Shine your connected core with TAFC to TAFJ Conversion

The banking world is going through a significant change with rising digital consumerism, technology disruption and regulatory compliance. FinTechs, Neo-banks and Challenger banks have redefined “banking as a platform” to offer customers with non-financial and life-style services beyond just traditional banking services. These growing drivers are necessitating banks to relook at their core system, for enabling it to be more future ready and consumer friendly while staying compliant. Additionally, the current pandemic has led to the emergence of digital banking.

What does the term ‘Connected Core’ signify?

Today, for financial organizations to operate out of a ‘Connected Core’, two pertinent notions need to be well grasped – Conscious contextualization and Comprehensive Competencies. Both the concepts will need longer expositions, but for our purpose here, let us briefly unscramble the two.

- Said simply, conscious contextualization in a Temenos implementation context is to validate that all the layers of ALM are designed and equipped for the reliability of the core banking application. It incorporates rapid development, build, deployment (across CI/CD pipelines), maintenance and support, through integration with other solutions (like customer on-boarding), for ecosystem enablement of the Temenos Suite of products.

- Comprehensive competencies on the other hand, is the product proficiency and the application mastery across the entire suite of Temenos applications. This cuts across the processes you deploy, the skillsets you on-board and the best-of-breed methods you reflect

The promise of a “Connected Core” includes all the platform led managed services for modernization, migration and maintenance. Having spoken about the broader picture, let us understand the underlying business imperative for a specific Temenos Transact (T24) transformation context, namely from Transact TAFC Runtime to TAFJ Runtime.

In the age of digital banking, banks must stay ahead of disruptive technology curves. Thus, the modernization of the core banking system becomes extremely critical, by staying on top of its latest release, using a robust upgrade and migration strategy. Upgrading also allows banks to avail newer and better functionalities.

What does TAFJ entail?

Temenos TAFJ embraces java technology, thus enabling banks to take advantage of the latest technologies. TAFJ helps banks to unlock the benefits of digital banking through seamless integration with contemporary technologies like Open Banking (APIs and microservices), Artificial intelligence (ai), ESBs/Message brokers, Data streaming, analytics, responsive UI, progressive web apps, IoT, richer user experience and usage of social media.

TAFC runtime is based on C language, while TAFJ is based on Java language. However, by extending support for INFOBASIC language on TAFJ, Temenos has not disrupted the way Transact (T24) developers have been coding. However, with TAFJ, developers can develop Transact customizations on Java too, to take full advantage of the technology.

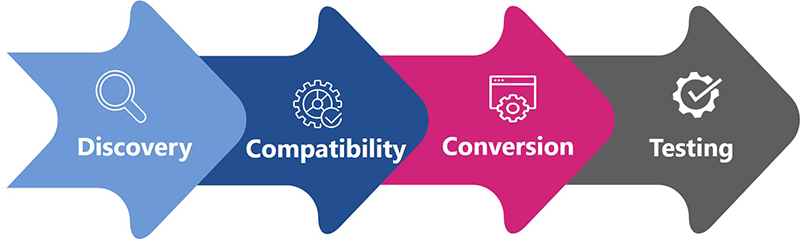

Maveric conversion approach for TAFC to TAFJ

Broadly speaking, the approach incorporates four steps.

- Discovery: Standardized templates to speed-up discovery and evaluation of the current Temenos Transact implementation.

- Compatibility: Validate the compatibility of the existing IT infrastructure for TAFJ

- Conversion:

- Data – make the existing data compatible for TAFJ

- Code – seamless migration of the existing code base is performed through Maveric Code Integrity Assistant (MCIA) to make the code compatible with TAFJ

- Testing: Finally, Business Consultants and Testers are engaged in the SIT and UAT of the converted environment to make sure nothing is lost!

We believe the top-three gains of moving to TAFJ would be:

- Better utilization of your existing investment on Temenos Transact

- Be in the frontline by capitalizing on the technology enablement of Transact through TAFJ

- Integrate Temenos Development Lifecycle with your existing CI/CD pipeline

As banking is rapidly moving towards branchless banking, the need for being on top of the next technology revolution is mission critical. This means, TAFJ conversion becomes all the more important for banks to gain a substantial competitive edge and shine their connected core.

View

Temenos’s core banking solution runs natively on the cloud. And, it can run on three main public clouds natively. This offers banks the flexibility to choose the cloud provider, most aligned to their needs. Since the solution can be deployed on a distributed relational database, subsequent migration from one cloud service provider to another is made easier.

Temenos’s core banking solution runs natively on the cloud. And, it can run on three main public clouds natively. This offers banks the flexibility to choose the cloud provider, most aligned to their needs. Since the solution can be deployed on a distributed relational database, subsequent migration from one cloud service provider to another is made easier. Today, Banks need to integrate with different Systems and Providers to create better products and provide seamless user experiences for their Customers. Along with Open Banking, Berlin Group, STET and other Standards, APIs play a major role in bringing about the technological disruption in Banking. In a bid to offer extensive capabilities for integrations, Temenos brings 700+ documented and supported Open APIs, enabling the entire breadth of its Solution features to be leveraged in tandem with other systems and providers.

Today, Banks need to integrate with different Systems and Providers to create better products and provide seamless user experiences for their Customers. Along with Open Banking, Berlin Group, STET and other Standards, APIs play a major role in bringing about the technological disruption in Banking. In a bid to offer extensive capabilities for integrations, Temenos brings 700+ documented and supported Open APIs, enabling the entire breadth of its Solution features to be leveraged in tandem with other systems and providers. AI is fast becoming a vital ingredient in enabling Banks to create personalised and relevant customer propositions and to service their clients as efficiently as possible. Temenos helps Banks achieve these goals by embedding its patented eXplainable AI (XAI) platform across the entire product portfolio, enabling Banks to rapidly roll out self-learning technologies.

AI is fast becoming a vital ingredient in enabling Banks to create personalised and relevant customer propositions and to service their clients as efficiently as possible. Temenos helps Banks achieve these goals by embedding its patented eXplainable AI (XAI) platform across the entire product portfolio, enabling Banks to rapidly roll out self-learning technologies.