Regulatory reporting and compliance is an unavoidable subject in Banking. It is a critical activity for banks and financial institutions, which requires, sustained effort from risk, finance, and IT teams. Many banking and financial organizations struggle with the high level of redundancy, dependence on manual processes, and opacity of their regulatory reporting processes.

Alarming Facts for Regulatory Non-Compliance in Banking

Current Outlook: Why it Needs Attention?

Many regulatory reporting processes are internal to the organization, but there is a regulatory body that oversees compliance. These regulatory bodies are dependent on the industry that the organization is part of. For the BFSI vertical, it is the Fellow Chartered Accountant (FCA), the energy industry is Office of Gas and Electricity Markets (Ofgem), advertising is ITC and the communications industry is “The Office of Communications” (Ofcom).

Like most regulatory bodies, FCA and others engage in periodic reviews. During these checks, they not only check what your organization is doing at that moment but also a back story to that point. Some of the most common forms of regulatory reporting in practice today include:

Complaint Handling Process: The complaint handling process checks how the business handles complaints and the official procedures in place to make sure it is productive and fair. Once the business has established a fair and process-driven system, the business should adhere to it and also make sure it conforms to regulation.

Training: This has to do with the processes the business puts in place for performance reviews, appraisals, CPD, and on-the-job training. Regulatory reporting ensures all of these processes are fair and above board to the parties involved.

Procedures and Processes: These check all the processes and procedures for operation in an organization regardless of how complex or diverse they may be. These processes are as intricate as the method of signing paperwork, explaining terms and conditions to customers, and others like that. All of these are examples of regulatory reporting as it is mandated and regulated.

Record Keeping: This is the basic form of regulatory reporting that most organizations do in some form or the other. It is the process of keeping and maintaining accurate, detailed, and accessible records of all the transactions carried out as regulatory bodies check it. These records also include the organization’s adherence to process in whatever form that may take. It should also cover penalties for whenever anyone deviates from the specified protocol.

Challenges Banks and Other Financial Organizations Face with Regulatory Reporting

Banks find it difficult to keep up with the fast-changing and increasing regulatory requirements.

The fast pace increased complexity, and granularity in the regulatory reporting requirements are putting banks under more pressure even with stretched budgets and resources. This challenge is more apparent for banks that cut across several regulatory jurisdictions and many of these organizations are constantly looking for ways to standardize reporting and stretch data models.

| Reporting timeframe of regulatory reporting reduced from months to weeks for improvement and a timely view of the financial risks. |

| Data integrity and quality with less than effective data quality frameworks. Studies show that 31% of institutions view data quality as a major challenge to effectively meet all the compliance requirements. Also, analysts spend a lot of their time in data collection and organization duties making them spend less time on data analysis. |

| Effective Tracking Maintaining an end-to-end data lineage to make it easier to track the final numbers back to the origin for quicker validation during onsite inspection. |

| Legacy Systems and processes Core systems are dependent on many manual processes and multiple independent systems to meet up several complex requirements. It puts immense pressure on time, accuracy, resourcing, and efficiencies. This inflexibility affects adaptability to the constantly evolving regulatory requirements. |

Emerging Trends in Regulatory Reporting

Technology is at the center of developing a culture of a comprehensive and proactive approach to help regulatory reporting. Compliance has gone beyond adding new resources for better effectiveness as it has shown that a gradual and planned adoption of new gen technologies such as AI, Cloud and Big data technologies etc, can help handle the challenge banks and other financial institutions are facing

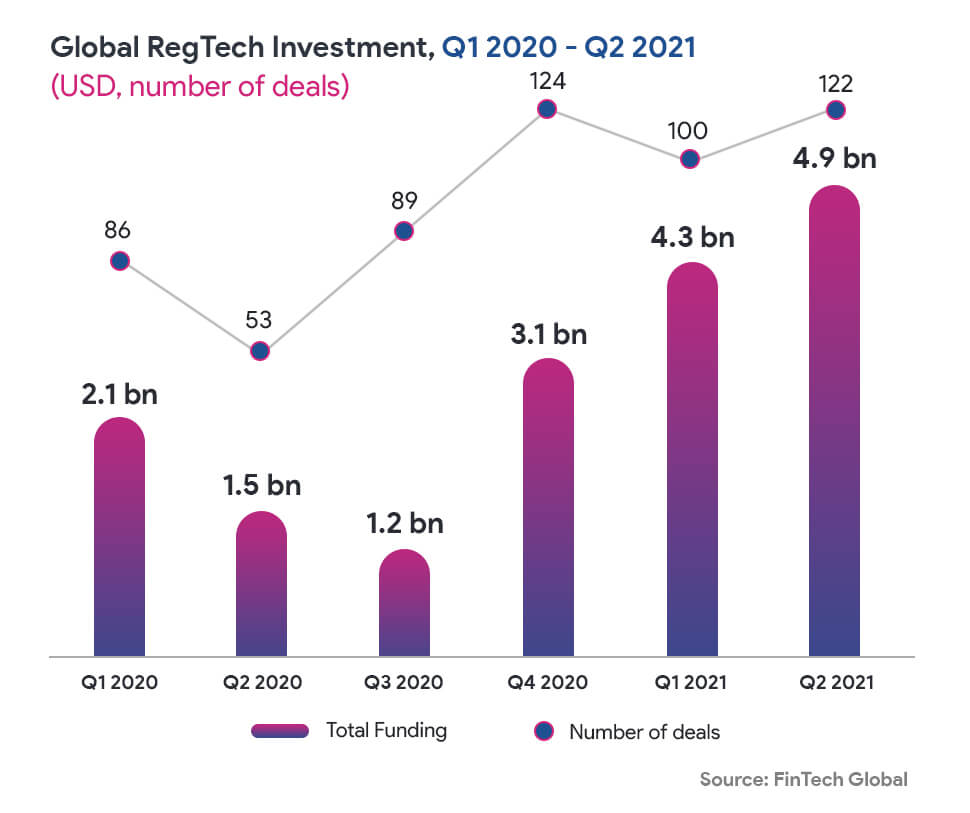

Regtech is the management of regulatory processes in the financial industry through technology. It can greatly help combat the challenges listed above and make regulatory reporting processes more efficient.

Effect of COVID on the Regulatory Landscape Today

The pandemic led several governments to shut down their economies in a bid to contain the spread. This had a direct effect on regulatory reporting as the operational and economic resilience of the global financial system is now the topmost priority of many regulators.

Banks have the pressure to continue lending regardless of the shrinking revenues, increasing cost reduction measures, increasing liquidity risk, and unstable workforce productivity because of remote working. Regulators are trying to establish a balance between putting adequate measures for risk assessment and mitigation to prevent a financial crisis by relaxing the following activities:

- Deferring the submission deadlines for regulatory reports

- Relaxing several reserve ratio requirements and buffers

- Loosening the implementation deadlines of new regulations

- Suspending non-critical supervisory examination activities

- Allowing early adoption of exposure/risk calculation methodologies

How RegTech Can Solve the Puzzle?

Using RegTech involves technology-driven improvements to the operating model of banks so that their regulatory reporting effort and spend are more efficient and creates value for all parties involved.

There are two main options by which RegTech implementation can greatly improve regulatory reporting:

Delivering Actionable Insights

RegTech can give organizations actionable insights into new and emerging regulatory requirements so they can improve efficiency in their compliance process. This removes any confusion about the constantly updated regulatory reporting methods so the organizations can save costs. These insights also include new technologies like advanced analytics, robotic process automation (RPA), cognitive computing, and distributed ledger technologies.

These technologies help organizations implement strategic end-to-end reporting solutions. The processes include extracting input data, checking the regulatory calculations and mappings, generating regulatory returns, and producing management information for analysis. Organizations can always stay up to date with any new changes in the regulatory and compliance methods of the appropriate bodies that guide them.

Cloud based Solutions

Banks can easily build robust platforms for automating financial compliance using cloud based RegTech solutions. These solutions can embrace the powers of AI and ML for offering greater agility to banks and regulators. Potential risks, threats and cases of non-compliance can be identified faster to take necessary actions. Cloud solutions also allow banks to easily exchange data. This streamlines the entire effort towards data reporting.

Point to Ponder

A research study conducted by Bank of England revealed the UK’s 30 largest banks have adopted nearly 2,000 cloud-based applications between them.

Conclusion

Financial institutions that implement or adopt Regulatory Technology will be adaptable to any fundamental shifts in the future. Apart from the technology used to run these processes, developing a granular and centralized data model to maintain, govern and document is important in delivering a an efficient and reliable solution to relevant stakeholders.