In the last few years, banking as an industry has seen a massive move towards digitization. Traditional banks are challenged by new-age, digital only banks that rely on replacing the traditional banking experience with a hyper-personalised digital first approach. In addition, banks need to boost their Return on Equity, bring down Cost to Income ratio etc. in order to stay competitive. Banks have also been facing threats from new entrants such as Google, Amazon and other technology companies looking to enter this space. COVID-19 has accelerated some of these trends, like changed customer behaviour and adaptation of newer tools and technologies by the banks.

Surveys observed rapid increase in customer reluctance to visit branches and they are inclined to try out newer tools to meet their banking needs. Banks have been closing branches globally at an unprecedented scale. Citigroup closed about 100 branches and JP Morgan, the largest bank in the US closed about 1000 branches in the immediate aftermath of the pandemic.

Customers now expect banks to maximize digital interactions and come up with digital alternatives for their day-to-day banking needs as they are now more open to trying out a new app than they were before the COVID-19 pandemic.

Digital Banking – Way Ahead

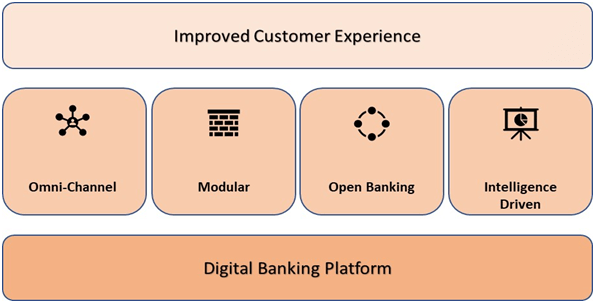

In the post COVID world, digital banks will need to replace many of the customer’s existing transactions and interactions with the bank by improved use of technology.

To achieve this, they will need to build a robust, scalable technology platform focusing on the following components:

Omni Channel

Banks need to ensure that their channels are streamlined to ensure seamless and superior customer journeys across channels. Traditionally, banks have had siloed channels with customized workflows and support. This approach is inherently inefficient and leads to broken customer journeys, staff and customer dissatisfaction and increased costs. To achieve a true omni-channel experience, banks have to re-engineer their platforms to be digital first. Workflows, customer journeys and experiences should be orchestrated through a central hub and then distributed to individual channels.

Mobile banking will be at the heart of omni-channel banking soon. An added advantage of mobile banking is that it can offer near real-time communication avenues to banks. Also, access and authentication can be handled through a mobile’s in-built security mechanism. Banks should focus on generating omni-channel experiences that are mobile friendly and can be repurposed across other channels.

Modular Banking

Customers expect increased dynamism at the front end. However, legacy bank systems are monolithic in nature leading to potential delays in implementing changes, increased time to market for new products along with an unpredictability of outcome.

To address this, banks must focus on decoupling existing monoliths to begin with. However, this will not be enough for banks to compete with digital only banks. Banks will need to incorporate a platform that at its core is “digital first”. This means the breaking down of functionality into smaller components that can be combined to alter processes and products as needed.

Having a truly “digitally advanced” platform will allow P&L owners within the bank to design and technology & engineering functions to develop and deliver new products and services rapidly.

Open Banking

Traditionally, banks didn’t require to share data with competitors or other service providers. Some banks used their data to improve their services and products, however there was no obligation for them to share this data with third parties or competitors. Open Banking and PSD2 have changed this in Europe and it is now likely that regulators world-wide would follow their European counterparts and require banks to get acccess to the customer data to third parties and competitors based on customer’s consent.

Open Banking will create opportunities for banks that are open to alliances with Fintechs and other third-party products, thus offering customers an end-to-end experience. Banks will need to open up their APIs and tap into third party capabilities to dramatically improve customer experience and build deep, lasting relationships with their customers.

Intelligence Driven

Traditional approaches to customer service, cross-selling and recommending products to the customers have relied on a “One size fit all” approach. With a bigger scale, financial penetration and reduced customer interaction, there is a clear opportunity for banks to use data to personalize customer experiences, recommendations, and services.

By integrating different kinds of customer data (demographic, transaction, interaction, behaviour, application usage etc.), banks can create unique experiences for each customer by leveraging technologies such as Cognitive Computing, Machine Learning, Natural Language Processing etc.

In the post-COVID world, customers will need to feel unique and cared for even when they interact with banks over digital channels.

Digital Banking experience will be a game changer for enhancing customer satisfaction post-COVID. Banks need to take a holistic view and invest across all pillars of digital banking to retain existing customers and acquire new ones.

(The author is the Vice President at Maveric DataTech, based in India with an experience of 18 years in Management Consulting, Data Analytics and Digital Transformation. He is currently responsible for the Advanced Analytics practice at Maveric DataTech)

This was originally published on Outlook India website and is being reproduced here.