Regulators have continued to focus on using technology, particularly digitizing reporting requirements and building data analytics systems, to analyze the now vast amounts of structured and unstructured data coming to them.

Regulators are taking this forward and increasingly taking a leadership role in fostering innovation via joint efforts, regulatory sandboxes, industry collaborations, and partnerships. Given the immense potential emerging technologies hold in driving innovation as well as causing disruption, regulators are increasingly playing a forward-looking role in adopting emerging technologies to provide a measured guiding path and ensure no risks to financial stability.

The regulatory sandbox approach is a popular and effective initiative undertaken by multiple regulators at national and international levels – essentially a “safe space” where financial services providers can test innovative technological solutions without immediate regulatory repercussions. This also encourages regtech firms to build solutions while engaging regulated institutions to participate and adopt these solutions.

Financial institutions have started to recognize the innovation potential of these ecosystems and beginning to leverage these sandboxes to contribute to solution development, test emerging technologies faster, and deploy solutions at a lower or shared fractional cost. ECB’s SSM Digital footprint blueprint is a great example of supervisors driving such an eco-system approach where multiple platforms and tools have gone live as part of the initiatives and benefiting all stakeholders.

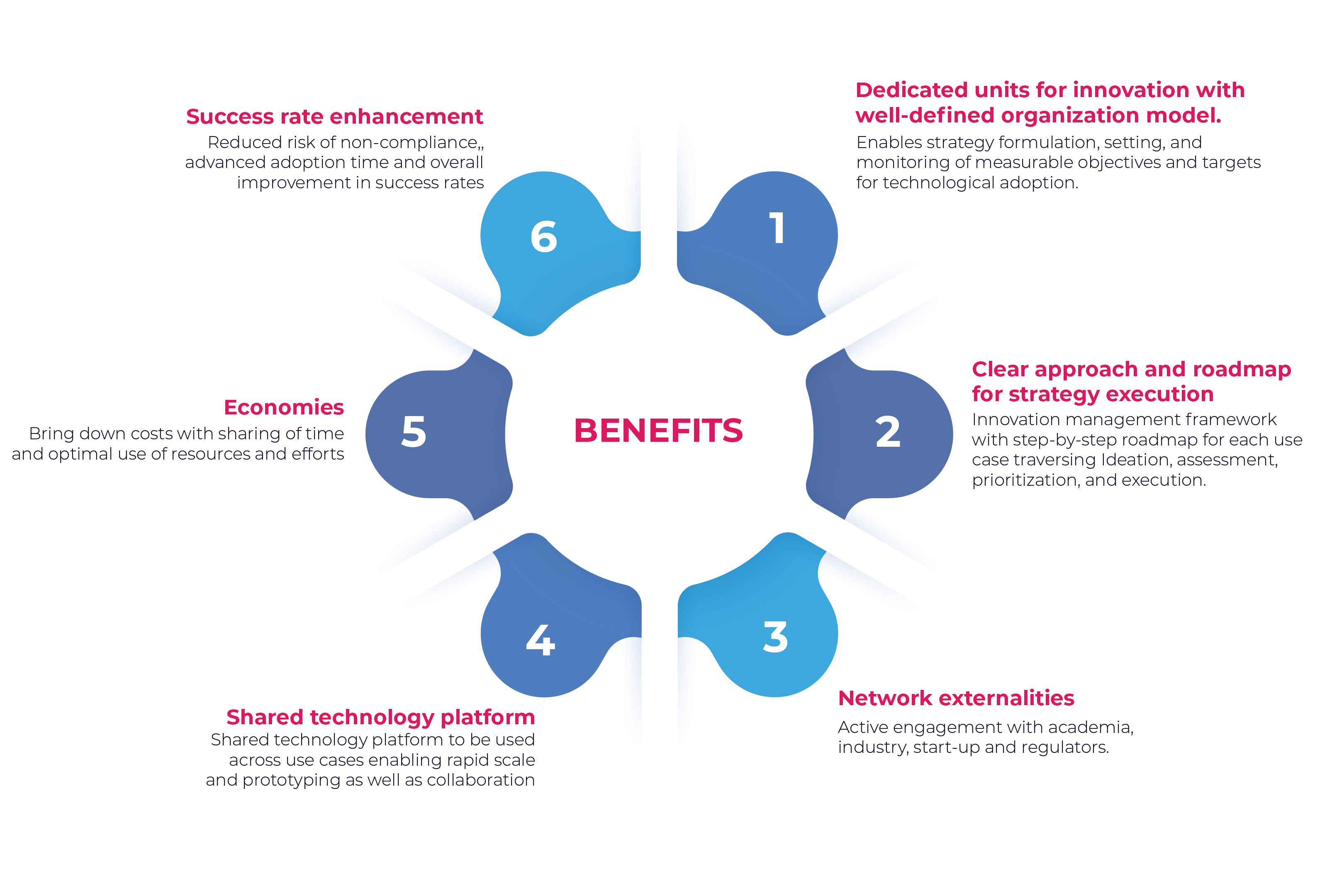

- Regulators have specialized and dedicated units/platforms for innovation and technology blueprints. These units have a well-defined organizational model – with governance structures, steering committees, multi-disciplinary innovation teams, and experts. This framework enables strategy formulation, setting, and monitoring of measurable objectives & targets for various technological adoptions.

- A straightforward approach and roadmap to achieve its strategy. The SSM Digital footprint, for example, has a defined Innovation management framework where each use case goes through a step-by-step roadmap (Ideation, assessment, prioritization, and execution). From 2020 till June 2023, more than 120 cases have gone through this roadmap, with 14 SupTech applications already implemented.

- An eco-system approach to leverage network externalities and actively engage with academia, industry, start-ups, and other authorities.

- Development of a shared technology platform for use cases, enabling rapid scale and prototyping. SSM has dedicated platforms leveraging AI, NLP, Network analytics, big data, and cloud computing, while the ECB has a SupTech platform for remote collaboration between supervisors.

Co-authored by Deepak Bhatter, and Venkatesh Padmanabhachari

Maveric’s thought leadership series – E.D.G.E (Experiences Delivered by Global Experts) – handpicks the game-changing technology ideas and pressing functional questions financial institutions must solve today.

These features – reports, whitepapers, podcasts, flyers, blogs, and infographics – are for Banking leaders and Technology evangelists to apply profound trends, the latest opinions, and transformational analyses to boost the performance of their organizations.

About Maveric Systems

Established in 2000, Maveric Systems is a niche, domain-led, BankTech specialist, transforming retail, corporate, and wealth management digital ecosystems. Our 2600+ specialists use proven solutions and frameworks to address formidable CXO challenges across regulatory compliance, customer experience, wealth management and CloudDevSecOps.

Our services and competencies across data, digital, core banking and quality engineering helps global and regional banking leaders as well as Fintechs solve next-gen business challenges through emerging technology. Our global presence spans across 3 continents with regional delivery capabilities in Amsterdam, Bengaluru, Chennai, Dallas, Dubai, London, New Jersey, Pune, Riyadh, Singapore and Warsaw. Our inherent banking domain expertise, a customer-intimacy-led delivery model, and differentiated talent with layered competency – deep domain and tech leadership, supported by a culture of ownership, energy, and commitment to customer success, make us the technology partner of choice for our customers.