PSD2 Solution

Our PSD2 offerings stems from our deep expertise in technology, banking domain and customer experience. We have been proud collaborators with banks across EU and UK, to help them achieve PSD2 compliance.

The Maveric PSD2 Solution is “Plug and Play” which enables your bank to embark on an accelerated path to compliance in as little as 12 weeks!

Key Features

We conceive and apply digital for banks in the context of customers, their journeys, and the various experience points across these journeys. Our PSD2 solution makes open banking easy and secure, with some of the following compelling features.

Banking System Integration

- API as key enablers

- Compliant with core banking system

- High operational stability

- Fallback mechanism

Regulatory Reporting

- Compliance reporting

- Dashboard and analytics

- Incident management

- Real-time updates

Development Tools

- Developer console

- Admin console

- Sandbox and production environments

Strong Customer Authentication (SCA)

- Secure communication

- Risk based authentication

- Consent management

Third Party Aggregator Management

- Busines as usual for banks

- Aggregator on boarding

- Aggregator management

Fallback Mechanism

- Reliable contingency solution

- Regulatory compliance

- Contingency planning, support and management services

Maveric can assist you at any stage of your PSD2 journey.

Get started in just 12 weeks

Discovery and Workshop

Our Digital Maveric experts will work with your team to organize a discovery workshop. This will help both the teams to assess the as-is situation and chart a project path for further engagement.

Developer console

The developer console of Maveric’s PSD2 solution has high operational stability. Our sandbox environment is supported with clear documentation to achieve value and remarkable user experience.

- Developer friendly experience

- Aggregator Sandbox

- High quality APIs

Integration of all components

The solution offers end-to-end implementation and integration with key features as below -

- Regulatory compliance

- API as key enablers

- Compliant with core banking systems

- High operational stability

- Fallback Mechanism

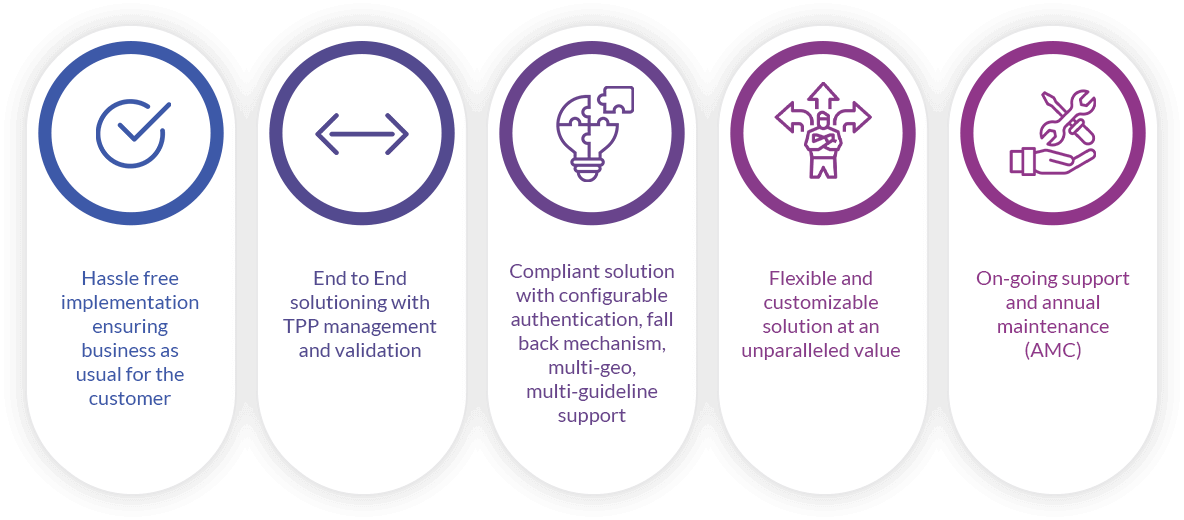

The Maveric Advantage

Hassle free implementation ensuring business as usual for the customer

End to End solutioning with TPP management and validation

Compliant solution with configurable authentication, fall back mechanism, multi-geo, multi-guideline support

Flexible and customizable solution at an unparalleled value

On-going support and annual maintenance (AMC)

The Maveric Advantage

Hassle free implementation ensuring business as usual for the customer

End to End solutioning with TPP management and validation

Compliant solution with configurable authentication, fall back mechanism, multi-geo, multi-guideline support

Flexible and customizable solution at an unparalleled value

On-going support and annual maintenance (AMC)

Other Solutions

Customer Acquisition And Onboarding

Challenge faced by any bank that is on the path to digital transformation is the ability to consistently create superior customer experience.

Temenos TAF C to TAF J Conversion

Stay current and unlock better functionalities with TAFJ