Key Elements & Trends Affecting the Modernization of the Core Banking Services

Core banking systems, the backbone of financial institutions, are undergoing a profound transformation to meet the ever-evolving demands of a digitally empowered customer base. This modernization, while complex, is undeniably necessary for banks to remain competitive, relevant, and agile in a rapidly shifting landscape. Let’s delve into the critical factors and trends shaping the future of core banking.

The Imperative for Change

Traditional core banking systems, often built on inflexible legacy architectures, need help to keep pace with contemporary needs. They hinder innovation and rapid delivery of the personalized, real-time services that customers have come to expect. These limitations pose significant obstacles to banks seeking to enhance the customer experience, tap into new revenue streams, and meet stringent regulatory requirements.

Maveric Systems, with deep expertise in banking domain modernization, understands these challenges firsthand. Their 3Cs Advantages (Contextualization, Competence, and Commitment) ensure they work collaboratively with banks to devise strategic pathways toward next-generation core systems that create lasting competitive advantage.

Key Drivers of Modernization

Several key factors are propelling the modernization of core banking services:

1) Changing Customer Expectations:

Today’s digital-savvy customers demand seamless, personalized, and omnichannel experiences. Legacy-core banking systems often need help to support these expectations.

2) Fintech Disruption:

Agile fintech’s set a new benchmark for customer-centricity and innovation. To compete effectively, banks must modernize their core infrastructure.

3) Cloud Adoption:

Cloud-native core banking solutions offer greater scalability, flexibility, and cost efficiency than traditional on-premises systems.

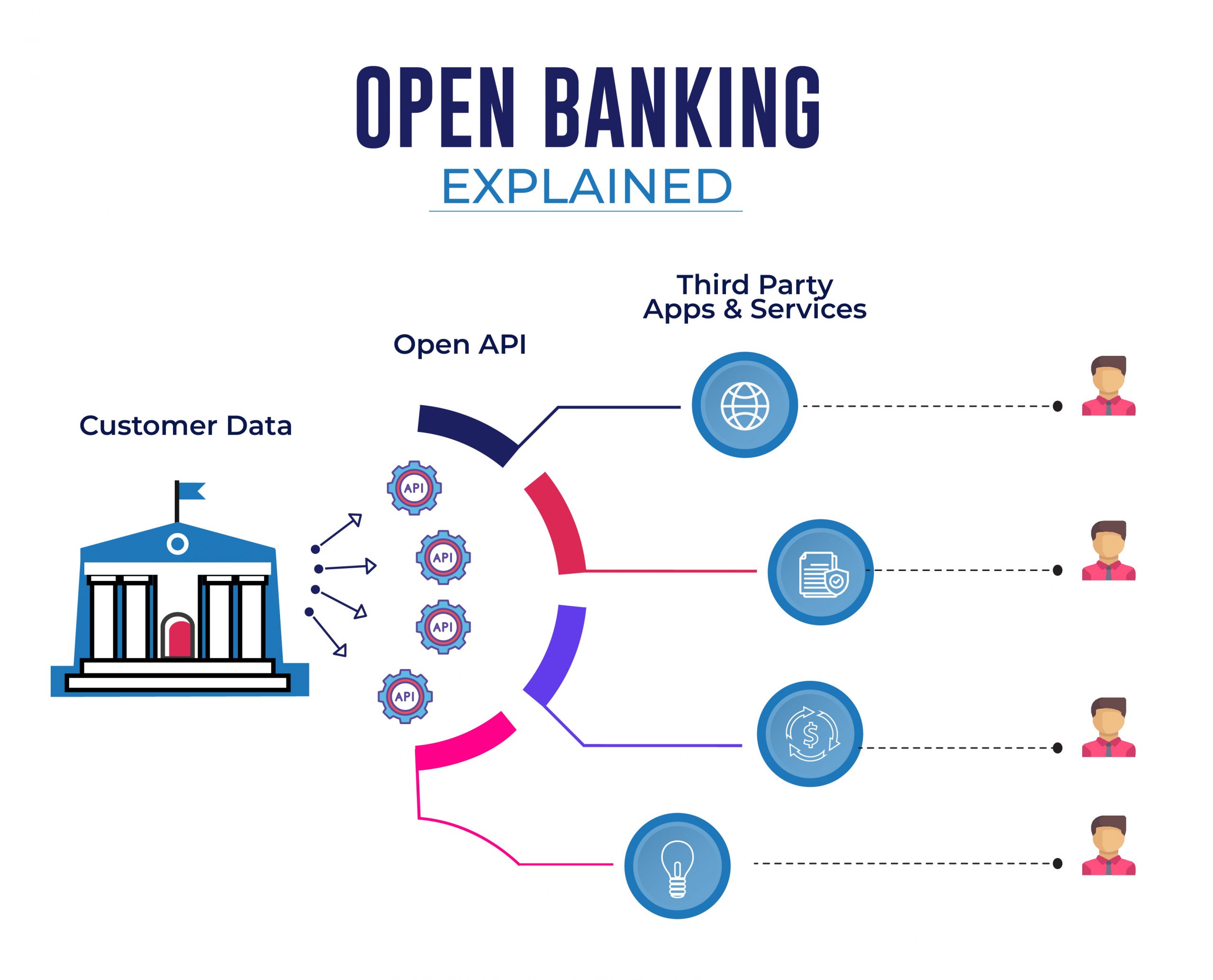

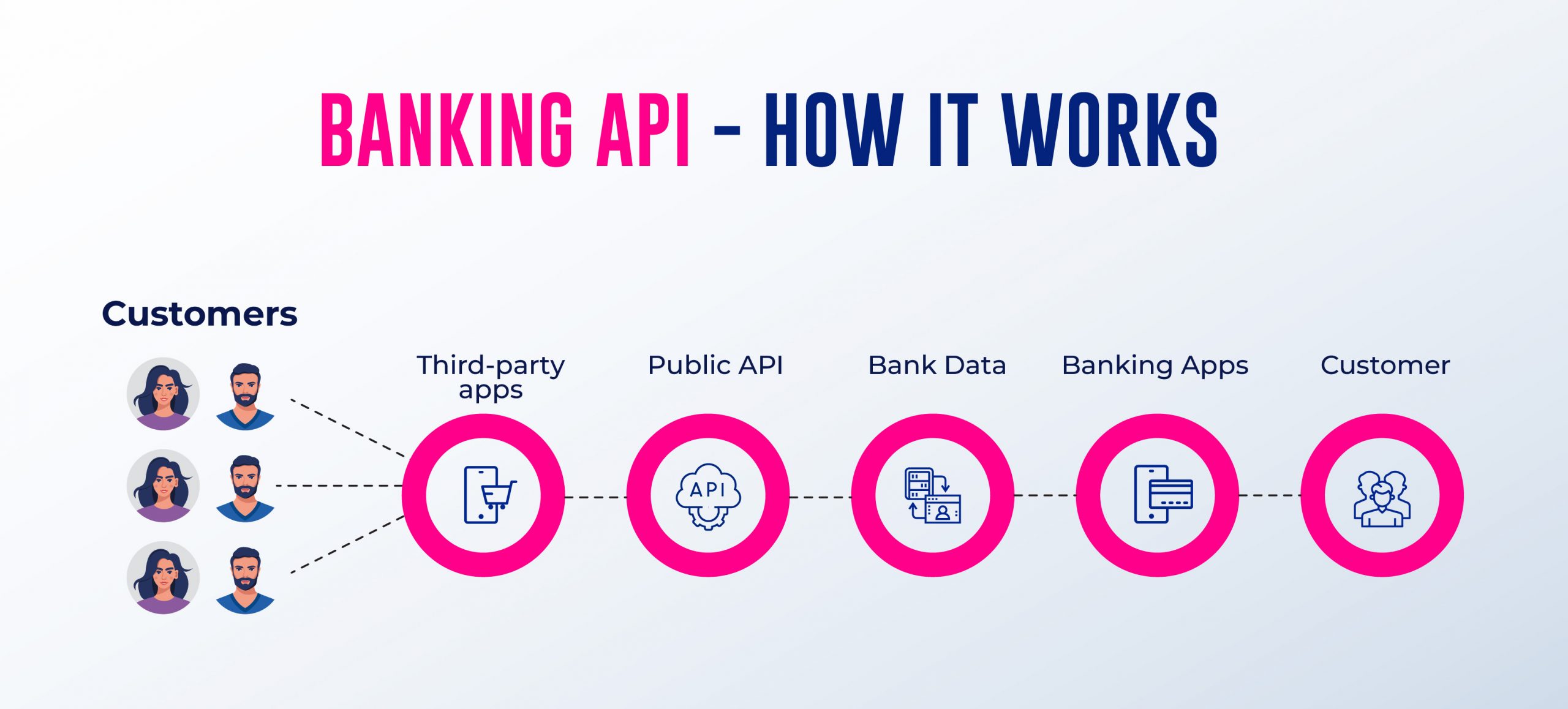

4.) Open Banking and APIs:

Regulations like PSD2 and rising customer expectations around data portability push banks towards open API-based architectures.

Trends Shaping the Future

Let’s look at some groundbreaking trends influencing this transformation:

Composable Banking:

Banks are moving away from monolithic suites and toward a more modular approach. This enables them to assemble and customize solutions, providing greater agility and faster time-to-market.

Data & AI:

Advanced analytics and AI-powered insights are becoming a mainstay. Banks can mine data for personalized recommendations, fraud detection, and risk management.

Real-Time Banking:

The ability to process transactions and information in real-time is becoming a critical differentiator, enabling banks to offer instant payments, contextual advice, and a truly frictionless experience.

Spotlight: Temenos as a Leader

With its cloud-native, API-first Transact platform, Temenos is a recognized leader in core banking modernization. Temenos banking solutions offer a robust and modular architecture, supporting open banking trends for seamless integration and innovation. Their solutions are gaining a reputation for helping banks across the globe enhance customer experience, operational agility, and overall competitiveness.

Industry Insights & Statistics

The urgent need for core banking transformation is reflected in industry statistics:

A recent survey by McKinsey found that over 70% of banks plan to modernize their core systems within the next two years. Industry analysts estimate the global core banking market could reach $320 billion by 2028, highlighting the investment in these advanced solutions.

Strategic Ways Forward

Modernizing core banking systems requires a well-crafted strategy. Here are some crucial points for banks:

Clear Vision:

Define the business goals and desired outcomes driving the modernization effort.

Phased Approach:

Consider a phased implementation and migration to manage risk effectively rather than a significant overhaul.

Choose the Right Partner:

Seek a partner like Maveric Systems with proven expertise in core banking modernization, ensuring access to the best technology and implementation support.

Conclusion

Core banking modernization is no longer optional but a strategic imperative. Banks embracing this transformation can reinvent themselves with customer-centric models, data-driven insights, and unmatched responsiveness. By adopting modern platforms like Temenos banking systems and working with knowledgeable partners, banks can position themselves for lasting success in the exciting and ever-evolving banking world.

About Maveric Systems

Established in 2000, Maveric Systems is a niche, domain-led, BankTech specialist, transforming retail, corporate, and wealth management digital ecosystems. Our 2600+ specialists use proven solutions and frameworks to address formidable CXO challenges across regulatory compliance, customer experience, wealth management and CloudDevSecOps.

Our services and competencies across data, digital, core banking and quality engineering helps global and regional banking leaders as well as Fintechs solve next-gen business challenges through emerging technology. Our global presence spans across 3 continents with regional delivery capabilities in Amsterdam, Bengaluru, Chennai, Dallas, Dubai, London, New Jersey, Pune, Riyadh, Singapore and Warsaw. Our inherent banking domain expertise, a customer-intimacy-led delivery model, and differentiated talent with layered competency – deep domain and tech leadership, supported by a culture of ownership, energy, and commitment to customer success, make us the technology partner of choice for our customers.

View