The year 2023 marked the first failure of a globally systematic important Financial institution (G-SIB) post the financial crisis 2008. This was preceded and succeeded by the collapse of other US Financial institutions. Coupled with the geopolitical tensions due to Russia’s invasion of Ukraine and a newer global monetary policy path, the global financial system landscape has completely changed.

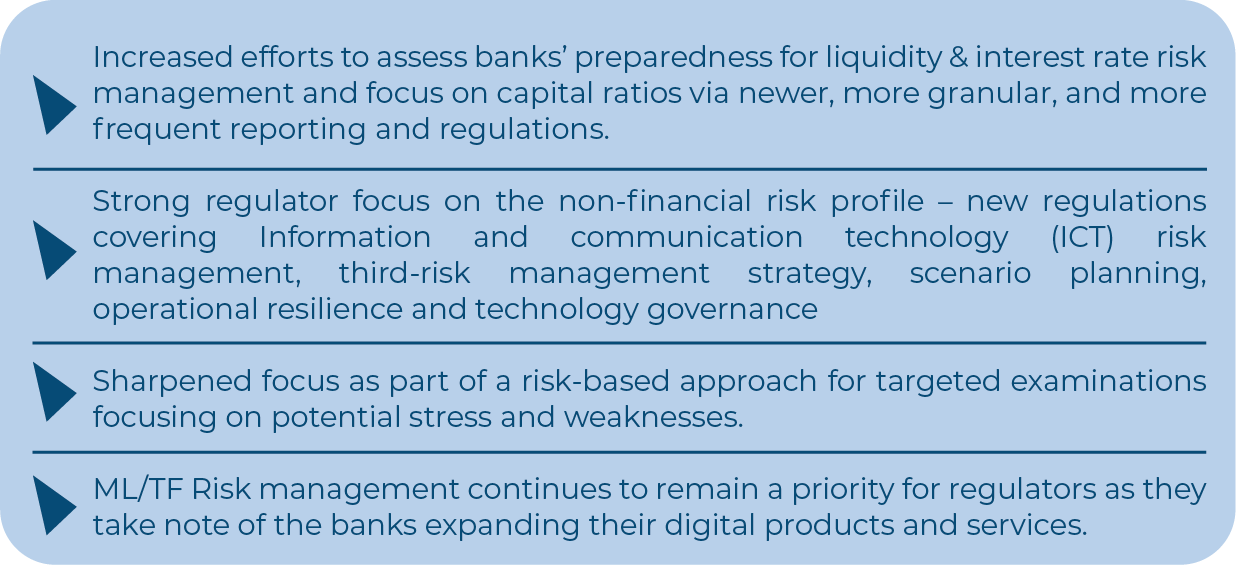

Against this backdrop, regulators have faced heightened risk to the financial market stability and a loss of confidence in the banking system and have taken measures to restore this confidence.

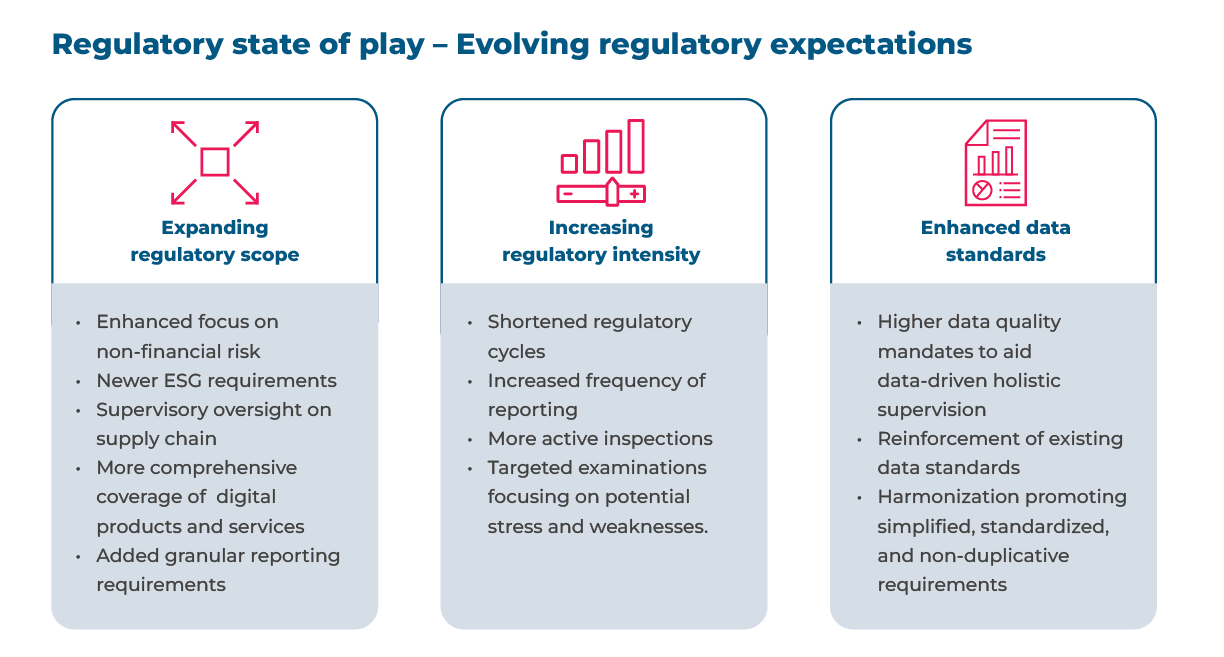

We have observed regulators globally re-examine the focus and scope of risk management as a first measure to restore this confidence back

While the regulatory reporting requirements will increase, the regulatory supervision is also expected to become more intense with heightened supervisory expectations.

Given the complex operating models of Financial institutions, every regulatory requirement today necessitates technological interventions and impacts a high number of different processes within the Financial institution as well as affecting both business and operations.

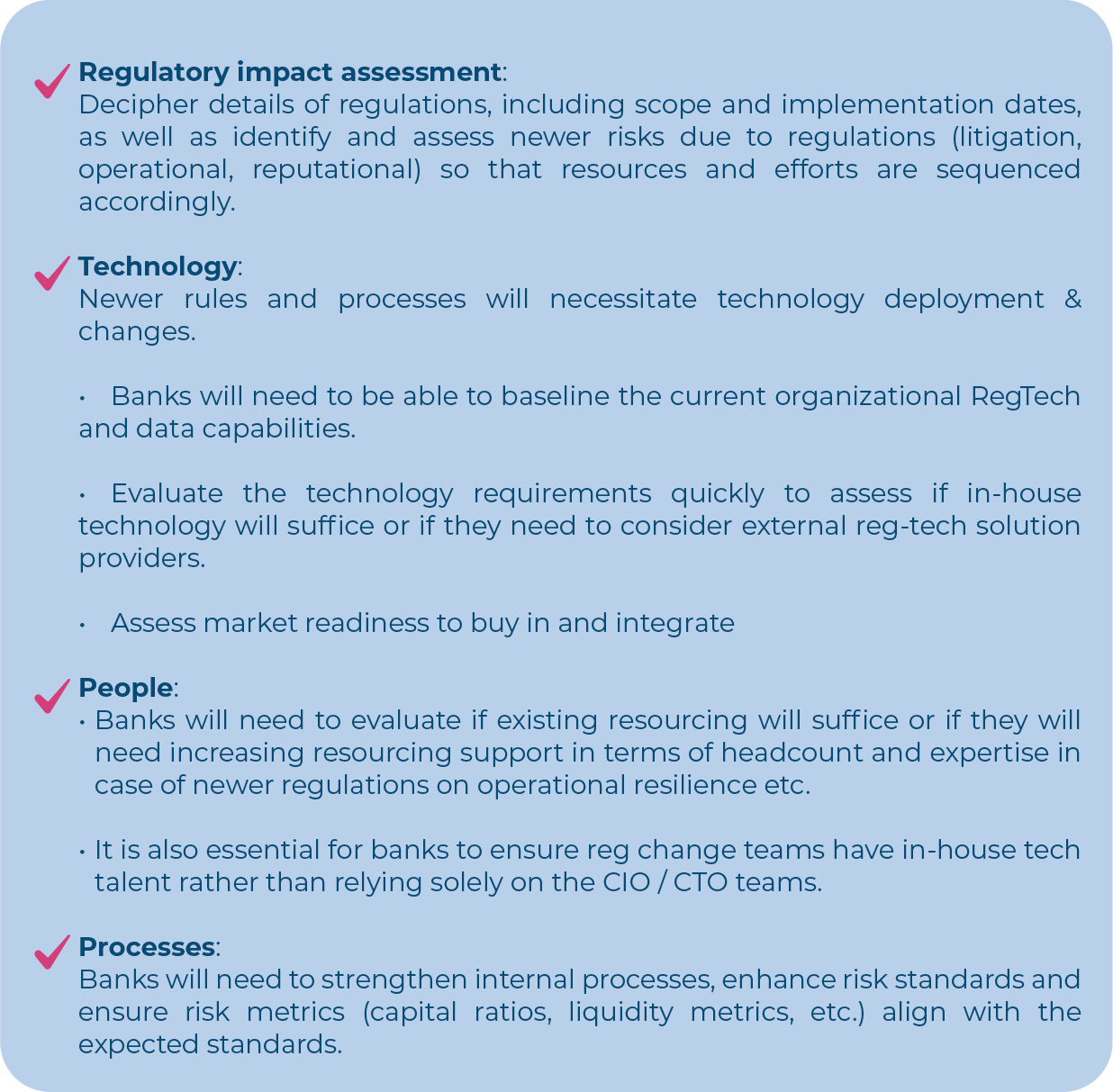

It is therefore critical for Financial institutions to move away from a reactionary tactical approach to a more proactive & strategic collaborative approach to address regulatory challenges and technology adoptions.

Aside from the legacy systems and reactionary approach, the traditional model and mindset are also an impediment. There is usually a disconnect between the compliance department and the business teams, technology, operations, and risk teams. The interpretation and finer details of a new regulation are left with the legal and compliance teams and then trickled down on a case-by-case basis.

We are also seeing implementation timelines come down, and hence, it is essential as a first step for the leadership teams in the Financial institution to assess future compliance readiness through

The leadership across various enabling teams representing the CIO, CRO, CFO, CCO, the business lines, and the Head of regulatory change need to come together to enable the Financial institution to establish an effective regulatory change and reporting infrastructure.

A clear operating model with the right culture and right incentives, empowering data architecture, standardized processes, streamlined digital workflow, and application of regtech technologies are all important components of the infrastructure.

Co-authored by Deepak Bhatter, and Venkatesh Padmanabhachari

Maveric’s thought leadership series – E.D.G.E (Experiences Delivered by Global Experts) – handpicks the game-changing technology ideas and pressing functional questions financial institutions must solve today.

These features – reports, whitepapers, podcasts, flyers, blogs, and infographics – are for Banking leaders and Technology evangelists to apply profound trends, the latest opinions, and transformational analyses to boost the performance of their organizations.

About Maveric Systems

Established in 2000, Maveric Systems is a niche, domain-led, BankTech specialist, transforming retail, corporate, and wealth management digital ecosystems. Our 2600+ specialists use proven solutions and frameworks to address formidable CXO challenges across regulatory compliance, customer experience, wealth management and CloudDevSecOps.

Our services and competencies across data, digital, core banking and quality engineering helps global and regional banking leaders as well as Fintechs solve next-gen business challenges through emerging technology. Our global presence spans across 3 continents with regional delivery capabilities in Amsterdam, Bengaluru, Chennai, Dallas, Dubai, London, New Jersey, Pune, Riyadh, Singapore and Warsaw. Our inherent banking domain expertise, a customer-intimacy-led delivery model, and differentiated talent with layered competency – deep domain and tech leadership, supported by a culture of ownership, energy, and commitment to customer success, make us the technology partner of choice for our customers