5 Key Techniques to Improve User Experience For Mobile Banking

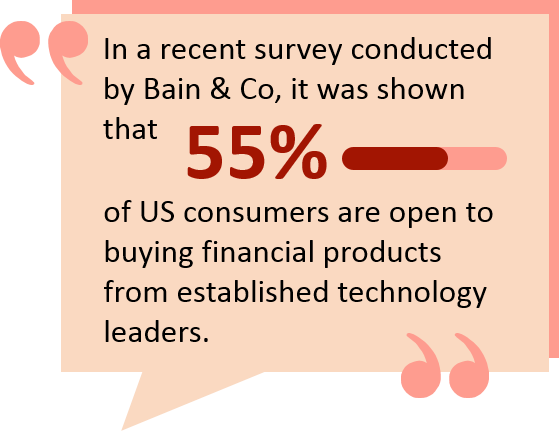

Customer acceptance of mobile banking apps and mobile banking services is on an all-time high by both existing and emerging economies. However, the impact of a good user experience is often underestimated. Research points out that nearly half the millennial customers are dissatisfied with mobile banking and online banking services. With increasing dependency on mobile banking apps should be a signal for banks to rethink their mobile banking design. The digitization teams responsible for mobile strategy will have to include user experience as a value-adding differentiator to increase customer satisfaction and loyalty.

A recent study on user experience for mobile banking revealed that there is a correlation between user experience and mobile banking. It states that these two needs to go hand in hand to increase adoption and usage numbers, especially in the developing countries.

Emerging economies are utilizing mobile banking and hybrid-online payments services to empower the bottom of the pyramid (BoY) population with financial inclusion. With over 3.9 billion BoY population worldwide ( 95% – South Asia, 68% Middle-East & Africa, and 27% Latin America). A mobile banking app with a combination of high functionality and good UX design can assist in tapping the potential banking market. (Statistics source – PwC)

Given the reason, it is imperative that a good UX experience is crucial for mobile banks to be used and appreciated by its customers.

Here are 5 ways to improve user experience for mobile banking:-

Make security a top priority

It is quite a challenge to create a secure, yet user-friendly mobile banking app on two of the major mobile operating systems – Android and iOS) since both are completely different. Balancing security with a good UX is pivotal. Recent times has seen a surge in mobile banking trojans which topped the threats related to mobile banking. Although incorporating a multi-factor authentication can be easy, user’s response is not favorable. Almost 74% customers hated two-factor authentication to sign in.

One way of addressing this security issue can by introducing either fingerprint or voice or facial recognition technology. This biometric technology analyzes physical characteristics and behavioral patterns. This allows for a new level of security and usability by solving user friction and security lapses. Nevertheless, it is good when developers adopt a “security first” philosophy when it comes to UX design.

Bankable integration of legacy systems and customer interface

Almost 66% of customers who use mobile banking regularly demand easier and faster services that many legacy banking institutions are straining to deliver, mainly due to the true integration of the back-end systems and manual process with the front-end systems. This lack of proper integration sets back the digital transformation goals of banking and financial organizations by large measures. Not surprisingly, 50% shareholders responsible for digital transformation, in a recent survey have said that legacy systems are one of the biggest barriers to making the transformation take effect.

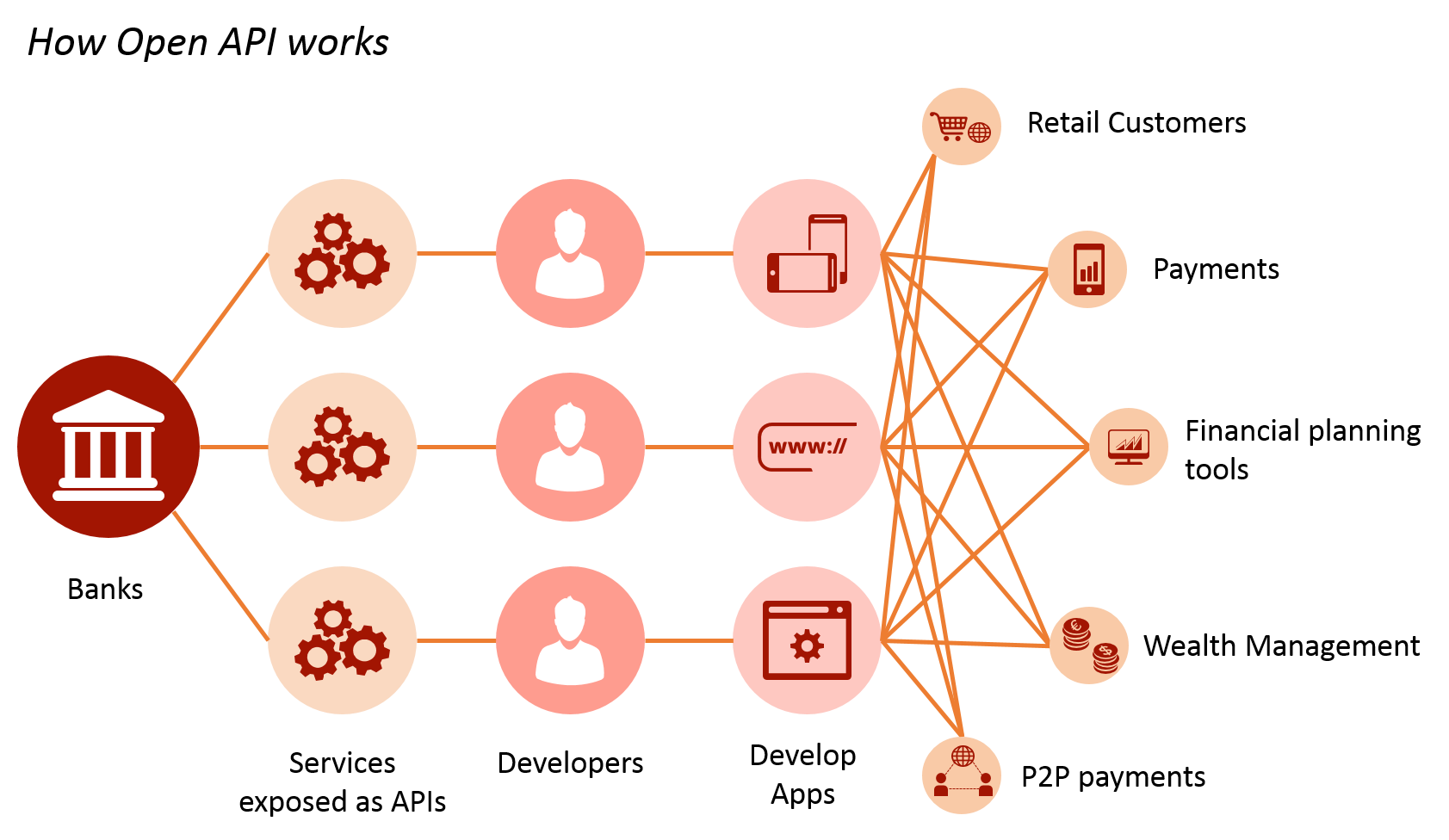

The current approach of integration is done by building a layer of applications around the legacy systems to provide a customer interface because a 360-degree transformation would involve replacing or extensively upgrading the existing back-end systems. For the future, the usage of a middleware – a Java or a PHP based backend to converse between legacy systems and mobile apps.

Another option would be to implement Infrastructure-as-a-Service (IaaS), through cloud computing. Even a hybrid integration, can connect legacy systems to internal applications and third-party applications through APIs.

Incorporate emerging technologies to enhance services

With evolving technology such as AI and machine learning, mobile banks applications will touch new degrees of sophistication especially with voice and facial biometrics, along with growing confidence in the beneficial nature of chatbots.

It is predicted that by 2020, 50% of all searches will be voice-based. These voices searched are predicted to be carried out by voice-enabled assistants powered by AI. Voice-enabled AI can perform searches and even initiate payments. The voice-controlled mobile application is already a reality. For example, the Royal Bank of Canada added Siri to their mobile app.

Many banks have already given a go-ahead to facial and image technology. The mobile user interface and core banking systems are connected via an Enterprise Content Management System. The inclusion of facial biometric technology as a part of user experience can ensure significant time savings and increased productivity.

Banking chatbots are enjoying widespread acceptance, so much so that by 2020, 85% customer interaction with banks will be through chatbots. Developing a conversation UI for chatbots can lead to high engagement and lower abandonment rate. Some uses of chatbot can extend beyond customer support and recommendations. For example, American Express (AmEx) employs chatbots that can identify and terminate credit card fraud.

Personalized Services to improve satisfaction

The power of personalization services through mobile banking apps has not yet plateaued. This includes both UX and content personalization. A UX personalization would involve allowing users to customize home screens, choose colors and increase or decrease font sizes. With additional how-to-guides and quick access to customer support (help buttons) would assist customers who prefer self-service. Through content personalization, geo-fence based notifications or reminders can be sent to customers when customers in near the vicinity of the bank. This location-based user experience design in real-time can increase the app engagement by 2x times.

Personalization experience can also be included in the form of budgeting tools, financial advisors for investment wisdom and even for scheduling appointments for VIP customers. AI integrated design can perform these functionalities with ease. It can also be used to extract data and financial records to cross-sell products to the right customer at the right time.

Minimize effort with streamlined navigation and reduced customer input

A good mobile banking design should ideally include proper navigation and instant redirects to point the customers to the content they are looking for. With landmarks and icons, such as search boxes, section navigation tools and labels in the app, it can appear intuitive whilst simple to use. Although, identifying where the customer is getting lost in the navigation process through touch heat maps can be used to rectify the problem areas. It is also a good guideline to tell the customer which screen they are looking at by highlighting the respective icon.

A mobile banking app that avoids demanding too much effort from the customer is the first to pleasing the customer. By automatically populating data or setting up defaults for repetitive actions can greatly reduce customer effort and errors. Auto-suggestion, spell-check and predictive text, without overdoing, can bring down the time spent on data entry.

For banks aiming to delight their mobile banking population, it is crucial to deliver high-quality user experience. In the long run, a great user experience will likely be a good pay off by increasing revenue through elevated customer satisfaction levels and by boosting customer loyalty. Also, in the future, AI will become instrumental in bringing a refined user experience in the mobile banking applications.

View