Automation in the banking sector began early with computerization of key functions across departments. Advanced ledger posting machines were introduced to automate account-related functions that formed the core of banking operations those days.

Over the years, banks slowly moved to improve customer service through branch automation. Banks were able to connect disparate branches, automate back-office functions and facilitate information sharing, without disrupting banking functions. The ‘Single Window Service’ facilities delivered all banking services at a single counter; significantly reducing transaction processing times.

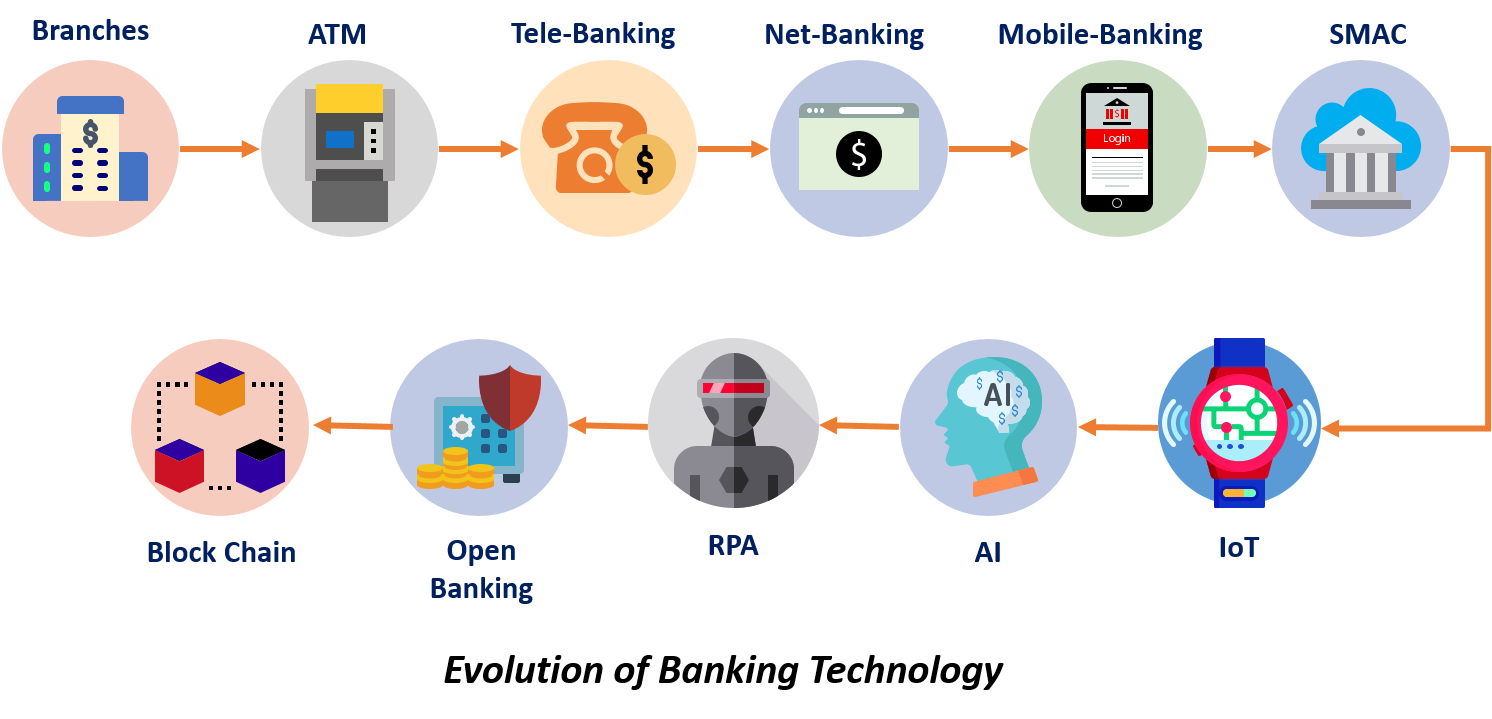

Although slow to adopt, the banking sector embraced the IT revolution to develop interbank connectivity. The multi-channel banking approach placed emphasis on building a centralized data infrastructure which consolidated databases across banks into a single large database. The system was crucial in improving services and lowering costs of service providers allowing banks to explore multiple delivery channels such as automatic teller machine (ATM), net-banking, telebanking, and mobile banking.

Introduction of ATMs radically transformed banking relationship between the customer and bank. The user-friendly technology complemented a bank’s branch functionalities making it accessible to customers who no longer required to enter a bank for basic financial transactions. Banks benefited by introducing a new customer service interface that significantly reduced operations cost.

The slow shift to customer-oriented services helped develop core banking applications which not only integrated enterprise software to in-house applications but also automated multiple delivery channels at once. Banks were able to build on cross-selling products such as insurance, bonds, credit cards, and other financial products.

In India, banking technology accelerated with the establishment of the Institute for Development and Research in Banking Technology (IDRBT) in 1996. The institute launched three important technology infrastructures, namely, Indian Financial NETwork (INFINET) in 1999, Structured Financial Messaging System (SFMS) in 2001, and the National Financial Switch (NFS) in 2004. These services formed the backbone of IT implementation in the Indian banking and financial sector. As a digital certification authority, the institute implemented high-end Public Key Infrastructure (PKI)-based services and solutions to secure transactions through INFINET.

Over the last decade, the banking industry has witnessed the impact of disruptive technologies and also of non-banking entities such as PayPal, Google Pay, and Amazon. As the internet became more accessible, banks moved to realize their dreams of total bank automation with internet banking and electronic fund transfer. To address the development, IDRBT promoted the Indian Financial Technology and Allied Services (IFTAS) to provide IT-related services to Reserve Bank of India (RBI), banks and other financial institutions. In 2016, IFTAS took over the operations of INFINET, SFMS and the Indian Banking Community Cloud (IBCC). India is also a member of the Committee on Payments and Market Infrastructure (CPMI), formerly the Committee on Payment and Settlement Systems (CPSS), to monitor and promote efficient payment and settlement systems in selected counties.

As the industry heads into the next digital revolution traditional banks face stiff competition by newer technology-driven start-ups and Fintechs. Historically, financial institutes have dictated how customers transacted/interacted with them. Non-banking entities have essentially changed the relationship wherein the tech-savvy consumers have more control over their financial transactions. This rapidly shifting consumer behavior is placing importance on operational and analytical customer relationship management (CRM) systems that can target customers effectively while providing operational support.

The API era

In this competitive era, banks are starting to use Application Programming Interfaces (APIs) to link their products, services, third-party value providers and customers – at one place. The adoption of APIs is a shift from the bank’s traditional process-led automation system to a customer-centric system.

From a consumer’s perspective, APIs enable users to access banking and financial services anywhere, anytime. From online shopping to creating new accounts, consumers enjoy banking at their convenience. For banks, APIs enable banks to connect new modules to their existing legacy systems while continuing to provide updated real-time services. As per a survey by Softwareag, 95 percent of executives from Europe, Asia-Pacific, and North America are already setting up APIs for internal systems, while 81 percent share their APIs with trusted partners. The survey also states that in the next 2 years, 50 percent of banks are planning to start supporting open-banking platform through published APIs.

The API-era brings with it the concepts of open technology and open platforms; concepts that threaten the longstanding tradition of closed innovation. More and more APIs are enabling cross-business collaborations to create a value-based market offering for customers. Fuelled by new regulations, such as EU’s PSD2 directive, open banking has gained significant traction around the world. The regulations aim to level the playing field for all financial bodies to innovate and compete in an open financial market.

The push for data sharing in open banking is removing cloud adoption barriers that have plagued the industry. The EU’s continuous effort to improve digitization and cloud computing laws for its financial institutes is a start to the industry’s willingness to adapt to new technology.

As technology develops, Fintechs and banking organizations will leverage APIs, the cloud and its associated innovations to deliver a host of products and services around individual customer preferences. The future of banking will heavily depend on how financial institutes leverage digital technology and data analytics towards building new services.