Challenge the Challenger Banks!

Does your bank fit into a box!

The entire universe has moved in to a box model. Finding a date, meeting a friend, hosting a party for friends, visiting a place, shopping for your daily needs, doing financial transactions have all moved from a physical state to a virtual world. This virtual world is getting contained in a box. Yes! You guessed it right – we now live and breathe with our smart devices and smart phones.

The digital adoption phenomenon was seen as a trend mostly with the millennials in pre-pandemic era, but owing to the current pandemic situation adopting to digital lifestyle is no more a choice. Every individual, regardless of their age, gender, and profession are required to accommodate digital as lifestyle.

Businesses, on the other hand, are trying to get onto the digital transformation bandwagon to retain their existence.

Banking is no exception!

Though banking sector has been steadily evolving from a paper-based transaction at a banker’s desk to a digital experience at the comfort of your couch. The banks have been found to be the late adopters of latest technology and are seeing a step behind in offering exceptional experiences to customers when compared to other business sectors such as retail, ecommerce, travel, education etc.

53% of the global population

will access digital banking by 2026

Source – A Study by Juniper Research

The challenges the banks are facing:

In the current era, the challenges for the traditional banks are two-fold.

- The first challenge is to keep up pace with the growing Fintech community Challenger and neo-banks have been riding on with this Fintech revolution.

- The second challenge is from the other business sectors where more and more companies are embedding finance in their business models in the pursuit of creating an exceptional user experience and customer stickiness through breathtaking-apps.

While the challenge from the other sectors is important, in this article, let’s focus on the first challenge faced by traditional banks today from the Challenger Banks.

The Outlook and Business Model of Challenger Banks

The business model of the challenger banks is ‘Digital only’ and the approach is always mobile first. Another differentiating factor is that they are highly agile and have offered many ‘Firsts’ in the banking sector.

The Challenger banks are gaining more acceptance among customers, especially millennials and youngsters, and are the first choice for fulfilling any banking service, regardless of whether it is onboarding, loan originations, wealth management, insurance, or any other service.

The reason behind the success of these challenger banks has been the way they approach technology and product innovations. Most of these banks operate using the ‘First principles design’ – which means they disregard existing processes, systems, technology and develop innovative banking experiences.

A sample scenario of Challenger Banks in UK

Issues faced by the traditional banks

Most of the traditional banks still run on the legacy systems. The tech stack of these legacy systems is complex and outdated. No doubt that these banks are offering digital product and services through various channels, but if there is a need to offer a modern or a highly innovative product in the market. The Go-to-market (GTM) turnaround is much higher for the traditional banks owing to tons of customizations required for every upstream and downstream systems.

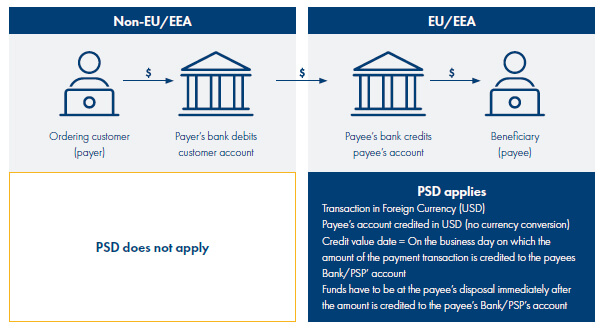

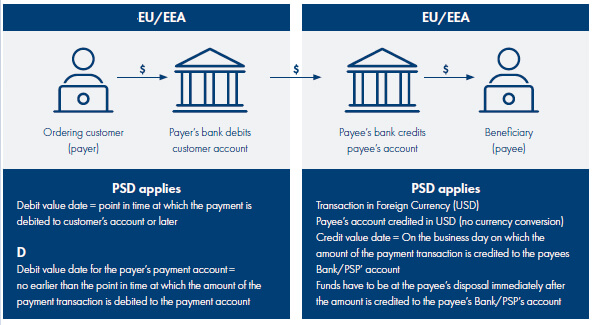

The below use cases are a few examples where the traditional banks are yet to cater to:

- Contextual credit:

My customer is at the billing counter at the super-market and the card transaction is declined because the credit limit is exhausted. The customer gets a transaction declined message from the bank and my customer has no other alternative for payment. Ideally as a bank, at that moment if my customer is still eligible for further credit, I should be able to offer an alternate credit line to the customer so that she can complete the purchase at the store. - Global money:

As a bank, how do I cater to a customer who:

- Engages in transactions in multiple currencies very frequently.

- Prefers to shop around the world through online channels across many global shopping sites.

- Loves to travel frequently to other countries.

- Prefers to hold foreign currencies not in another country but in the same country.

While the requirements of the above persona have been addressed by the challenger banks, especially in Europe/UK region by offering digital foreign currency accounts under the same umbrella of digital account, the traditional banks are yet to catch-up.

The bottom-line here is that offering a multi-currency account depends on the capability of the underlying core banking system of the bank, but enabling some cool features and a superior user experience around this product will depend on the capability of the digital banking platform on the bank, for example:

- Virtual exchange of currencies:

This can be required for completing a transaction in another currency or just to benefit from the rate movements. Under the traditional account model of the bank this requirement cannot be easily accommodated. - Cryptocurrency:

Another popular trend that has caught the attention of many alongside the digital banking adoption is the recognition and acceptance of crypto currencies as a new form of money. Example: Bitcoin, Ethereum etc.The popularity of these virtual currencies has forced many countries to legalize them as new form of payments and this trend is more prevalent in Europe/UK region.

While the challenger banks are offering services like buying and selling of these currencies, most of the traditional banks are still working towards offering these services.There are many ways of offering these services to the customers. One of the fastest ways would be to partner with a service provider and integrate their services with the bank’s digital offering.

- Temporary virtual cards:

I am an avid online shopper, I buy a lot of merchandise from global online marketplaces which offer cheap products. I also want to subscribe to Netflix only for a month, but I do not want to use my regular debit card online because of the fear of data theft or any unwanted deductions on my subscriptions.What solution does my bank have?

As the name suggests the answer is temporary/disposable virtual cards. The unique feature of these temporary cards is that it can be created by the customer on the digital app instantly and can be used only for a limited timeframe as defined by the customer of the bank. Post this defined timeframe the card ceases to exist. Imagine the time-taken if a customer had to apply for this type of card at a branch and then wait for the bank to process the card and mail it to him. The whole purpose of offering such a feature would be defeated

- Explainable AI:

My customer applies for a loan through an automated loan origination journey. But his application is rejected by the automated credit decisioning system. As a bank, it’s my responsibility to provide customers with a humane explanation for the loan rejection.How do I solve this problem?

There are many AI based credit-decisioning tools available in the market and many banks are employing these tools worldwide, but one of the key challenges banks are facing is that these systems operate as ‘black-boxes’ offering very little insights on how they arrive at these decisions.

There is an increasing mandate from regulators that banks should be able to explain to their customers the results of automated decisions that affect them, especially in cases where the results are negative or not in favor of the customer. If the banks are able to come-up with a solution which can explain the results to the customer in a simple plain language, then they will have a competitive edge in the market.

All the use cases discussed above are time-critical and require a faster Go-to-market(GTM) to challenge the Challenger banks. The traditional banks will require high agility, flexible yet robust digital platforms to beat the competition.

The Options and way forward for the banks:

To offer solutions to these kind of advanced use cases, the traditional banks have three choices:

- Take the long and tedious route of customizing the legacy systems at various levels.

- Invest a huge corpus on R&D, design and develop new in-house solutions.

- Opt for a digital overhaul and invest in a trusted, robust end-to-end ready to deploy omni-channel system

The first two-options mentioned above are good possibilities, but the success rate and the time taken to Go-to-market are unclear and uncertain.

Beat the Challenge with Temenos Infinity

Banks can go with the tried and tested option of implementing a whole new digital banking suite like Temenos Infinity from the most trusted banking tech company in the world – Temenos. This way the traditional banks will be equipped not only to provide an awesome user experience, better products and also be future ready to beat the challenge posed by the so-called challenger banks.

About Temenos Infinity Digital banking suite:

Temenos Infinity drives awe inspiring customer experience journeys right from the stages of customer acquisition, servicing, and retention. The new age omni channel platform offers breathtaking propositions as mentioned below

The Maveric Edge

As a certified Temenos partner, Maveric systems re-energizes your connected core by extracting maximum value through full lifecycle implementation of Temenos Infinity. Our close alignment with Temenos as a certified partner, help banking customers to get rapid and easy access of Temenos Infinity’s application features. With our certified Temenos specialists, we orchestrate and articulate unmatched Temenos product stack mastery to lay the success path for your future.

View

Customer self-service is an important part of customer experience in the banking industry. Nowadays, customers want their interactions with the banks to be intuitive and straight forward. With the rise of mobility, more and more customers are now accessing their banks through their smartphones. In fact, a BI study indicated that a whopping 97% of millennials use online or mobile banking, which helps them stay on top of their finances with personalised alerts for spends and bills. Hence, mobile banking applications are no longer a value-added service for the banks but an absolute necessity.

Customer self-service is an important part of customer experience in the banking industry. Nowadays, customers want their interactions with the banks to be intuitive and straight forward. With the rise of mobility, more and more customers are now accessing their banks through their smartphones. In fact, a BI study indicated that a whopping 97% of millennials use online or mobile banking, which helps them stay on top of their finances with personalised alerts for spends and bills. Hence, mobile banking applications are no longer a value-added service for the banks but an absolute necessity. Customers nowadays choose to have a mortgage with one bank, an unsecured loan with another and savings accounts with yet another. The banking relationships are fast fragmenting.This decline of customer loyalty ended up clearing a pathway for FinTechs to come into the market. The new age digital banks also demonstrated that by competing aggressively against the traditional banks on the basis of their effective customer experience journeys despite the traditional banks’ access to much more customer data. These Neo Banks gain the trust of their customers through a seamless digital experience, and then offer multiple new products to them by positioning themselves as a convenient one-stop shop for all of the customer’s needs, thereby managing to cross-sell products and making further inroads into the financial lives of their customers.If the traditional players are to keep up with their challenger counterparts and be the choice of their customers for more offerings than one, then they need to constantly interact with their customers and inform them about their offerings, and in this day and age, this is only possible through a digital medium.

Customers nowadays choose to have a mortgage with one bank, an unsecured loan with another and savings accounts with yet another. The banking relationships are fast fragmenting.This decline of customer loyalty ended up clearing a pathway for FinTechs to come into the market. The new age digital banks also demonstrated that by competing aggressively against the traditional banks on the basis of their effective customer experience journeys despite the traditional banks’ access to much more customer data. These Neo Banks gain the trust of their customers through a seamless digital experience, and then offer multiple new products to them by positioning themselves as a convenient one-stop shop for all of the customer’s needs, thereby managing to cross-sell products and making further inroads into the financial lives of their customers.If the traditional players are to keep up with their challenger counterparts and be the choice of their customers for more offerings than one, then they need to constantly interact with their customers and inform them about their offerings, and in this day and age, this is only possible through a digital medium.