How Banking Transformation Services Drive Innovation in BFSI Sector

The BFSI (Banking, Financial Services, and Insurance) sector has undergone a remarkable transformation over the years, driven by technological advancements, changing customer expectations, and regulatory shifts. Financial institutions (FIs) must continuously innovate and adapt to stay competitive and relevant in this dynamic landscape. Banking transformation services are pivotal in driving innovation within the BFSI sector. This article will explore the evolution of challenges and recent shifts in the BFSI sector, highlight some of the recent achievers and innovators in the industry, discuss the pressing challenges ahead, and conclude by examining the technology factors that will be game-changing for the BFSI sector shortly.

Enhancing Banking Transformation Services

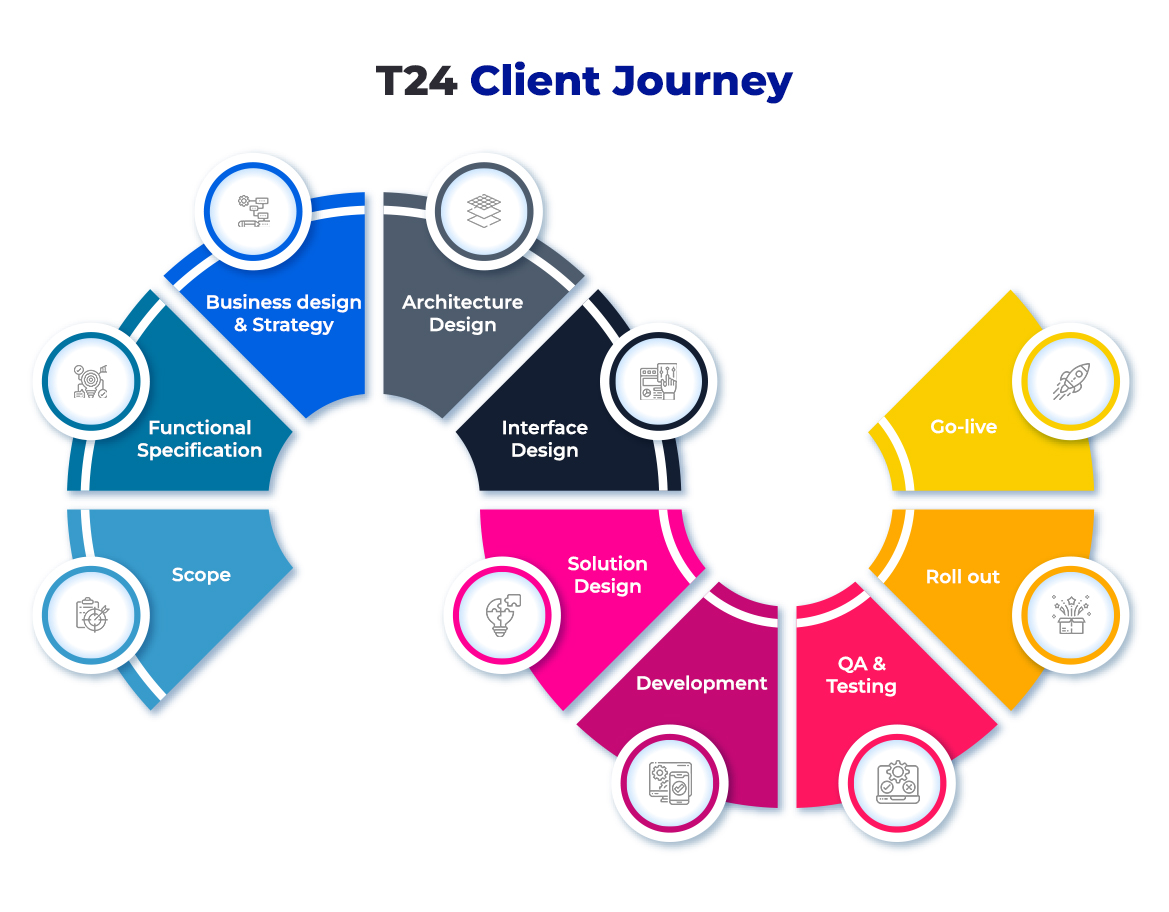

Partnering with seasoned BankTech companies like Maveric that challenge the status quo through fresh thinking and deep domain contextualization is a powerful way to feed the innovation pipeline for leading BFSI players.

Evolution of Challenges and Recent Shifts in the BFSI Sector

The BFSI sector has faced challenges, including legacy systems, slow technology adoption, and increasing customer demands. However, recent years have witnessed significant shifts, primarily driven by technology and changing consumer behaviors.

Corporate Banking Transformations

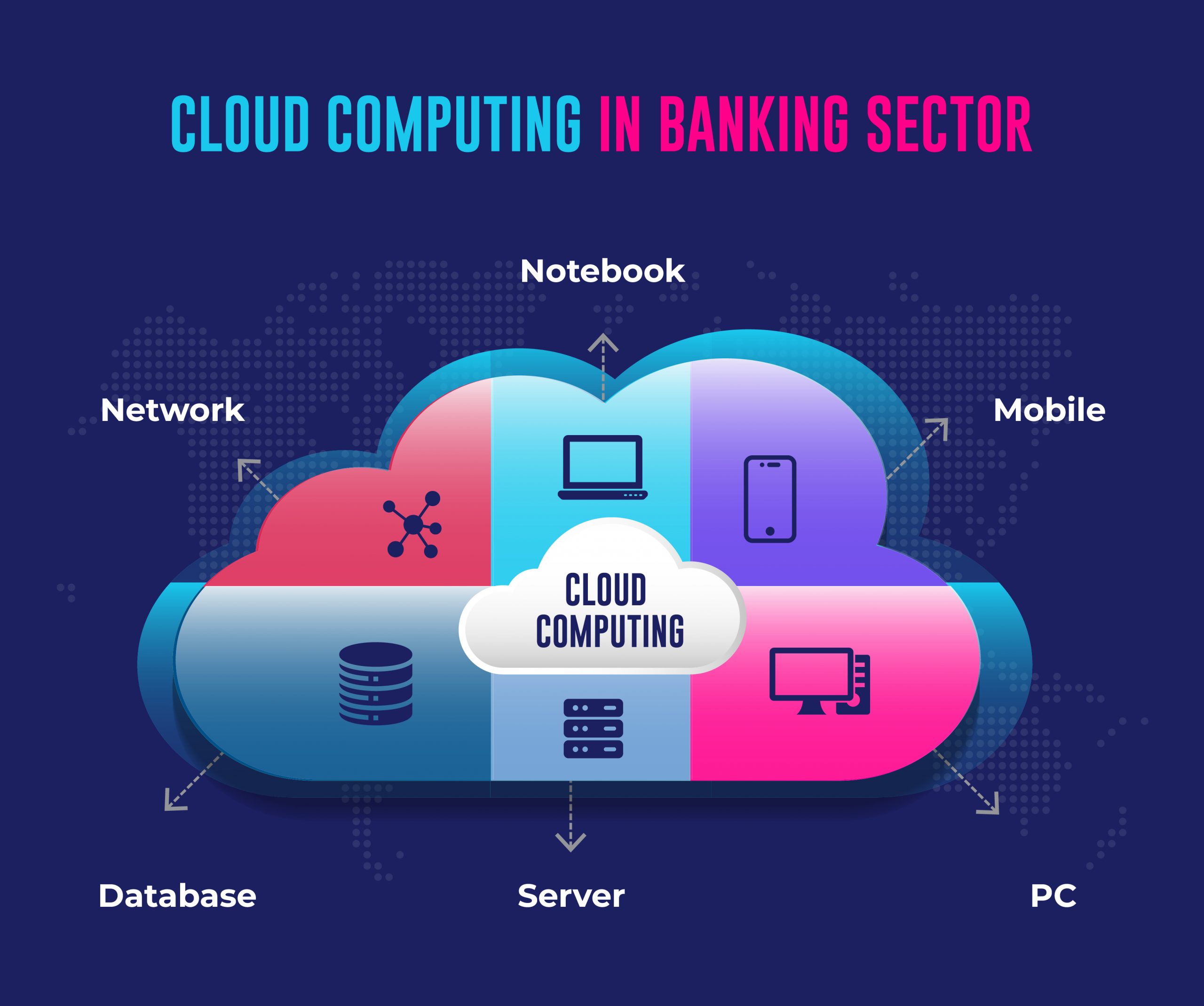

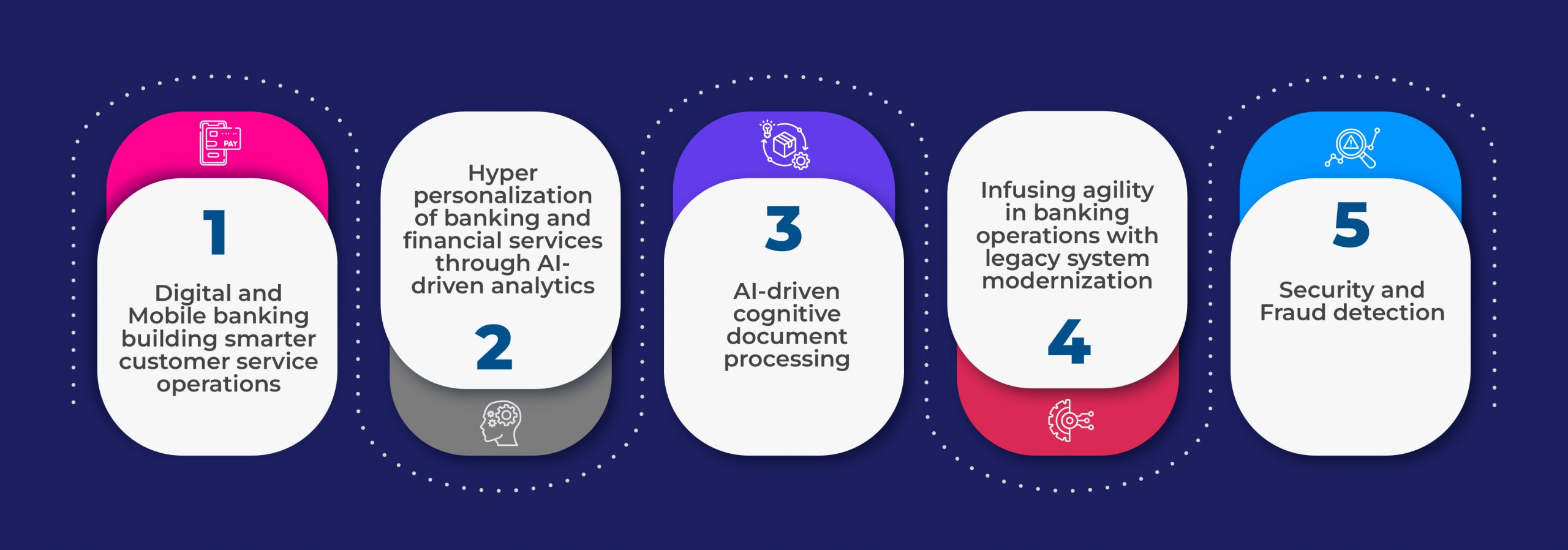

Digital technologies have accelerated the pace of digital transformation in the BFSI sector. FIs are embracing mobile banking, digital payments, and online account management to cater to tech-savvy customers who expect convenience and seamless experiences.

Fintech Disruption

The emergence of fintech startups has disrupted traditional banking models. Fintechs leverage innovative technologies, such as AI, blockchain, and data analytics, to offer specialized financial services, challenging the status quo and forcing traditional FIs to adapt or collaborate.

Customer-Centricity

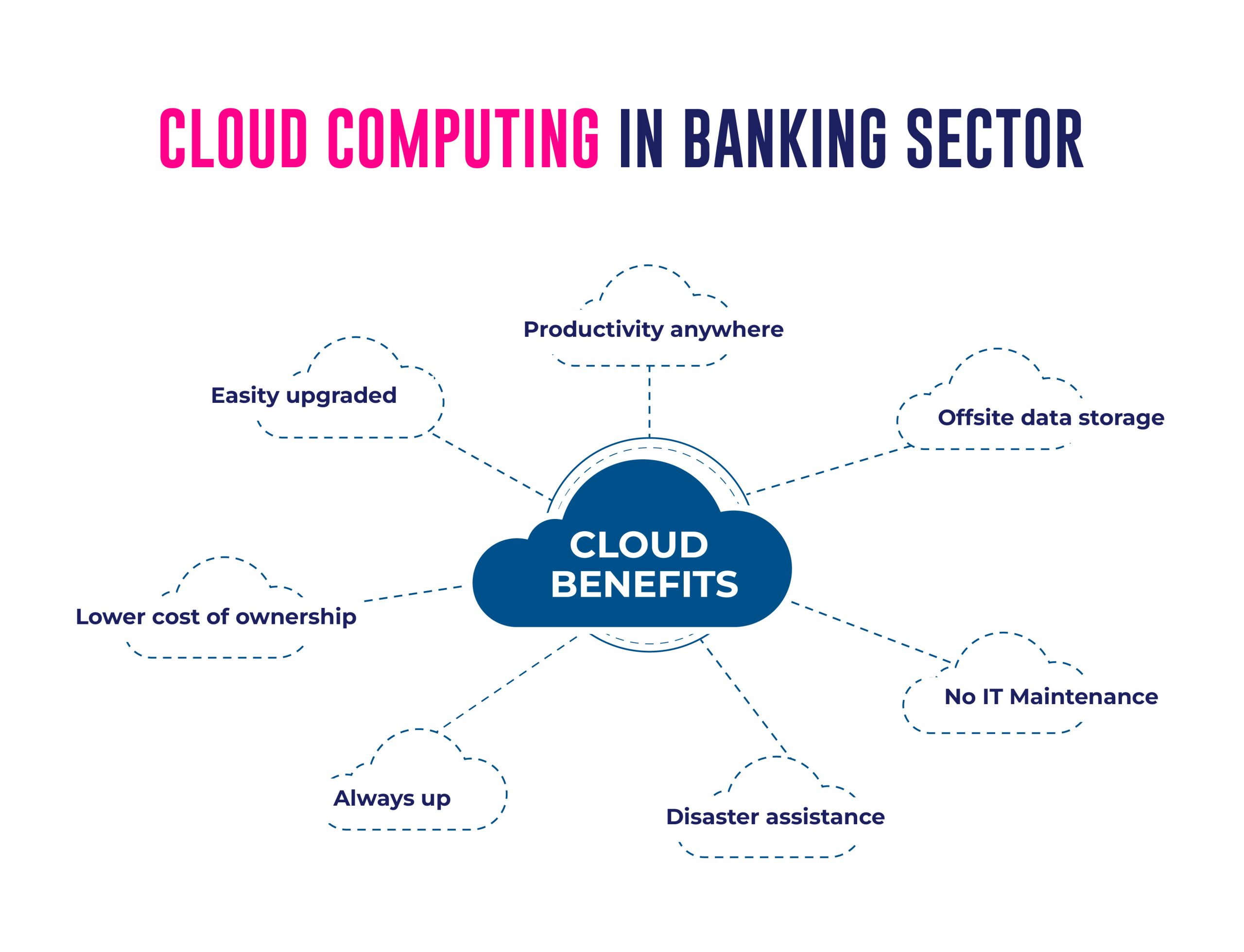

Customer expectations have evolved, with a growing demand for personalized services and hyper-personalized experiences. FIs must focus on customer-centricity, leveraging data and AI-driven insights to deliver tailored solutions and improve customer engagement.

Regulatory Compliance

Regulatory changes have been frequent, posing compliance challenges for FIs. Stricter regulations like GDPR and PSD2 in Europe have forced FIs to enhance data security and transparency.

Digital Corporate Banking Solutions: Recent Achievers and Innovators

Several FIs and fintech companies have emerged as trailblazers, driving innovation in the BFSI sector. For instance, digital-only banks like Chime and Revolut have gained popularity by offering mobile-first banking experiences with no monthly fees and innovative budgeting tools. Meanwhile, PayPal has extended its offerings to include peer-to-peer payments, online checkout solutions, and even cryptocurrency transactions, diversifying its services to meet customer needs. Additionally, Stripe has become a fintech leader by providing seamless payment processing solutions for online businesses, simplifying the complex world of online transactions.

Pressing Challenges Ahead in Banking Transformation Services

While the BFSI sector has made significant strides, several challenges lie ahead. Cybersecurity remains a top concern as cyber threats become more sophisticated, requiring FIs to fortify their defenses continually. The rise of digital currencies and decentralized finance (DeFi) also presents regulatory and security challenges for FIs, as they navigate this rapidly evolving landscape. Moreover, as customer expectations continue to rise, FIs must balance delivering personalized services and ensuring data privacy, which poses a delicate challenge.

Technology Factors Driving Corporate Banking Transformations.

Several technological factors will play a game-changing role in the BFSI sector. AI and ML will drive predictive analytics and personalized customer experiences, allowing FIs to anticipate customer needs proactively. Blockchain technology will revolutionize data security and transaction transparency, making operations more efficient and secure. Additionally, the Internet of Things (IoT) will enable the integration of financial services into everyday devices, expanding the scope of banking and payments.

Conclusion

The BFSI sector has experienced significant shifts in recent years, driven by digital transformation, fintech disruption, and changing customer preferences. To stay ahead, FIs must embrace banking transformation services that drive innovation. Leaders in the sector have already demonstrated their adaptability and ingenuity, leveraging technology to meet customer demands. However, as the industry evolves, it must address pressing cybersecurity and regulatory compliance challenges. By harnessing emerging technologies like AI, blockchain, and IoT, the BFSI sector can position itself for continued growth and success, catering to customers’ evolving needs in the digital era.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.

View