The Ultimate Guide to Digital Transformation in Banking

Digital change, sometimes called “digitization,” is an essential process in the 21st century. It’s usually called using digital technologies or Information Technology (IT) to change the way traditional, analog business processes have been done in the past. These activities could be related to logistics, money, management, or even education or training.

Aims and Aspirations for Banking Digital Transformation.

The primary goal of the digital transformation process is to meet the market’s growing needs and improve the customer experience in the most efficient way possible. So, this process changes how customers get value by making the way a business is run and managed more efficiently. In recent years, the results of this digital change have become more and more transparent. Some industries, like freight forwarding, education, and business marketing, have already changed their services into the mainstream by offering new “Software as a Service” (SaaS-based) solutions like Enterprise Resource Planning (ERP) software, online learning modules, and product upscaling through e-commerce.

The end goal of the transformation process is to make sure that the industry or business uses technology to keep improving all aspects of how it does business and interacts with customers. And the financial business, especially the banking sector, is an excellent example. Here are some crucial ways that digital change has helped the banking industry:

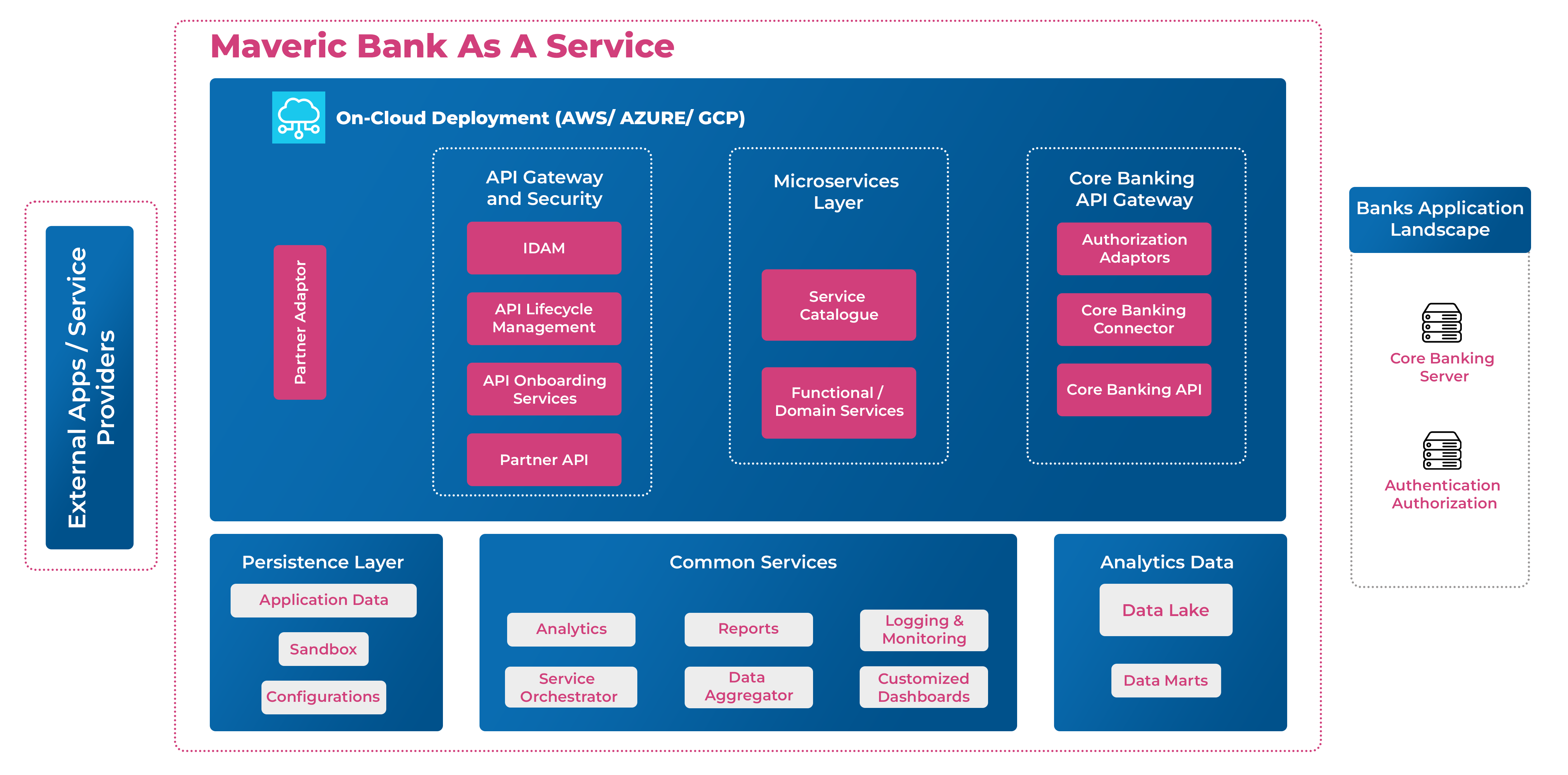

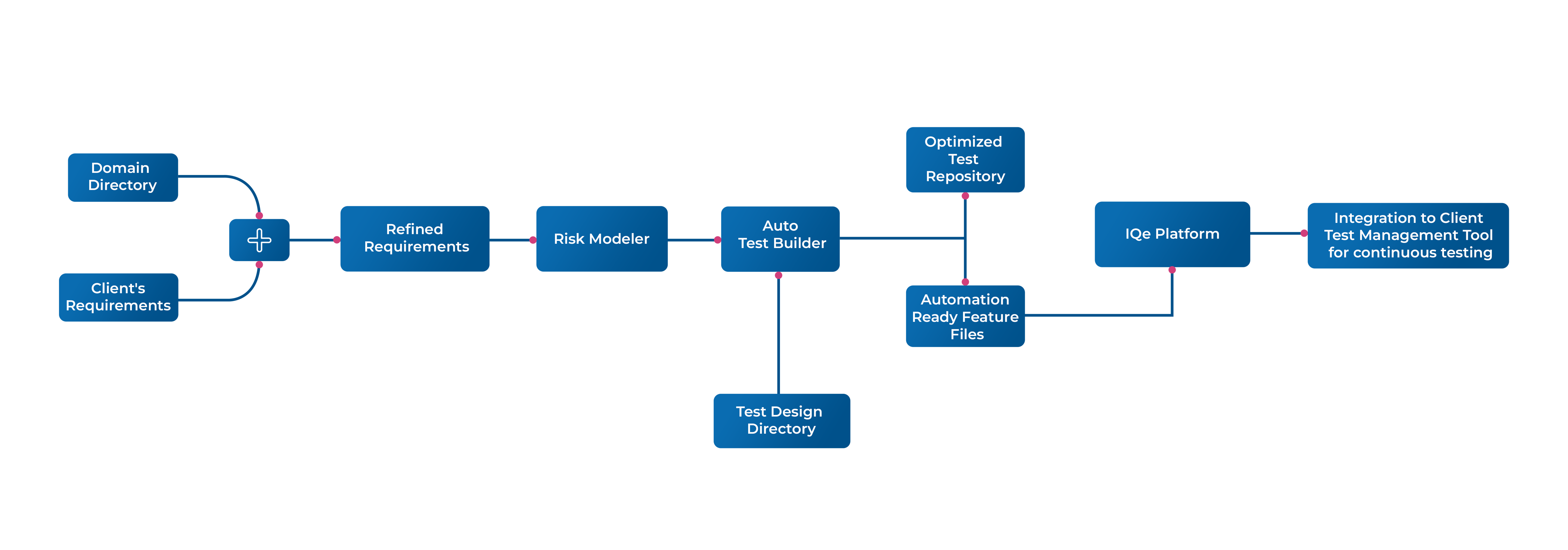

Partnering with domain experts in Digital Transformation like Maveric Systems brings a stellar advantage for leading FIs to forge ahead and strike early strategic initiatives.

Four Primary Drivers for Digital Transformation in Banking

- Changing consumer tastes and habits: Consumers now want experiences that are unique, easy, and smooth. They want to be able to use their banking services at any time, from anywhere in the world, and on any device. If you don’t offer these services, you might lose customers to rivals who are better at digital things.

- Fintech businesses are creating more competition: Fintech companies have shaken up the traditional banking industry by coming up with new goods and services that meet consumers’ changing needs. With new businesses starting digital-only banks, mobile payments, peer-to-peer lending, and other easy-to-use financial services, traditional banks need to change and respond to the changing market by embracing digital transformation.

- The need to save money and work well: Banks have constantly been pressured to cut costs and improve their return on investment (ROI). Finance reform can improve several processes, cutting down on mistakes and manual work. This can help save money and make the business more money.

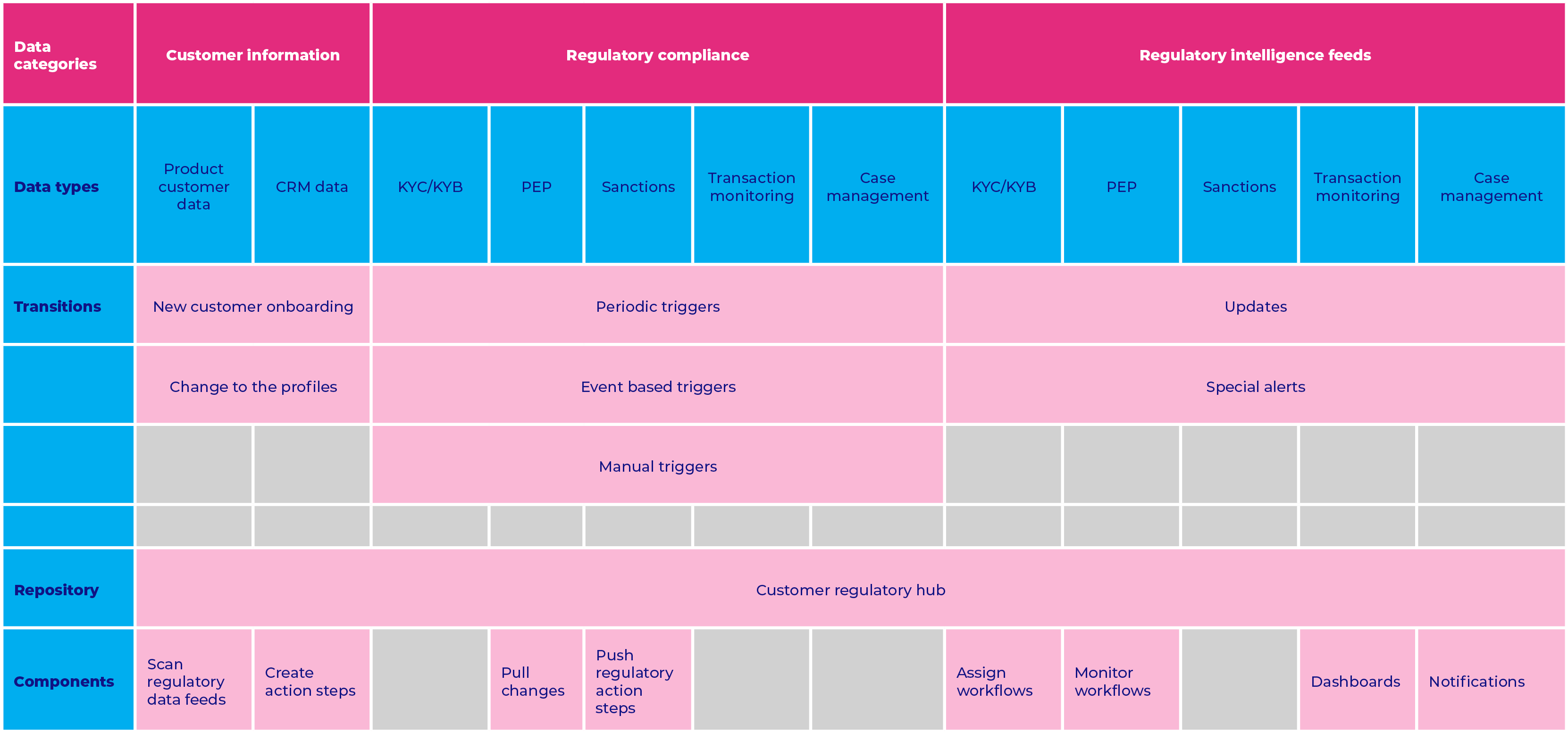

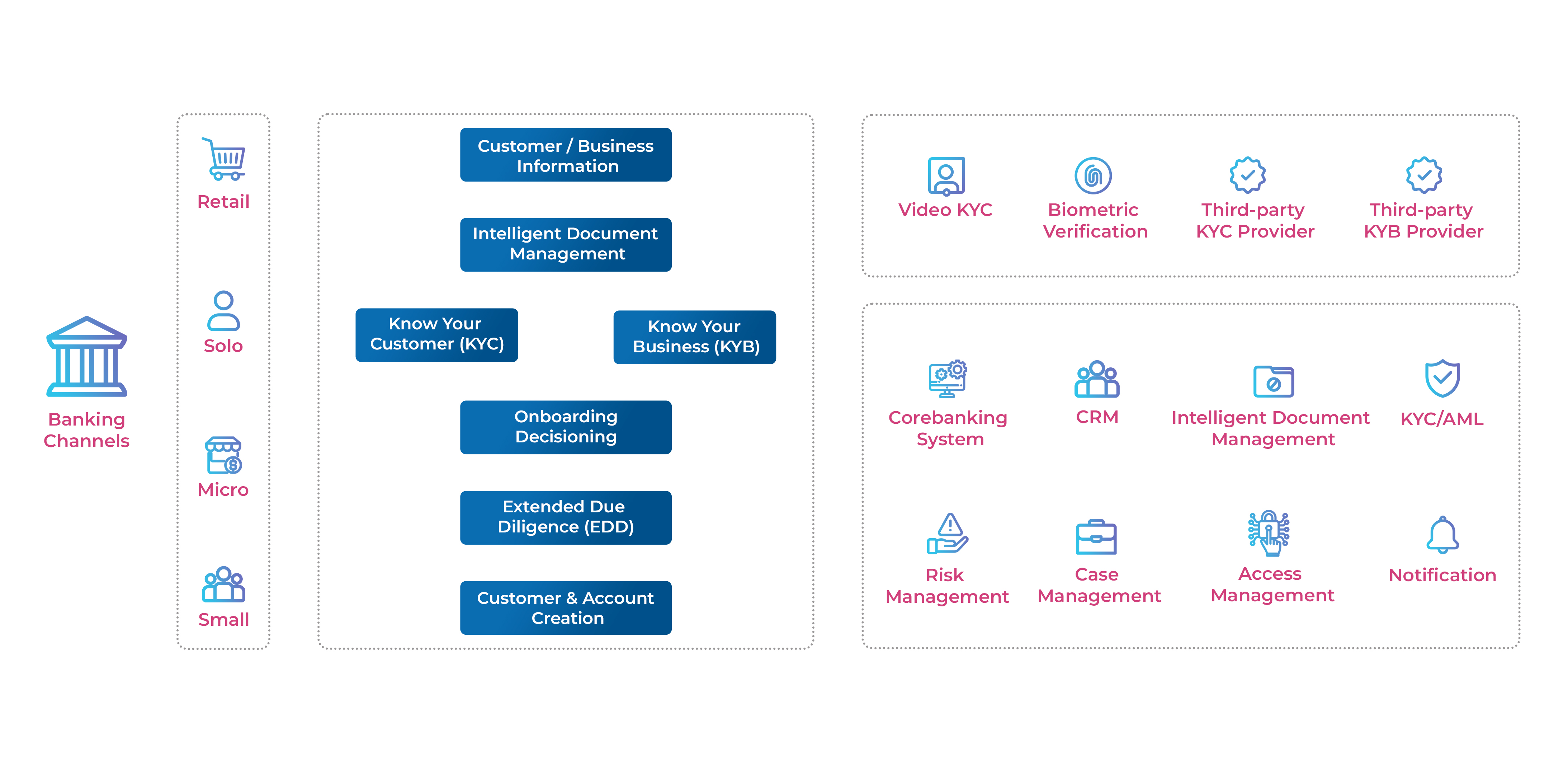

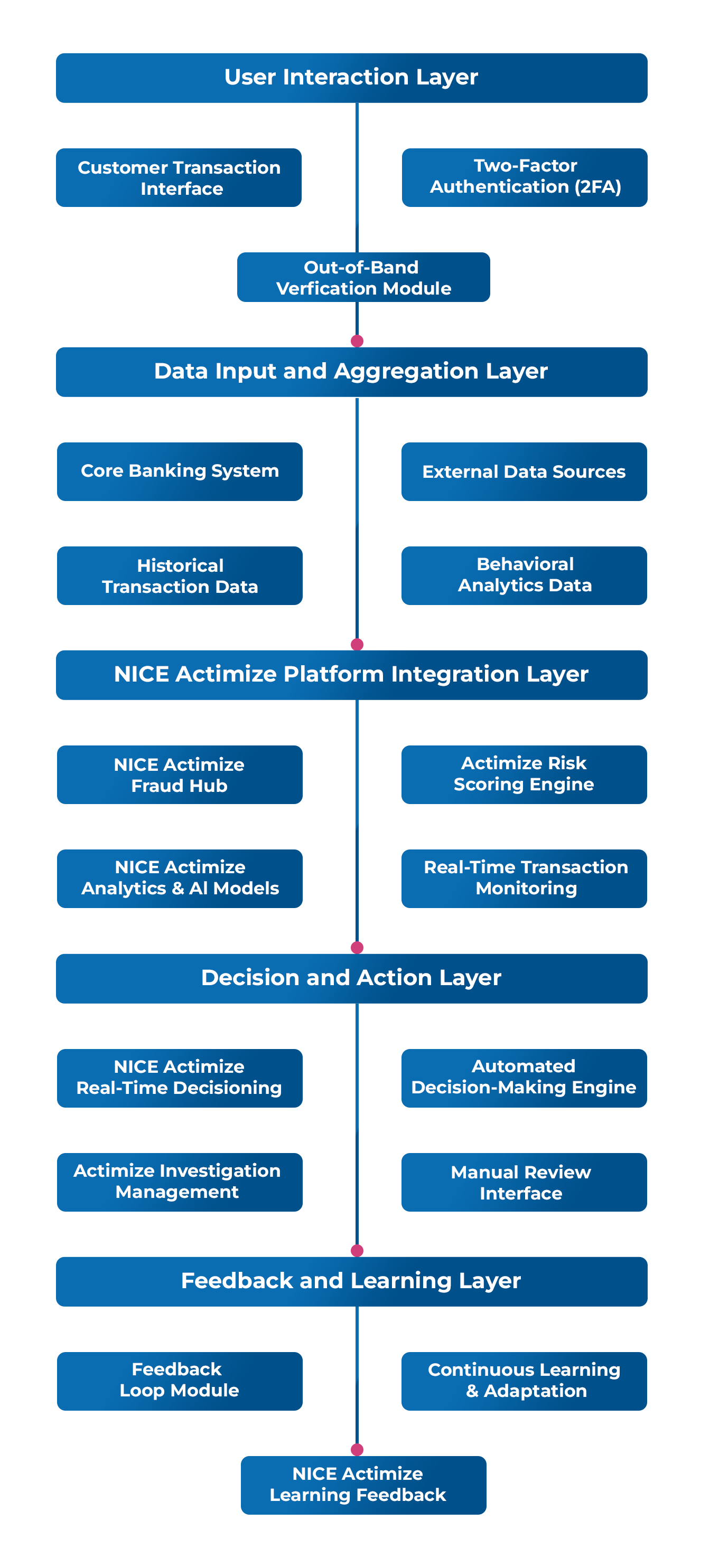

- Compliance with rules and regulations: KYC, AML, and GDPR are just a few rules that banks must follow. By automating many of these tasks, digital transformation can save time and ensure that the information collected is correct.

Essential Components for Digital Transformation in Banking

- Mobile banking and digital payments: Customers can now easily view their accounts, pay bills, move money between accounts, and do many other things on their mobile phones, thanks to apps that are easy to download and use.

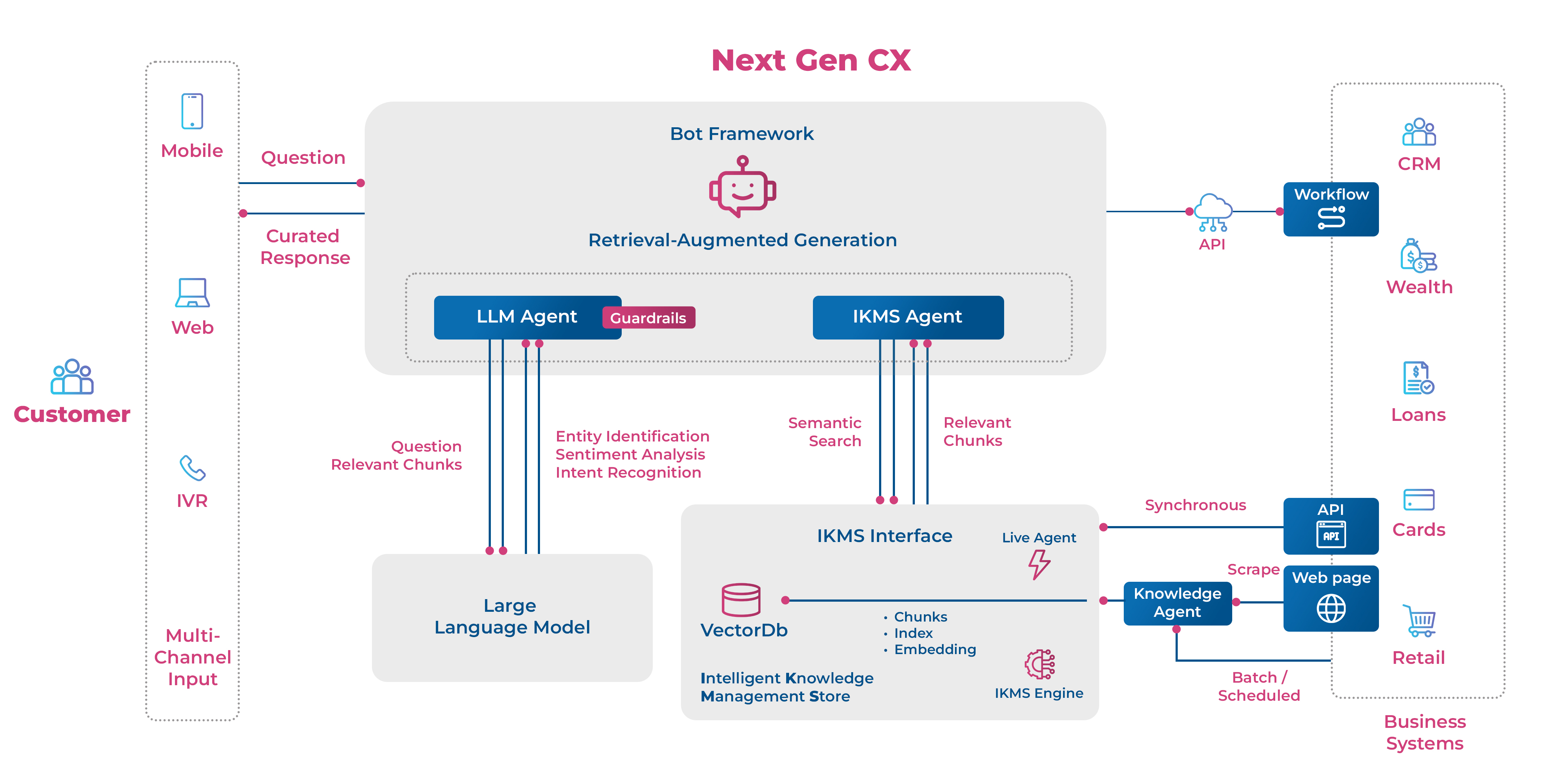

- The analysis of big data and artificial intelligence: With BDA and AI, banks can look at many data to find patterns and trends. This can help them make better products and services that meet customers’ wants. It can also help them find possible problems and ways to deal with them before they become a problem.

- Cloud computing and updating the system: Banks have been moving their operations to cloud-based platforms to make the customer experience more tech-savvy and focused on the customer. This lets them scale their operations quickly and safely so they can better adjust to market and customer needs changes. Because of this, banks can also cut costs and improve how well they run.

- Cybersecurity and information protection: New risks, like cyber threats and data breaches, have also come with the change in the banking world. To keep their customers’ information safe, banks must ensure they have robust cybersecurity and data privacy means. They must follow strict rules like the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS).

Conclusion

As smartphones, tablets, and other mobile devices increase, users now want their banking services to be more accessible and flexible. IT solutions for banks have also helped them lower their running costs. With technology, banks can do their jobs with fewer staff, reducing overhead costs. This could mean more money in the bank and more competition in the market.

One study (from Moneytransfer.com) says that by 2025, there will be 216.8 million digital banking customers in the US alone, and by 2024, there will be more than 3.6 billion online banking customers and users worldwide. The numbers can show how quickly people are using digital banking solutions, and they can also show why everyone should use Banking IT Solutions.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.

View