The financial industry is experiencing a profound transformation, and at the forefront of this change is the digital revolution. With the rise of digital corporate banking solutions, corporate banks are streamlining their operations and revolutionizing how they serve their customers. In this blog, we’ll explore how these solutions reshape corporate banking and their impact on customer service excellence and provide recent examples of innovation in this space.

The Digital Wave of Corporate Banking Transformation

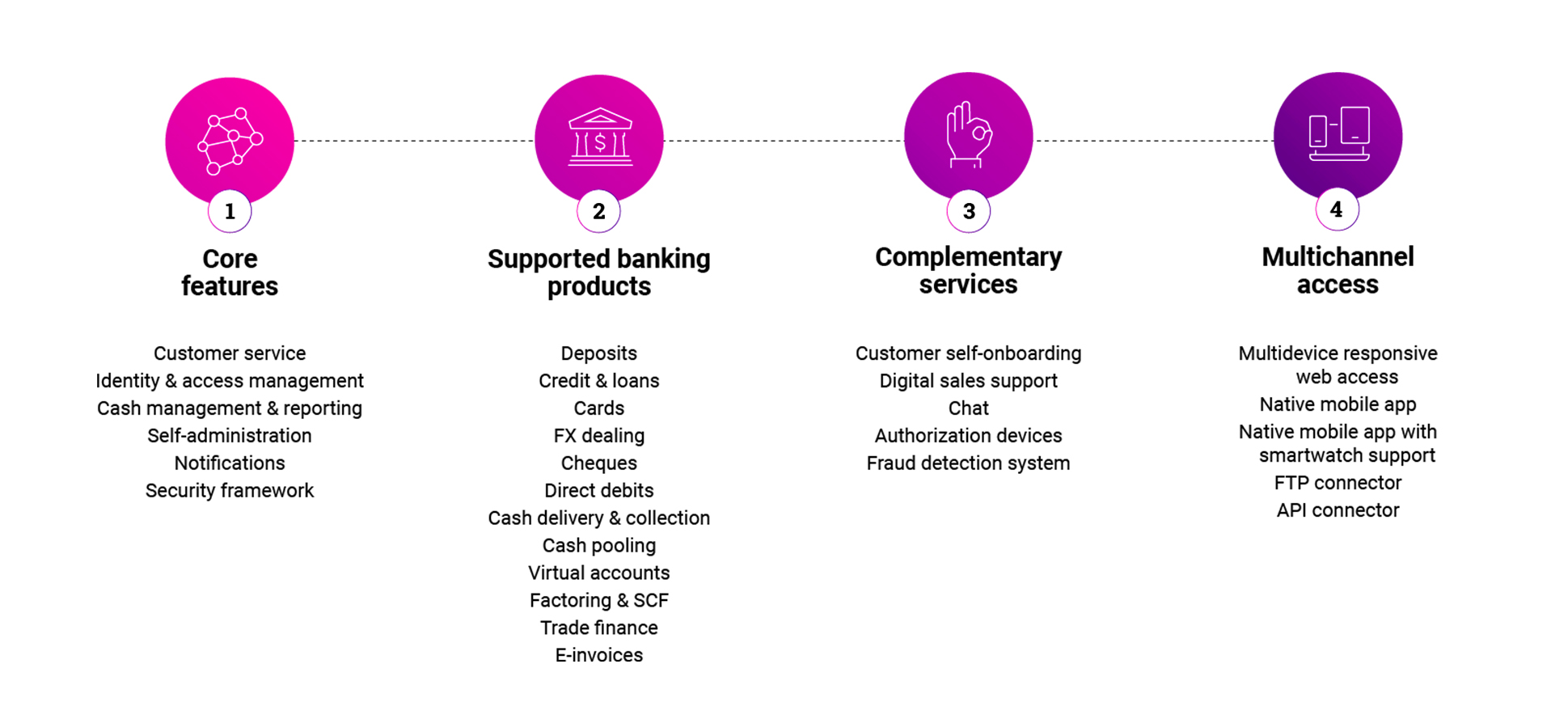

Digital corporate banking solutions have ushered in a new era of convenience and efficiency. These solutions include many technologies and specific solutions for corporate clients. The keywords in focus – digital corporate banking solutions and corporate banking digital transformation – signify the core of this revolution.

Streamlined Corporate Banking Products and Services

Digital corporate banking solutions have enabled banks to enhance their product and service offerings. Gone are the days of tedious paperwork and manual processes. Today, corporate banking products and services are just a few clicks away. For instance, electronic invoice financing platforms have simplified business working capital management, facilitating quicker access to funds for growth. Using AI-driven credit risk assessment tools also ensures faster loan approvals, benefiting both banks and their clients.

Personalized Customer Experiences

One of the keys to customer service excellence is personalization. Digital corporate banking solutions allow banks to gather valuable insights about their clients’ preferences and behavior. This information can be leveraged to tailor products and services to individual needs. A prime example is how some banks use data analytics to offer custom financial advice and recommendations. This builds stronger customer relationships and helps clients make more informed financial decisions.

Enhanced Accessibility and Convenience

Corporate clients no longer need to visit a physical branch or spend hours on the phone to perform banking transactions. With mobile apps, web portals, and chatbots, digital corporate banking solutions have made banking services accessible 24/7. This level of convenience is a game-changer in customer service, ensuring that corporate clients can access their accounts, initiate transactions, and seek support at their convenience.

Recent Examples of Innovative Digital Corporate Banking Solutions

To illustrate the impact of digital corporate banking solutions, let’s look at some notable innovations by financial institutions:

1. JP Morgan Chase

JP Morgan Chase has been a frontrunner in digital corporate banking solutions. Their “Chase for Business” platform offers tools and services to simplify various corporate banking aspects. These include online account management, expense tracking, and even the ability to accept payments online. Such innovations have empowered businesses, making financial management more straightforward.

2. Citibank

Citibank has made significant strides in providing mobile banking solutions for corporate clients. They introduced a mobile app specifically tailored for corporate users, allowing them to manage accounts, complete transactions, and access real-time financial data, all from the palm of their hand. This level of accessibility has been lauded for its contribution to customer service excellence.

3. Wells Fargo

Wells Fargo has adopted AI-driven technologies to enhance customer service. They utilize chatbots and virtual assistants to answer routine customer queries, thus freeing up human agents to handle more complex issues. This automation ensures quicker responses and resolution of issues, contributing to an improved customer experience.

Challenges and Approaches to Success

While digital corporate banking solutions are undoubtedly a boon, there are challenges that banks must overcome to achieve true customer service excellence. Key challenges include data security and privacy concerns, regulatory compliance, and ensuring a seamless omnichannel experience.

To address these challenges, FIs must invest in solid cybersecurity measures to protect sensitive customer data. Additionally, staying updated with changing regulations and adhering to compliance standards is imperative. Moreover, offering a consistent experience across various digital channels and maintaining the human touch in customer interactions will be crucial.

Conclusion

Digital corporate banking solutions have revolutionized corporate banking by streamlining products and services, enabling personalized experiences, and enhancing accessibility. Notable examples from institutions like JP Morgan Chase, Citibank, and Wells Fargo underscore the impact of innovation in this space. However, the road to customer service excellence has its challenges. Still, with a commitment to data security, compliance, and a seamless omnichannel experience, banks can successfully navigate this digital transformation and continue elevating customer service excellence.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.