The Impact of Technology on Corporate Banking

Corporate clients account for 56 percent of banks’ annual global revenue, or approximately $1.85 trillion. Banks that have begun digital transformations have seen favorable results, including 10 percent revenue growth in digitized products and 20 percent cost reductions in various corporate banking value chain segments.

In a delicate and tight economic environment, banks should assist their customers more than ever by introducing innovative IT services by teaming with credible systems integrators like Maveric Systems.

Big data and analytics play a role in this change, while improved connectivity drives sales and onboarding efficiency and effectiveness. With the help of technology, leading banks have pushed to provide clients with multichannel access, thereby cutting cost-to-serve and enhancing customer-centricity. Automation of procedures reduces mistake rates and shortens processing times.

A Clear Case for Technology for Corporate Banking

Today’s economic environment is characterized by rapid inflation, rising energy, and commodity costs, and increased default risks; equities markets reflect these concerns. The situation opens up a clear strategic path for technology deployment.

The business case for B2B APIs in cash management, payments, invoice reconciliation, and working capital finance is very apparent. The platforms being rolled out globally by regulators, such as unified payment systems in India, enable banks to exploit API platforms more effectively.

Leveraging Technology for Differentiating from Competition

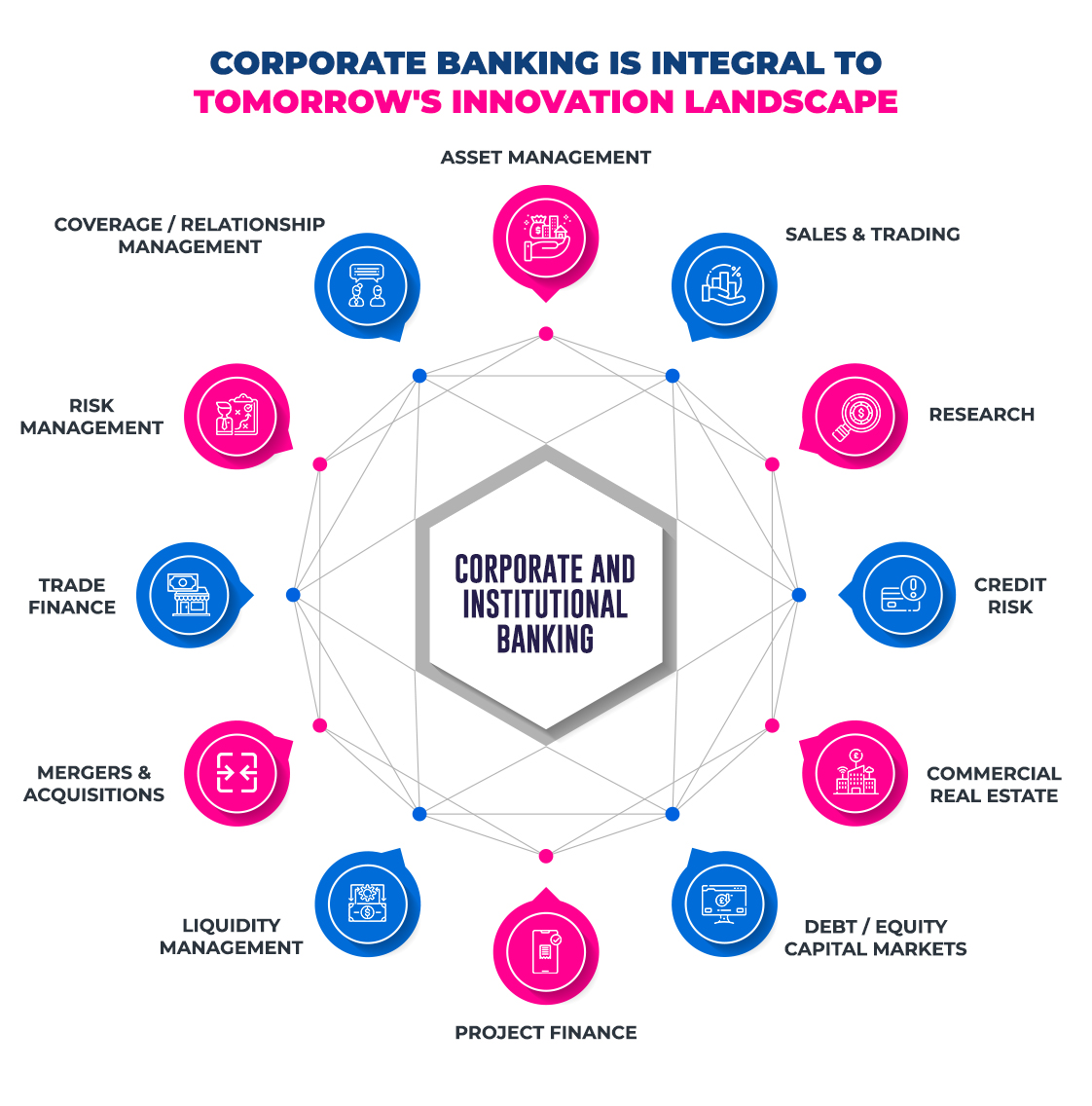

Most bankers are persuaded to alter their treasury offerings and create customized solutions for client companies. It can serve as a point of differentiation. As most banks are universal providers of financial services, they cannot differentiate themselves beyond pricing and networking. They are confident that development will come from transaction banking business lines so long as they equip their services with ready-to-use IT solutions for corporate customers. It involves upgrading their IT tools, even though uptake is sluggish. To cherry-pick services, these technologies are APIs, mobility, advanced analytics, cloud computing, AI, and open architectural platforms.

Expanding the Supply Chain Finance Portfolio

Corporate banks will derive up to 10% of their revenue from supply chain finance products such as factoring, supplier finance, receivables finance, and buyer-led programs. These unique business lines are intriguing and assist banks in spreading risk throughout their SME customer portfolio. Many of these items may be made available through a technology platform with minimum relationship management and active engagement. Partnering with a supply chain finance platform within an ecosystem might be highly profitable for corporate banks since it attracts digitally-originated, scalable businesses.

Learning from Retail Banks

Some retail banks have been so successful with digital transformations that they might serve as global examples of successful digital transformations. To be successful, corporate banks must be as ambitious as their retail counterparts in seeking comprehensive reforms. Corporate banks worldwide should provide customers with more sophisticated advice on their day-to-day business operations and fulfill their more complicated banking product and service requirements.

To do so, they must improve in two key areas: first, by developing analytics capabilities at scale to achieve a new level of customer understanding and targeting, and second, by applying digitization at scale to deliver a nearly seamless integration of banking services into corporate clients’ daily business activities. These endeavors will necessitate considerable modifications to the operating model and the development of an entirely new set of capabilities.

Conclusion

Digitization is transforming corporate banking. Digital has become the sine qua non of practically every action, from basic corporate procedures to how clients engage and trade. However, digitization in corporate banking is still in its early phases. More significant changes will occur as it matures, enabled by the unfettered flow of data among banks, their clients, and other parties. The ensuing “ecosystems” will stimulate new operating paradigms and cause extraordinary disruption.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.

View