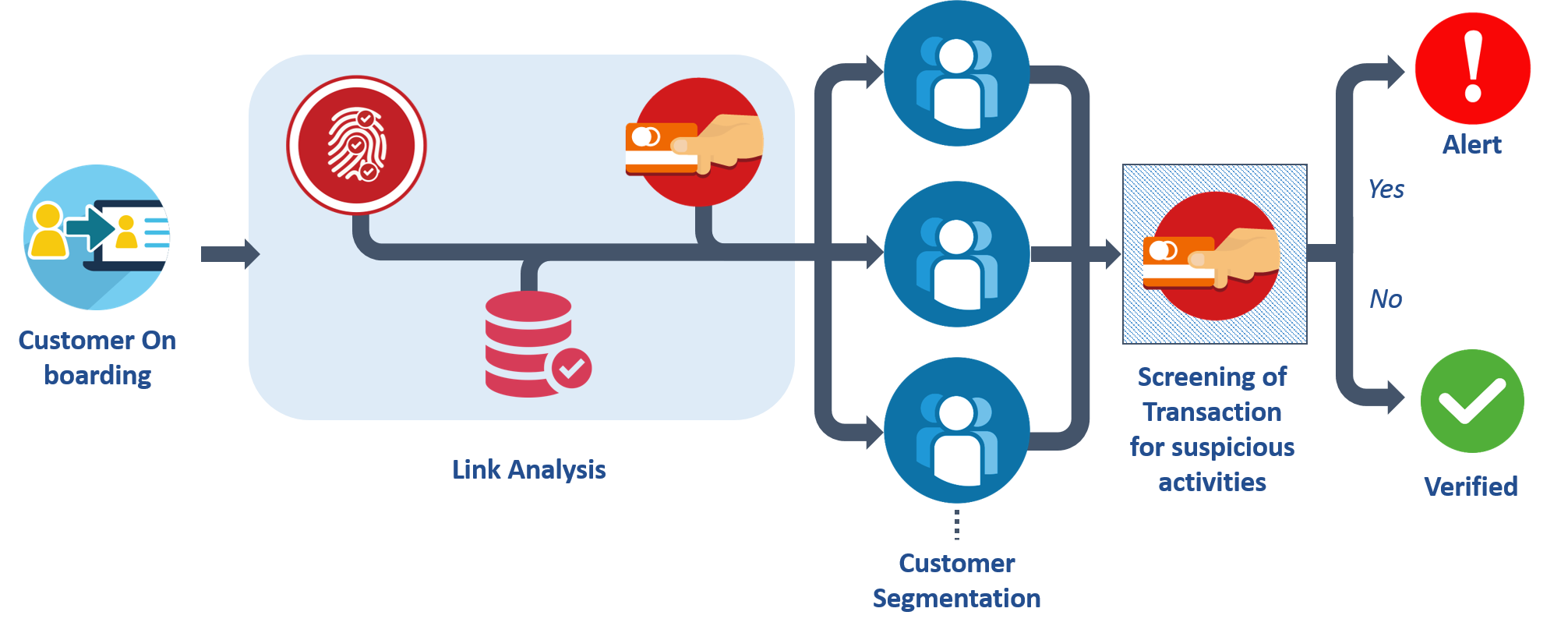

Artificial Intelligence (AI) AI and ML are now being deployed right from the CDD (Customer Due Diligence) stage. Called Customer Onboarding, the CDD process ensures that an automated agent provides real-time, dynamic features to the onboarding human agents to detect fraud more accurately and easily. In the next stage, called the Link Analysis, the AI/ML agents help link KYC data with other sources of structured and unstructured data and also real time transactions. This leads to faster customer segmentation where a customer behavioural map can be drawn and can be benchmarked. Once the data is generated, linked and segmented, other features like screening transactions and alerting on suspicious activities are driven through AI/ML automatically with least intervention from human agents.

ML Deployment in real world

Many FIs and banks are using ML for non AML operations such as building the customer transaction profile, offering AI chatbots – mostly for upselling products to customers or for better customer service. There is a gradual acceptance of ML in fraud detection and AML regulations.

Citibank has made a strategic investment in Feedzai, an data science company that works in real time fraud detection. However, an example of a direct application of ML to detect fraudulent transactions across the globe is that of AUSTRAC (Australian Transaction Record Analysis Center) in collaboration with the RMIT University in Melbourne.

While FIs and banks and national agencies know the power of ML and its benefits, they are looking at ML as a human augmentation tool rather than a fully automated system. They are using ML without much ado to detect suspicious activities and flag it for experts to jump in and screen. However, this viewpoint is rapidly changing due to cost over-runs and sheer volume of alerts that are being generated. We will soon see ML taking on a more central role in AML compliance.

Sources:

[2] ML in AML applying data science ai to tackle international financial crime

[3] LEVERAGING MACHINE LEARNING WITHIN ANTI-MONEY LAUNDERING TRANSACTION MONITORING

[4] 5 steps AML compliance 2017

[5] Dow Jones and ACAMS Global AML survey results 2016

[6] A data mining-based solution for detecting suspicious money laundering cases in an investment bank