Building for the future: How legacy core banking companies are preparing for new-age digital assets.

The last decade has seen the rise of many new-age digital assets, such as cryptocurrencies, security tokens, and non-fungible tokens (NFTs). These offer several advantages over traditional assets, such as increased transparency, faster settlement times, and lower transaction fees, and are also seen as a diversification option. The global Cryptocurrency market cap stands at over a Trillion and is expected to grow further in the coming years.

Some incumbent core banking companies have been around for decades, providing customer services worldwide. Many core banking systems have evolved, giving various functionalities and services, including wealth management, trade finance, etc. They must also adapt and embrace new-age digital assets to stay competitive and meet customer expectations.

This, however, requires multiple changes in the legacy software.

Changes required in legacy software:

Various changes are required to make legacy software compatible with new-age digital assets, depending on the specific features of those assets. However, some general considerations include the following:

- Adding support for new standards: New digital assets, such as ERC-20 for Ethereum-based tokens, may require further measures. Legacy software may need to be updated to support these standards.

- Updating protocols: Legacy software may use outdated communication protocols incompatible with new digital assets. Updating these protocols can help ensure compatibility.

- Introducing new data structures: Digital assets often use new data structures that legacy software may not be able to handle. Introducing these data structures can help the software manage the recent acquisitions.

- Enhancing security measures: New digital assets may require additional security measures not present in legacy software. Enhancing security measures can help ensure the safety and integrity of the assets.

- Improving integration: Digital assets may need to integrate with other systems, such as wallets, exchanges, or blockchains. Improving integration can help ensure seamless communication between the software and these systems.

- Updating user interfaces: Legacy software may not have user interfaces optimized for managing digital assets. Updating the user interface can help users manage the assets more efficiently.

Overall, updating legacy software to handle new digital assets requires a holistic approach that considers the specific needs and requirements of the assets, as well as the overall architecture and design of the legacy software. It may also require collaboration with third-party providers, such as wallet or exchange providers, to ensure seamless integration with other systems.

Challenges:

In addition to making essential software changes, traditional core banking products also encounter challenges in keeping up with new investment options and adapting their offerings for digital assets.

- Regulatory uncertainty – Digital assets are still a relatively new and unregulated asset class, and there is a lack of clarity around how they should be treated from a regulatory standpoint. Strict regulations are expected to be enforced on these assets. To avoid legal or reputational risks, core banking companies must navigate this regulatory uncertainty carefully.

- Another challenge is the lack of standardization and interoperability between digital asset platforms. Digital assets are issued and traded on various platforms with standards and protocols. This can make it difficult for legacy core banking companies to integrate these assets into their existing systems and workflows.

- Providing ongoing support: Digital assets constantly evolve and may require constant updates and maintenance to ensure compatibility with legacy software. Providing ongoing support can help ensure that the software remains compatible with new digital assets as they emerge.

Remediation Strategies:

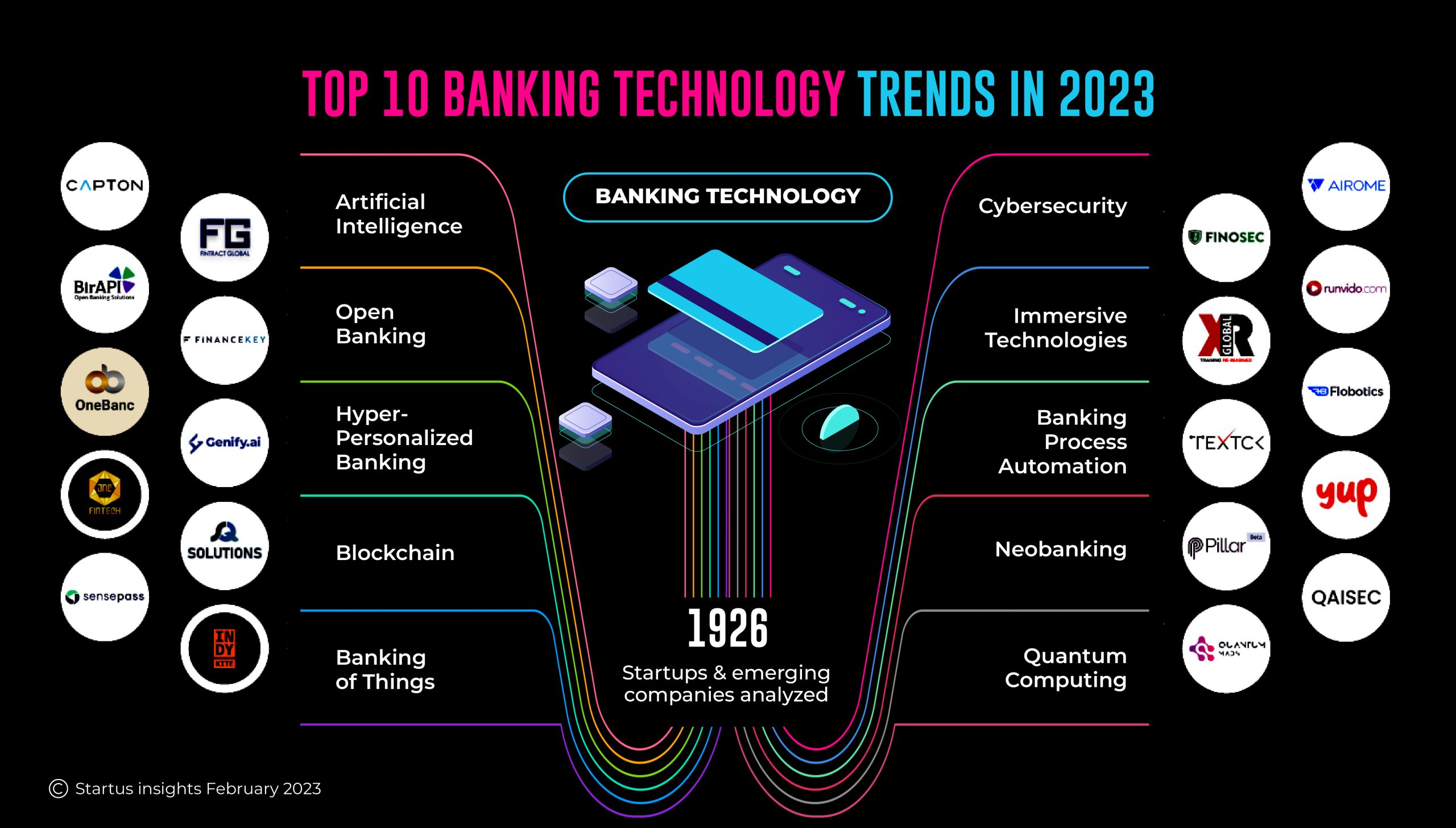

Below are some steps that legacy software firms should take to stay abreast of the latest trends and developments in the digital asset space. Many of these have been adopted by the leading core banking product companies.

- In addition to hiring experts in blockchain technology, smart contracts, and cryptocurrency markets, traditional product companies can team up and invest in fintech firms to tap into the specific knowledge, technology, and resources required for digital assets. A few examples seen in recent times:

- Temenos has partnered with Taurus, a Swiss-based digital asset infrastructure provider, to enable banks to offer their clients digital asset products and services. The partnership integrates Taurus’ digital asset infrastructure with the Temenos Transact platform, allowing banks to manage digital assets alongside traditional banking products.

- Infosys Finacle, part of EdgeVerve Systems Limited, and R3, one of the fastest-growing blockchain software companies in the world, have partnered to collaborate on blockchain solutions.

- Avaloq invested in METACO, a provider of hardware wallets for digital assets, which also offers digital asset custody solutions.

- Legacy product companies should invest in technology infrastructure to support digital assets and develop solutions.

- Oracle, apart from their banking solution FLEXCUBE, has created the Oracle Blockchain Platform, allowing the creation and management of blockchain networks.

- TCS’s Quartz™ for Markets offers services around tokenized securities and its proven TCS BaNCS.

- Infosys Finacle, a leading core banking software provider, has developed blockchain-based solutions Trade Connect for trade finance and Payments Connect for real-time payments.

- Wealth management products should offer a seamless user experience for clients who want to manage their digital assets alongside traditional assets. This includes offering intuitive user interfaces, mobile apps, and other tools to help clients manage their portfolios.

Conclusion:

Despite the challenges, legacy core banking companies are well-positioned to play a vital role in the digital asset space. They have existing customer relationships and regulatory expertise that can be leveraged to offer digital asset services. By adapting and evolving, these companies can remain relevant in the new digital age and continue to provide value to their customers.

New-age digital assets will continue to play a vital role in the financial industry, and legacy core banking companies must adapt to this new digital landscape to remain competitive. Legacy core banking companies can embrace digital assets and provide unique and innovative customer services by forming partnerships with fintech startups, investing in cutting-edge technology, and developing solutions.

View