Financial institutions use data and predictive analytics to improve customer experience and amplify business success. Today, banks want more than incremental gains. They want data-driven revenue breakthroughs. Banks increasingly rely on data. It’s the future of communication and might address banks’ most significant issues.

Data drives today’s financial market. The information helps financial services businesses personalize, streamline, and profit. This change affects operating costs, staffing, customer experience, and more.

Engaging banking domain experts like Maveric Systems for next-generation data technology solutions enable leading banks to make bold bets and maximize their innovation potential.

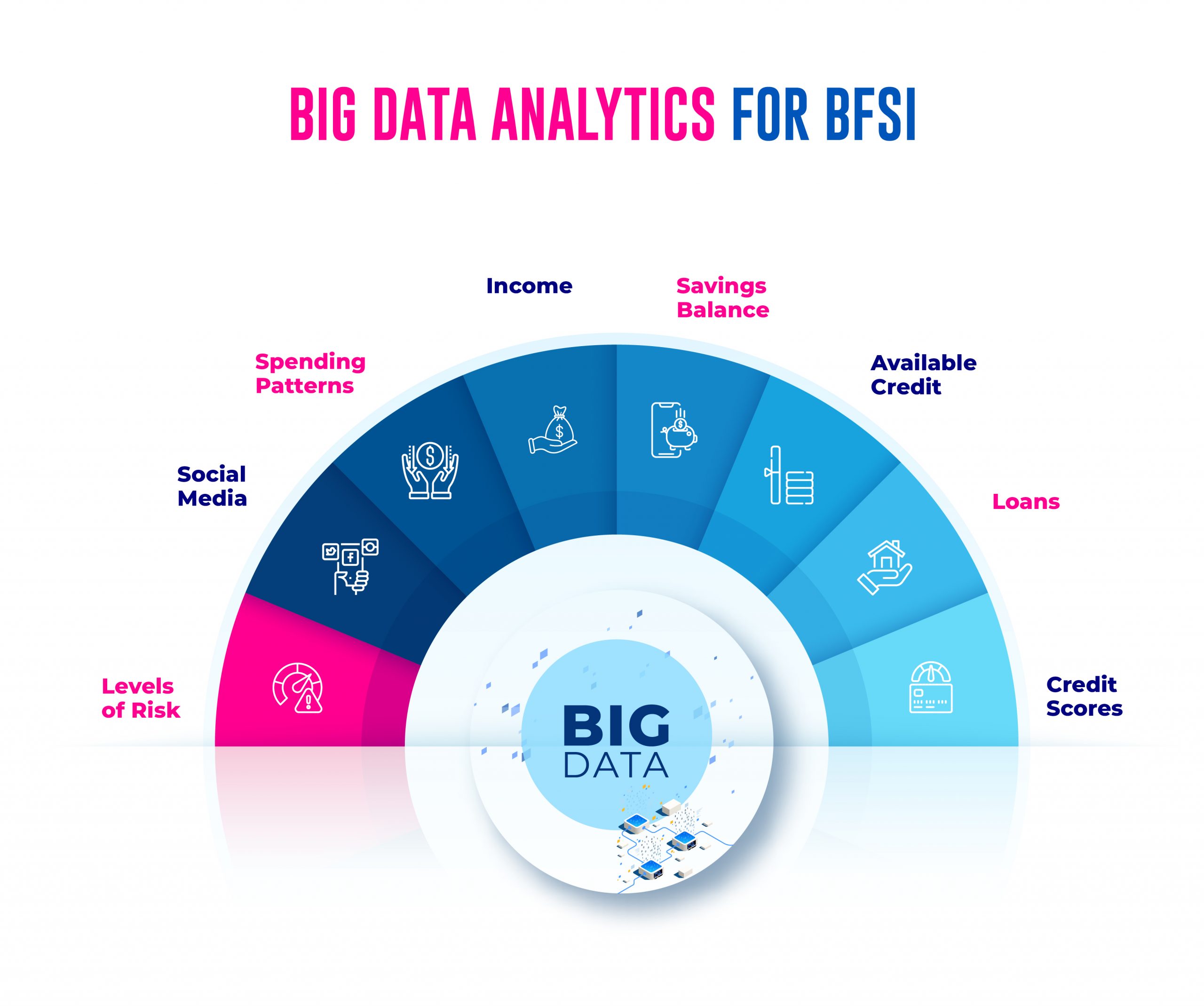

The Growing Use Cases for Big Data Analytics for BFSI

- Fraud Detection: Banks and financial organizations aim to reduce fraud, but analytics may also control risk. Banks can prioritize fraud detection by assessing account risk. Analytics can detect and rate fraud-prone consumers and apply different levels of monitoring and verification to those accounts.

- Operational/liquidity risk: Operational risk is the risk of company losses. Operational risk includes financial institution-specific hazards. Liquidity risk includes macro, comprising interest rate swings, foreign exchange rate changes, and bond value changes. Operational hazards include fraud, theft, computer security breaches, and management incompetence. Banks utilize data analysis to identify high-risk loan defaulters and act before things get out of hand.

- Investment bank risk modeling: Risk modeling simulates how a portfolio of assets (stocks, bonds, futures, options, etc.) or a single asset (such as an interest rate) reacts to different scenarios. Risk modeling across all assets reduces portfolio risk and improves performance.

Data-Driven Banking

Technology and analytics enhance strategic planning and decision-making. Data-driven banking rethinks banking data. Instead of displaying account information, currency fluctuations, or analyzing your data, banks use it to add product and service information to their products. This gives banks more insight into their customers’ lives and helps them increase earnings by delivering more accurate data about their clients’ demands.

This helps customers make more competent judgments and allows third-party companies to promote a bank’s products, which benefits society.

Three Key Components for creating a holistic Data Analytics Strategy

- Data Volume: We realize “Data Analytics” demands “excellent data,” but volume comes first. Many corporations tend to ignore volume. They think it’s available. Building a data bank is an enterprise problem today; only a few businesses take it seriously. Data collection, curation, and storage systems require the correct personnel and time at project start-up. Not establishing a data warehouse and putting everything there is the data team’s primary business goal.

- Data Accuracy: Data quality follows volume. More data is needed to ensure relevant insights/models. It reduces data team productivity. Data workers spend much of their time reassembling data to improve quality. Data scientists spend over 82% of their time cleaning and preparing AI/ML data. Organizations need good data pipelines and reliable data flow infrastructure for accurate insights.

- Data Security and Compliance: Organizations should prioritize data governance, security, and compliance when establishing a data strategy rather than technology-focused data volume and quality. A data analytics roadmap needs the correct mix of people, data, products, technology, process, and governance to be productive. An analytics roadmap should also begin with thoroughly analyzing the company’s business goals and key indicators.

Conclusion

Finance is increasingly using data analytics. Data analytics is helping more companies enhance internal processes worldwide. Data analytics helps them understand customers better. This allows CEOs to make smarter business decisions. Finance professionals use data analytics to gain insights that improve decision-making. Finance teams use data analytics to understand KPIs (KPIs). Revenue, net income, payroll, etc. Data analytics helps finance teams analyze fundamental KPIs and spot revenue turnover fraud.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric Systems accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric Systems teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore. Get in touch with Maveric Systems today!