As Regulatory compliance and reporting obligations continue to increase in volume, scale, intensity, and complexity in terms of jurisdictional differences and evolving supervisory expectations, it is also apparent that Financial institutions are and will continue to rely on RegTech solutions and technologies like AI, ML, and Cloud to meet these challenges. However, RegTech is not a magic pill, and it alone may not help.

It is important to pause and consider the current state of the Financial institutions operating model and processes, assess Regtech’s suitability, and attune for adoption.

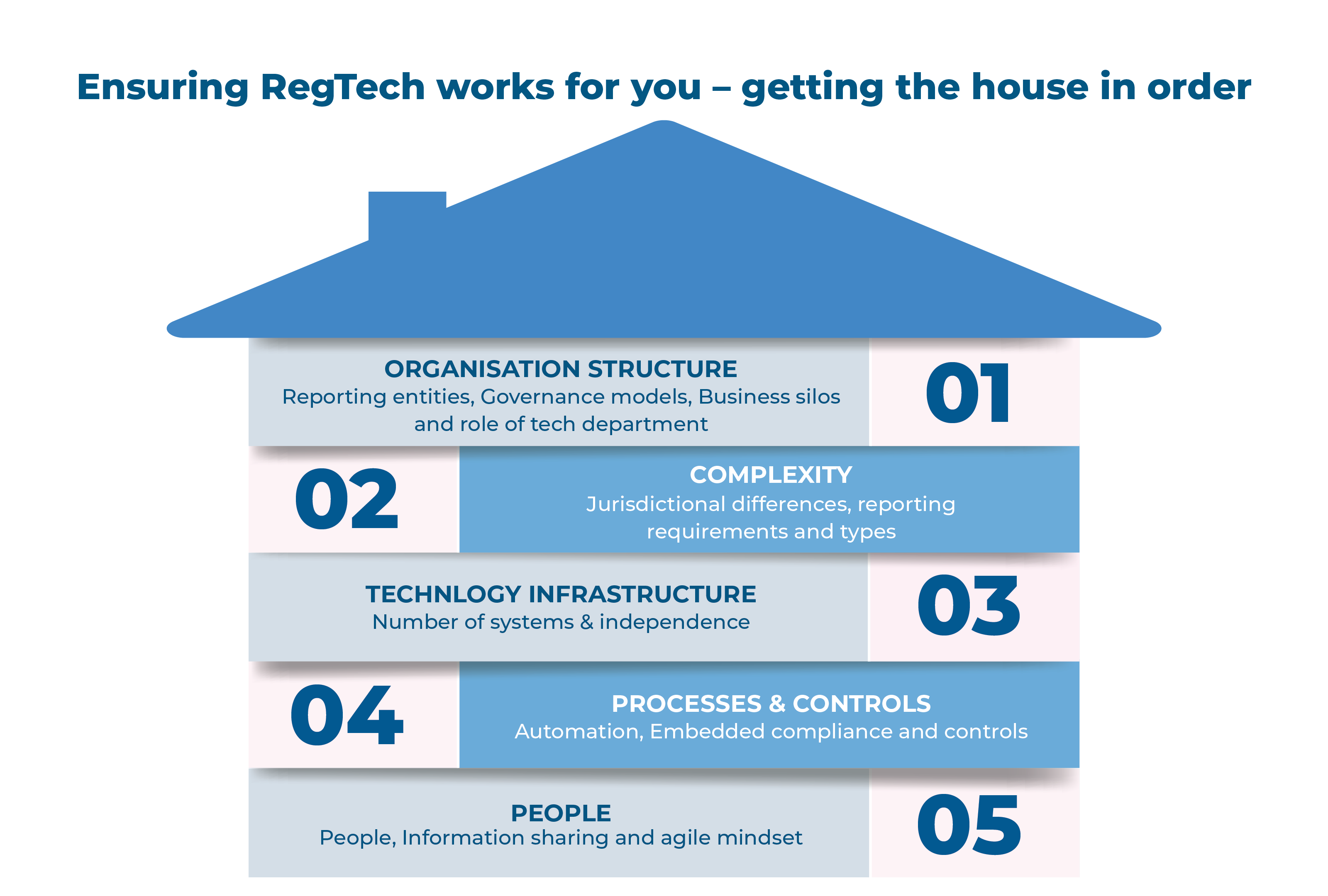

Organization structure and complexity: Given the complex operating models of Financial institutions, every regulatory requirement today necessitates technological interventions and impacts many different processes within the Financial institution, affecting both business and operations.

It is, critical for Financial institutions to move away from a reactionary tactical approach to a more proactive & strategic collaborative approach to address regulatory challenges and technology adoptions. The leadership across various enabling teams representing the CIO, CRO, CFO, CCO, the business lines, and the Head of regulatory change need to come together to enable the Financial institution to establish an effective overarching organization structure to implement regulatory change and reporting infrastructure.

Technology Infrastructure and Data Architecture

Many Financial institutions still have different legacy systems working in individual silos. These systems have already undergone multiple patchworks in case of any new regulatory requirement in an often reactionary and tactical approach. This has made the IT infrastructures of Financial institutions highly complex and challenging for Reg tech implementations.

Increased, more granular, and ad-hoc reports necessitate new data extracts from multiple applications and functions for almost each new regulatory requirement.

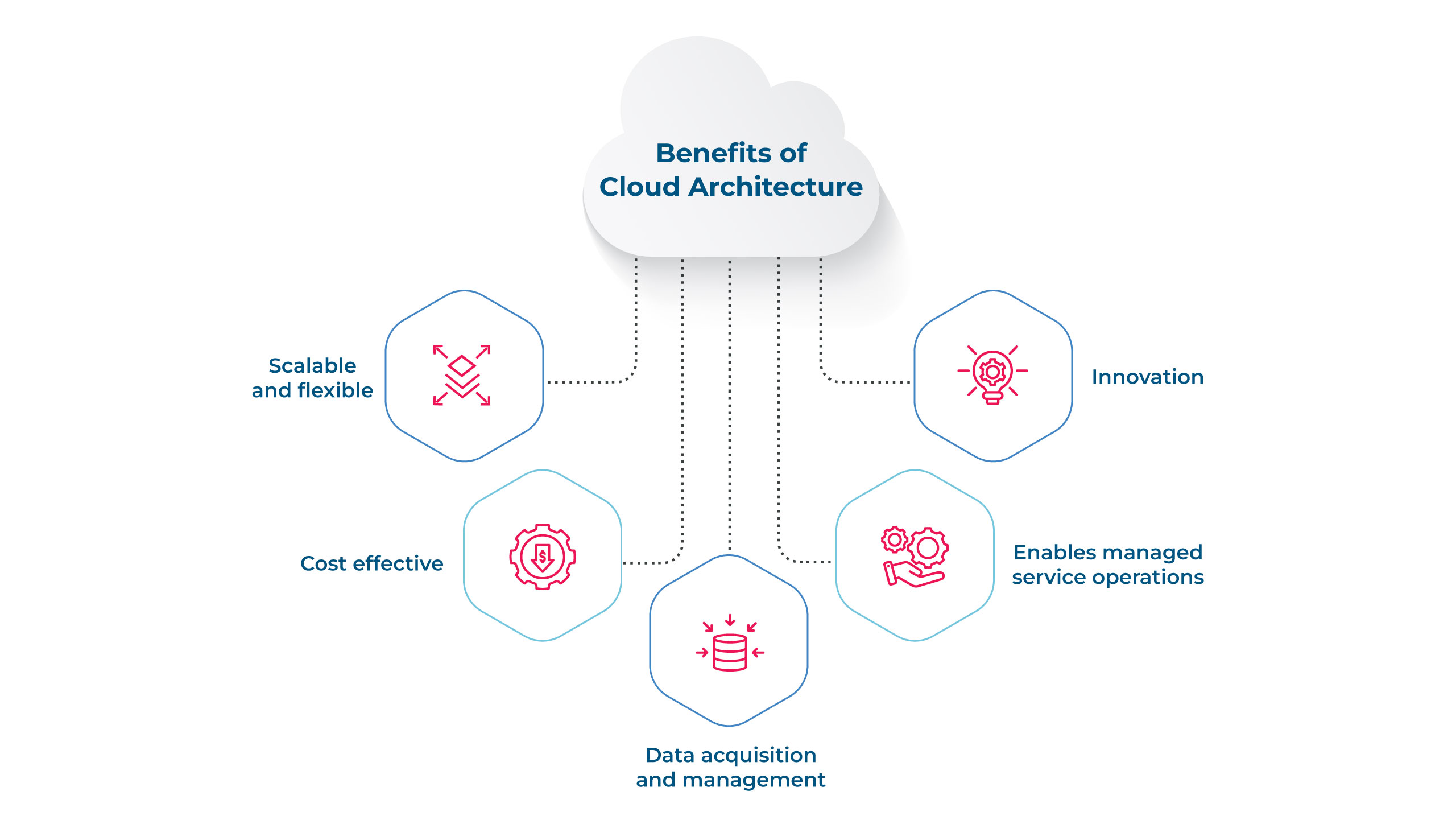

Data thus continues to remain the core issue, and Financial institutions need to create a data-centric architecture to continue to stay compliant. New technologies like AI, API, big data, and cloud architecture together help structure and move data, providing transparent and easy access to data across the organization.

- More scalable and flexible – Help address the challenge of legacy systems struggling to meet ever-increasing regulatory requirements.

- Cloud-based architecture are more cost-efficient and also gives the option of pay per usage, thereby being a viable solution even for smaller Financial institutions in light of increasing regulatory compliance requirement.

- Cloud-based architecture along with APIs can help in the data acquisition, storage, and maintenance – help address the challenge of data acquisition and data to report processing from multiple solution providers.

- Cloud adoption enables managed service operations where non-core work can be outsourced and more efficiently managed.

- Collaboration and innovation – Cloud-based architecture Financial institutions can help Financial institutions leverage the innovation potential of technology firms.

Processes and controls

Financial institutions also need to look at their internal processes to ensure alignment with existing change initiatives as well as scalability across multiple reporting domains and expand to other processes and internal reporting. Financial institutions should also seek to apply advanced analytics and derive business insights using the granular data so obtained to increase their ROI.

People

Financial institutions will need to seed the right culture of collaboration and knowledge sharing, promote the right incentives and rewards to encourage standard standardized tooling, and adopt an agile mindset to ensure faster development and adoption of technologies.

It will thus require a much greater convergence of efforts and a strong partnership between various teams and stakeholders in the Financial institution to enable the required infrastructure and help the Financial institution stay compliant.

Co-authored by Deepak Bhatter, and Venkatesh Padmanabhachari

Maveric’s thought leadership series – E.D.G.E (Experiences Delivered by Global Experts) – handpicks the game-changing technology ideas and pressing functional questions financial institutions must solve today.

These features – reports, whitepapers, podcasts, flyers, blogs, and infographics – are for Banking leaders and Technology evangelists to apply profound trends, the latest opinions, and transformational analyses to boost the performance of their organizations.

About Maveric Systems

Established in 2000, Maveric Systems is a niche, domain-led, BankTech specialist, transforming retail, corporate, and wealth management digital ecosystems. Our 2600+ specialists use proven solutions and frameworks to address formidable CXO challenges across regulatory compliance, customer experience, wealth management and CloudDevSecOps.

Our services and competencies across data, digital, core banking and quality engineering helps global and regional banking leaders as well as Fintechs solve next-gen business challenges through emerging technology. Our global presence spans across 3 continents with regional delivery capabilities in Amsterdam, Bengaluru, Chennai, Dallas, Dubai, London, New Jersey, Pune, Riyadh, Singapore and Warsaw. Our inherent banking domain expertise, a customer-intimacy-led delivery model, and differentiated talent with layered competency – deep domain and tech leadership, supported by a culture of ownership, energy, and commitment to customer success, make us the technology partner of choice for our customers.